Cloud technology has become integral to the payment processing industry, transforming how transactions are conducted across various sectors. Traditional payment processing methods have several challenges, including high costs, slow transaction speeds, and security concerns. Cloud-enabled platforms address these issues by leveraging the power of cloud computing to streamline payment processing, enhance security, and deliver value-added services.

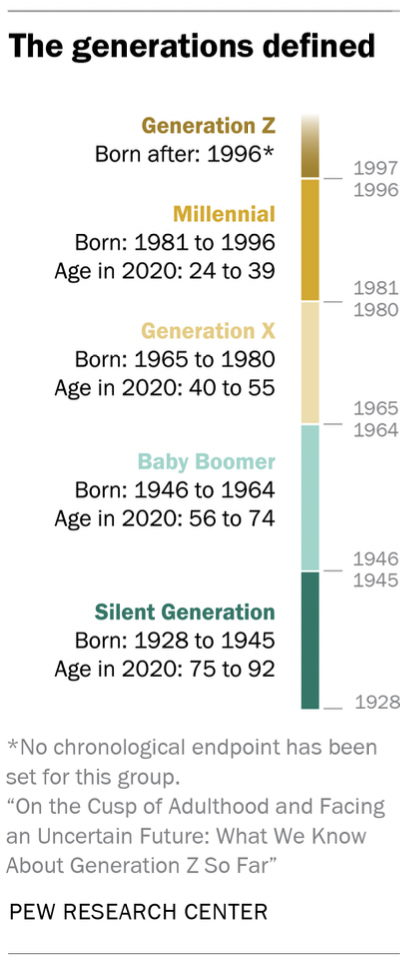

But along with technology changes, the payments industry is also facing significant customer demographic changes. Boomers, Gen Z, COVID aftereffects – all of these are forcing the industry to change its approach. In this article, we will delve into the role of cloud technology and how it can be leveraged to help with the demographic headwinds buffeting the payments industry.

Demographic Headwinds

A significant demographic shift is underway, and the payment processing industry is feeling the impact. Here are some of the demographic changes merchants need to be aware of.

Tech Savvy Consumers

Millennials and Gen Z, who have grown up with digital technology, drive the demand for digital payment solutions. These generations prefer to use mobile devices for payments and expect fast and convenient payment experiences.

Data Privacy Concerns

Younger generations are more aware of the value of their personal information and are concerned about data privacy. This awareness influences their choice of payment methods and the merchants they choose to engage with. Merchants must be aware of these concerns and ensure their payment processing systems are secure and compliant with data protection regulations.

Digital Adoption

The COVID-19 pandemic accelerated the adoption of digital technologies, forcing even the most traditional consumers to adopt online shopping, mobile payments, and contactless transactions. This sudden and widespread digital adoption has reshaped the payment landscape, and merchants must adapt to these changes to stay competitive.

Image courtesy https://medium.datadriveninvestor.com/who-are-boomers-gen-x-gen-y-and-gen-z-d1784f02d25d

Worker Shortages

The Baby Boomers, a sizeable generation, are retiring en masse and being replaced by smaller generations, leading to a shortage of workers. Moreover, Millennials, who are more tech-savvy, educated, and brand-centric, and who value their personal information highly, are replacing them. Unfortunately, this generational shift is causing merchants to struggle to find employees while also seeking new ways to connect with their customers to deliver a consistent brand experience. Luckily, however, cloud-enabled payments can help with all of these shifts.

Cloud-Enabled Payment Processing: A Game Changer

Cloud-enabled payment processing presents a revolutionary solution to the challenges associated with traditional payment processing methods and the demographic headwinds that are taking place. Cloud-enabled platforms leverage cloud computing to process transactions in real time, reduce costs, enhance security, and deliver value-added services to merchants and customers. Let’s look deeper at the benefits.

Real-Time Processing

As mentioned, a cloud-enabled platform processes transactions in real time, significantly reducing the time it takes to complete a transaction. This is particularly beneficial for retail and food service sectors, where fast transaction speeds are crucial for customer satisfaction and operational efficiency. For example, a restaurant using a cloud-enabled platform can process payments instantly, reducing wait times for customers and enabling the staff to serve more customers during peak hours.

Cost Reduction

By leveraging the power of cloud computing, the need for multiple intermediaries is eliminated, resulting in lower transaction fees for merchants. Additionally, cloud-enabled payment processing reduces the need for physical hardware, such as point-of-sale (POS) terminals, further reducing merchant costs. For instance, a retailer using a cloud-enabled platform can accept payments via mobile devices, potentially eliminating the need for expensive POS terminals.

Enhanced Security

Cloud-enabled platforms utilize advanced security features, such as end-to-end encryption and tokenization, to ensure the safety of payment data. End-to-end encryption ensures that payment data is encrypted from the moment it is entered into the system until it reaches its final destination. Tokenization replaces sensitive payment data with a unique token, which is useless to fraudsters even if intercepted. These security features significantly reduce the risk of data breaches and fraud, protecting both merchants and customers.

Value-Added Services

The payment process is no longer just about facilitating transactions. It’s about providing a complete ecosystem of services that add value to both merchants and customers. This perspective aligns with the broader trend in the payments industry, where providers are evolving from being transaction facilitators to becoming partners that offer a suite of services that enhance the overall business operations and customer experience.

For example, now payment providers are leveraging the vast amounts of data generated during transactions to deliver value-added services to merchants and customers. These insights include customer behavior, payment trends, and business performance data.

Additionally, suppose a retailer offers both in-store and online purchasing. In that case, a cloud-enabled payments solution can track in-person and online transactions from the same customers, leading to better data and more consumer insights. This information enables merchants to make data-driven decisions, optimize their operations, and tailor their offerings to meet customer needs.

Loyalty Programs

In addition to data being valuable to the merchants, data can also be used to benefit the customers. For example, data can be used to develop personalized loyalty programs, encouraging repeat business by rewarding customers for their loyalty. For instance, a coffee shop using a cloud-based platform can analyze the purchasing behavior of its customers to offer personalized rewards, such as a free coffee after a certain number of purchases.

The Bottom Line

The demographic shifts and technological advancements we are witnessing have catalyzed a change in the payment processing industry. Millennials and Gen Z, with their preference for digital payments, concern for data privacy, and demand for fast and convenient experiences, are steering the market toward innovative solutions. The pandemic further accelerated this digital adoption, making it imperative for merchants to adapt to the new payment landscape. Meanwhile, worker shortages due to the mass retirement of Baby Boomers and the specific demands of the incoming workforce have created additional challenges for merchants.

Luckily, cloud-enabled payment processing is a great solution. It offers real-time transaction processing, cost reduction, enhanced security, and many value-added services. Merchants can leverage transaction insights to optimize operations, tailor offerings, and develop personalized loyalty programs. This not only helps in overcoming the challenges posed by the demographic shifts but also in transforming them into opportunities for growth.

Cloud-enabled payment processing is not just a tool for overcoming demographic headwinds – it’s a game-changer that can help merchants transform their operations, enhance customer satisfaction, and drive business growth. Embracing this technology is no longer an option but a necessity for merchants who want to stay competitive in this rapidly evolving landscape.