Has someone asked you to pay with eCheck? Are you looking to collect eCheck payments from your customers? Are you all around confused by eChecks? Don’t worry; you’re not alone.

We’ve compiled a list of the most common eCheck (electronic check) questions with answers here, so you can learn everything you need to know about eCheck payment processing rates, times, and more.

1. What Is an eCheck?

An eCheck, or electronic check, is a digital version of a traditional paper check. WIth an eCheck, money is electronically withdrawn from the payer’s checking account, transferred over the ACH network, and deposited into the payee’s checking account.

These payments are facilitated by the “Automated Clearing House” (or ACH) network, an electronic network used by U.S. financial institutions. With an ACH merchant account, a business can withdraw payments for goods or services directly from their customer’s bank account. The payment must be authorized by the customer, either by signed contract, acceptance of a website’s “Terms and Conditions,” or a recorded voice conversation.

2. How Do eChecks Work?

Electronic check processing is similar to paper check processing, only faster. Instead of a customer manually filling out a paper check and sending it to the business they need to pay, technology allows the process to happen electronically, saving both time as well as paper waste.

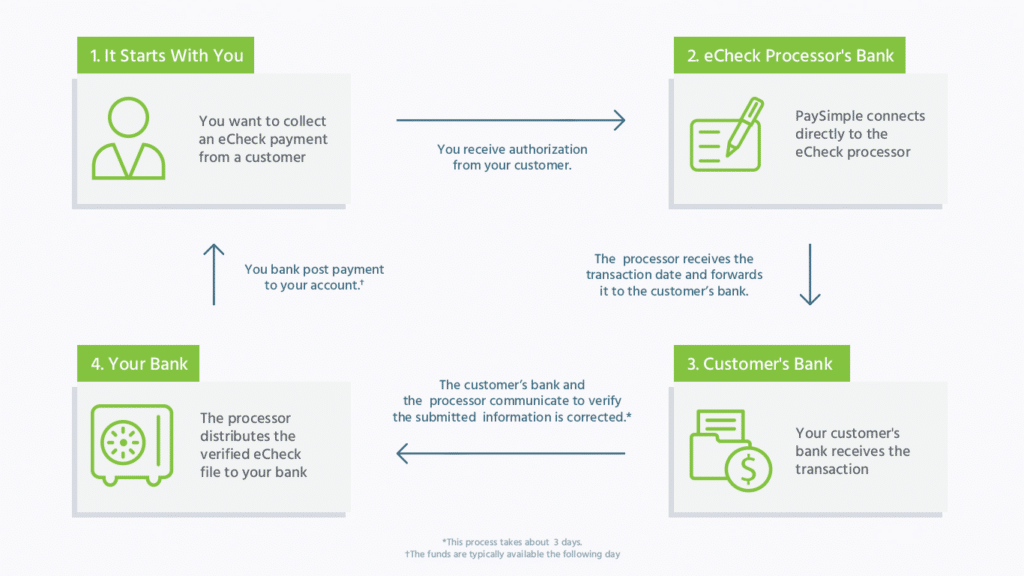

There are a few steps involved to process an electronic check:

- Request authorization: The business needs to gain authorization from the customer before making the transaction. This can be done via an online payment form, signed order form, or recorded phone conversation.

- Payment set-up: After authorization, the business inputs the payment information into the online payment processing software. If it is a recurring payment, this information also includes the details of the recurring schedule.

- Finalize and submit: Once information is properly entered into the payment software, the business clicks “Save” or “Submit” to start the ACH transaction process.

- Deposit funds: The payment is automatically withdrawn from the customer’s bank account, the online software sends a payment receipt to the customer, and the payment itself is deposited into the business’ bank account. Funds are typically deposited into the merchant’s bank account three to five business days after the transaction is initiated.

How are you accepting payments?

Learn all the ways to accept online payments

Click here to access the FREE [Cheat-Sheet]

3. Do ACH and EFT Mean the Same as eCheck?

EFT stands for “Electronic Funds Transfer.” This all-encompassing term includes many types of financial transfers, including:

- Wire transfers

- Direct deposits

- Electronic benefits payments

- ACH disbursements

ACH stands for “Automated Clearing House.” As noted, this is the electronic network used by financial institutions in the United States that provides infrastructure for payment processing companies. Learn more about what is ACH here.

The best way to explain the similarities and differences of ACH, EFT, and eCheck is that an eCheck is a type of electronic funds transfer (EFT) that uses the Automated Clearing House (ACH) network to process the payment.

With an eCheck, the money is electronically withdrawn from the payer’s account, sent via the ACH network to the payee’s banking institution, and then electronically deposited into the payee’s account. This is all done similar to paper check processing, just electronically.

4. What Types of Payments Can You Make with eChecks

Since merchants pay a smaller fee to process eCheck payments than they do to process credit card payments, it’s common to accept eCheck payments for high-cost items such as rent, mortgage, or car payments, and high-cost monthly fees such as legal retainers or fitness memberships.

5. Can I Use eChecks for Recurring Payments?

eChecks are actually one of the most popular types of recurring payment. You might have also heard of the term “recurring ACH payment” or “direct debit” which is the same as a recurring eCheck payment.

For example, property managers will often ask tenants to fill out a recurring eCheck rent payment form. This gives them the ability to automatically deduct rent from their tenant’s checking account on a certain day each month.

6. How Long Does it Take for an eCheck to Clear?

The eCheck clearing process varies slightly between providers, so eCheck processing time varies. Generally, funds are verified within 24 to 48 hours of the transaction being initiated. If the payer has the funds available in their checking account, the transaction is typically cleared within three to five business days and the funds are moved to the payee’s account.

7. How Do I Send an eCheck Payment?

In order to send an electronic payment, verify that the business or person you’re sending money to has an ACH merchant account. This merchant account allows them to use the ACH network to accept payments via electronic funds transfer.

Once that’s confirmed, this is how to pay with eCheck:

- The payee sends you an online payment form. You fill in your checking account number and routing number, as well as the payment amount. By clicking “Submit” you authorize the payee to withdraw the payment amount from your checking account.

- If you need another option, you can also set up eCheck payments by phone. The payee will ask for your checking account and routing numbers by recorded phone call. They input these numbers, as well as the payment amount, into an online payment terminal. Upon clicking “Process,” the payment is deducted from the payer’s bank account and deposited into the payee’s.

8. Do eChecks Process on the Weekends?

Since eChecks rely on financial institutions to process the transaction, most are limited to business days. Your payment will process three to five business days after your transaction is authorized. For example, if you make a payment on Monday, your payment could clear as early as Thursday. If you accept a customer payment on Friday, the funds may not show up in your business account until Wednesday.

9. What if an eCheck Bounces?

Unlike a paper check, people paying by eCheck will generally have a good idea of when their money will leave their account–within three to five business days. Funds are typically verified in your account 24 to 48 hours after authorizing the payment. If you don’t have sufficient funds, your eCheck will “bounce” like a typical check.

The request for authorization you confirmed with an online payment form or phone call acts as your promise to pay the amount. Contact the business you paid to see if there are any fees for your bounced check, any penalties for late payments, and set up an alternative payment method as soon as possible.

10. How to Cancel an eCheck?

If you’re a business owner, you may be faced with cancelling an eCheck for your customers. The exact process for doing so will depend on the payment system you’re using and the stage of the transaction.

If the payment has already cleared into your account, you can’t cancel the electronic check and will have to set up a refund. If the payment is still pending, contact your payment processor for the best way to proceed.

11. How Much Does it Cost to Process an eCheck?

Rates can vary depending on the provider of the eCheck merchant account. Some eCheck processing companies charge a higher per-transaction fee and a lower monthly fee, while others charge the opposite. The average fee ranges from $0.30 to $1.50 per eCheck transaction.

12. How Can I Get an eCheck Merchant Account for my Business

Signing up for an eCheck or ACH merchant account is similar to getting a credit card merchant account. Once you find a merchant account provider, you’ll typically need to provide information like:

- Federal Tax Identification Number (EIN)

- Years in business

- Estimated processing volumes

- Other details to confirm business standing

The payment processor or merchant account provider will review this information to determine acceptance. Approval can happen in a matter of days.If you’d like to learn more about merchant accounts, use our handy, alphabetized guide.

Accept eChecks for Your Business with PaySimple

At PaySimple, we make it easier for businesses to get paid. Our all-in-one solution allows you to seamlessly accept ACH eChecks, credit cards, online payments, and more with one tool. Our industry-leading customer service team can walk you through all the steps of setting up eChecks and answer any additional questions you have.

Start a free 14 day trial with PaySimple to set up your eCheck online payment solution: