What is ACH?

About ACH payments and how they work

What does ACH stand for?

ACH stands for Automated Clearing House and is a centralized electronic funds transfer system that connects financial organizations nationwide. The ACH network is one of the most reliable payment systems in the world, handling a variety of recurring and one-time transactions between consumers and businesses. In 2021 alone, the ACH network processed nearly $73 trillion worth of payments.

Billions of transactions are processed each year through the ACH network and it supports more than 20% of all electronic payments in the US.

The ACH network is governed by the National Automated Clearinghouse Association (NACHA), which is a non-profit association that is funded by the financial organizations that use the ACH network.

ACH payments processed through the PaySimple system are processed using this secure, highly-reliable network. This same network is also used by federal bank and government institutions to securely transfer funds. The Federal Reserve acts as an ACH Operator through which banks transmit or receive ACH entries.

How does ACH work?

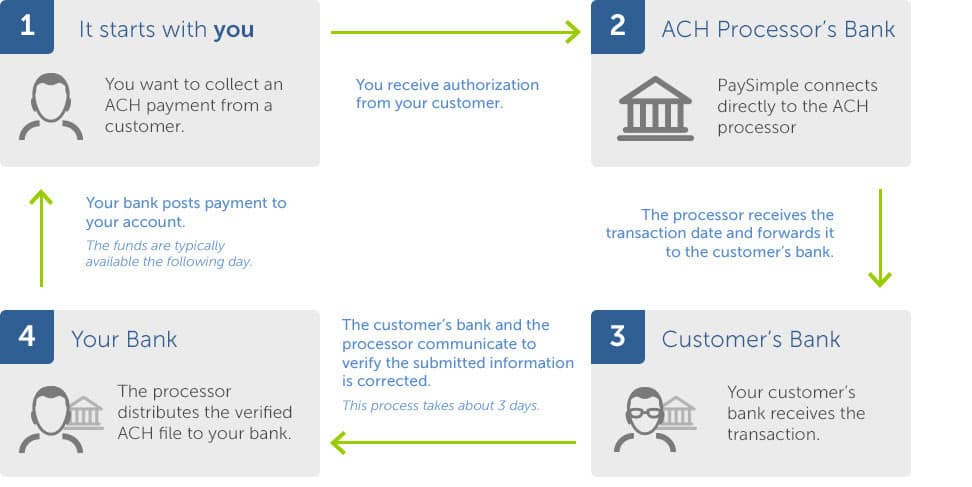

The ACH network moves money from one bank account to another – electronically. Below is a detailed illustration showing what happens when your customers pay using ACH.

1. As the originator you would initiate a direct deposit or direct payment transaction through PaySimple using the ACH network.

- The originator can be an individual, corporation, or other entity that initiates entries into the ACH network.

2. The ODFI (Originating Depository Financial Institution) enters the ACH entry at the request of the originator and batches these entries to send to an ACH operator at regular intervals.

- The Originating Depository Financial Institution (ODFI) is a participating financial institution that originates ACH entries at the request of and by (ODFI) agreement with its customers. ODFI’s must follow the NACHA Operating Rules and Guidelines.

3. ACH transactions are sorted and made available by the ACH operator to the RDFI (Receiving Depository Financial Institution).

- The Receiving Depository Financial Institution (RDFI) is any financial institution qualified to receive ACH entries that agrees to follow the NACHA Operating Rules and Guidelines.

4. Your customer’s account, the receiver, is debited by the RDFI and funds are distributed to your bank.

- The receiver can be any individual, corporation or other entity that has authorized an originator to initiate a credit or debit entry to a transaction account held at an RDFI.