From their early youth, Gen Zers, defined as those born from the mid-to-late 1990s to the early 2010s, have been exposed to technology, social media, and mobile devices. This demographic is coming of age in a world where technology is not just an advantage but a way of life. Now, this generation’s approach to payments and commerce is reshaping how businesses operate. Here, we will explore key payment methods that Gen Z prefers and the implications these preferences have on merchants and the financial sector.

They Prefer Digital Financial Tools

As stated above, Gen Zers were exposed to technology, social media, and mobile devices from their early youth, and they have never lived a life without the Internet. Case in point: 99% of Gen Zers either own a smartphone or have access to one, and they have been found to check social media up to 100 times per day, according to a report by Visa.

As expected, members of this generation feel at ease while using technology for financial transactions, including mobile payment apps. For example, more than 6 in 10 Gen Zers prefer mobile devices for digital purchases. Because they have never known life without the Internet and feel comfortable with it, they do most of their banking and financial business online.

Peer-to-Peer (P2P) Platforms

P2P payment platforms have provided a cash alternative, positioning them as an influential financial gateway for Gen Z. This trend is not merely a fleeting fascination but a fundamental shift in how Gen Z approaches financial transactions. (Think Zelle or Venmo.) The convenience, speed, and user-friendly interfaces of P2P platforms resonate with a generation that has grown up in a digital world.

Gen Z’s preference for P2P payments has set a new standard for transaction speed. Traditional banking methods that require several business days for processing are seen as less appealing and outdated. While this generation appreciates speed, it’s important to note that while P2P platforms offer speed and convenience, they also raise new security challenges. To gain the trust of Gen Zers, merchants and financial institutions must invest in robust security measures to protect against potential fraud and to maintain the trust of this tech-savvy generation.

Buy Now Pay Later (BNPL) Solutions

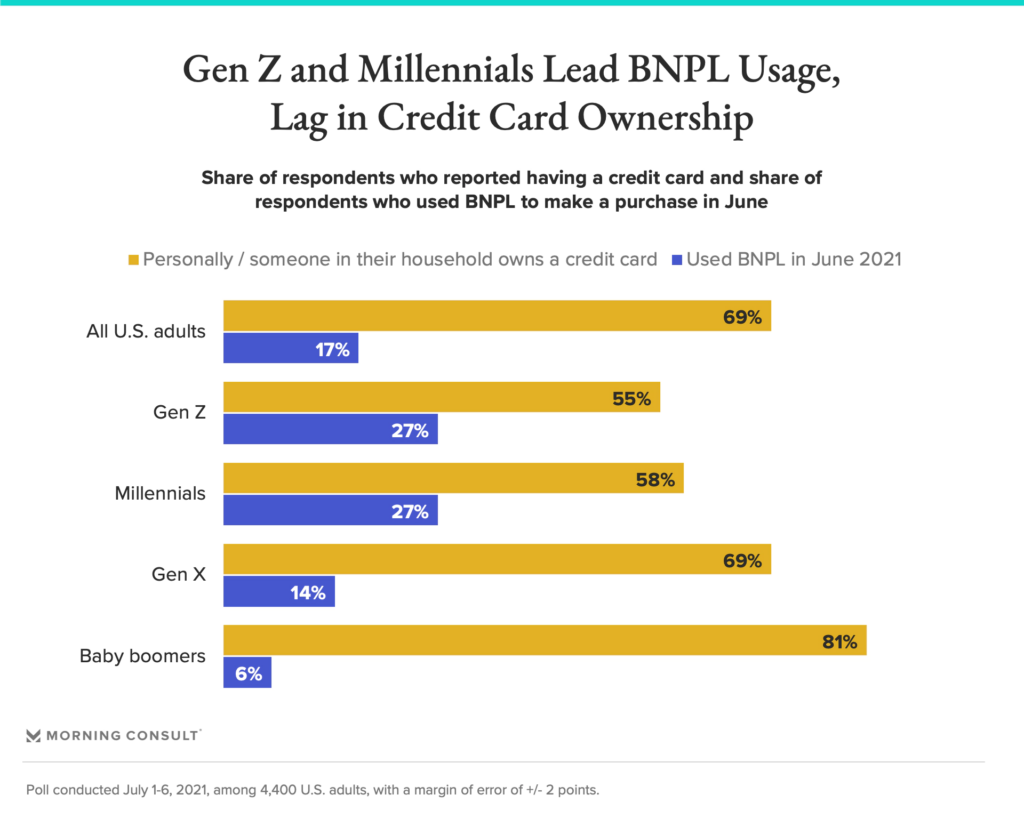

BNPL solutions allow consumers to purchase products immediately and pay for them over a set period, often without interest if paid within a specific timeframe. These solutions are typically facilitated through third-party providers that partner with retailers. Gen Zers appreciate BNPL solutions because they offer flexible payment options that align with their desire for control and autonomy in financial decisions. Gen Zers also like BNPL because they can enjoy the products they want without the immediate financial burden.

Many Gen Zers are also wary of traditional credit cards and the associated interest rates and fees. BNPL provides a more transparent and often interest-free alternative. Finally, as digital natives, Gen Zers are comfortable with online shopping and digital financial tools, and BNPL fits seamlessly into this lifestyle, offering a convenient and modern payment method.

Image courtesy: https://pro.morningconsult.com/articles/outlining-the-potential-growth-of-bnpl-services-apple-pays-newest-reported-venture

Cryptocurrencies

Gen Zers are continuing to revolutionize the financial world by embracing new asset classes like cryptocurrencies. Approximately 1 in 4 Gen Z invests in crypto, and 1 in 10 in NFTs. This growing interest in digital assets is not merely a speculative endeavor but a profound alignment with the values, technology, and future financial paradigms that resonate with this generation.

Gen Z’s attraction to cryptocurrencies stems from a desire for financial autonomy and control. The decentralized nature of cryptocurrencies aligns with a generation that values transparency and disintermediation. Financial institutions must recognize this shift and explore ways to offer products that align with these values.

Additionally, as cryptocurrencies become more mainstream among Gen Z, there is a growing expectation for seamless integration with traditional banking services. Banks and merchants must consider offering crypto wallets, payment options, and investment products to meet this demand.

Implications for Businesses

The preferences and behaviors of Gen Z in the financial domain have significant implications for businesses, especially those in the retail, banking, and financial sectors. Here are the key takeaways:

- Adoption of Digital and Mobile Payments: With more than 6 in 10 Gen Zers preferring mobile devices for digital purchases, businesses must ensure that their payment systems are optimized for mobile and digital wallet transactions. Failure to do so may result in losing this tech-savvy customer base.

- Embracing Peer-to-Peer (P2P) Platforms: The popularity of P2P platforms among Gen Z requires merchants to adapt to the demand for instant payments. Traditional banking methods that take several days to process may be seen as outdated. Integrating P2P payment options can enhance customer satisfaction and competitiveness.

- Investment in Security Measures: Using digital financial tools also brings new security challenges. Businesses must invest in robust security measures to protect against potential fraud and maintain the trust of Gen Z, who are likely to be more aware of and concerned about digital security.

- Offering Buy Now Pay Later (BNPL) Solutions: The interest in BNPL solutions indicates a need for flexible payment options. Retailers and financial institutions that offer these services may attract more Gen Z customers looking for convenience and alternatives to traditional credit.

- Integration of Cryptocurrencies: Approximately 1 in 4 Gen Z invests in cryptocurrencies. This growing trend necessitates that banks and merchants consider offering crypto wallets, payment options, and investment products. Ignoring this shift may result in missing opportunities to engage with a generation that values financial autonomy, transparency, and innovation.

- Understanding Gen Z Values: Gen Z’s attraction to new financial paradigms reflects their underlying values. Businesses must recognize and align with these values to create products and services that resonate with this generation. This may include transparency in transactions, ethical considerations, and leveraging technology for enhanced user experience.

- Preparation for Future Trends: Gen Z’s willingness to embrace new technologies and payment methods indicates that they will likely continue to drive innovation in the financial sector. Businesses must stay ahead of these trends by continually adapting and innovating to meet this generation’s evolving needs and expectations.

The Bottom Line

Gen Z’s approach to payments and commerce is reshaping how businesses operate. Their preference for digital tools, mobile payments, P2P platforms, BNPL solutions, and cryptocurrencies requires a fundamental shift in business strategies. Adapting to these preferences is not just a matter of staying current but a vital step in ensuring future success and relevance in a rapidly changing financial landscape.

Merchants and financial institutions must recognize these preferences and adapt accordingly. This means investing in technology, forming strategic partnerships, and understanding the regulatory environment. Those who align their strategies with the preferences of Gen Z will not only meet the demands of a significant consumer base but also position themselves at the forefront of the future of payments.

The implications of Gen Z’s payment methods are far-reaching, affecting how transactions are conducted and how businesses build trust, loyalty, and engagement with this emerging generation. By understanding and embracing these methods, merchants and the financial sector can create a commerce ecosystem that resonates with Gen Z, ensuring continued growth and innovation in the ever-changing world of payments.