As a small business owner, protecting your customers’ data is essential. But with the rise of banking and financial fraud, it’s more important than ever to safeguard your customer information from malicious attacks. Unfortunately, doing so can often lead to compromises to customer service and the customer experience; however, this doesn’t have to be the case.

Fraudsters are also more savvy these days, and have increased their activities, targeting customers with account takeover attacks and committing refund fraud, identity theft, promo abuse, and other forms of payment fraud.

To combat these fraudsters, e-commerce companies are investing in fraud detection and prevention tools. However, implementing a solution is not enough to solve the problem. They need a holistic fraud prevention strategy. In this blog article, we will provide business owners with 6 proven tactics to prevent online payment fraud without sacrificing customer service.

Deterrence

According to McKinsey and Company, a simple way to prevent fraud is to stop bad actors before they begin. A great way to do this is to talk about fraud prevention features that your business leverages openly. When fraudsters know that you are aware that they exist, know how they operate, and you are taking measures to fight back, they are deterred and are likely to go after another business that they view as an easier target.

Authentication

While customers want frictionless purchasing experiences, we all understand the hassle of dealing with fraud and prefer to prevent it rather than deal with its consequences afterward. One way businesses can increase customer satisfaction and loyalty while also staying focused on fraud prevention is by requiring authentication of purchases or providing follow-up emails to confirm purchases. This is especially important with credit card fraud, most of which is committed online.

By doing this, customers’ confidence in the business improves, and the business can help prevent fraudulent purchases before they get delivered to the bad actor.

Detection

Machine learning is a subset of artificial intelligence that teaches machines to learn from data without being explicitly programmed to do so. Machine learning algorithms can quickly and accurately analyze large amounts of data and detect patterns and anomalies that human analysts may miss. As a result, machine learning is increasingly being used by businesses to detect and prevent fraud.

By using machine learning algorithms, businesses can detect fraud faster and more accurately than with a team of humans. Algorithms can use past trends and data to flag accounts and transactions that seem risky based on a range of factors, such as purchase history, location, device type, and more.

Machine learning algorithms can also learn and adapt over time, becoming more accurate and efficient as they process more data. By using machine learning, businesses can increase the efficiency of their fraud detection practices and catch fraudulent activity before it causes significant damage.

Customized Experiences

A frictionless payment experience enables customers to make online transactions quickly and easily without going through a complicated process or dealing with multiple steps, saving them time and effort.

With a frictionless payment experience, customers can complete transactions in a matter of seconds, which is particularly useful when they are making a purchase on-the-go or need to complete a payment quickly. However, this frictionless experience can cause problems when in the hands of fraudsters.

Therefore, to not sacrifice customer service but also fight fraud, one option for business owners is to set up customized experiences based on risk profiles detected by machine learning. For example, by leveraging internal data and data science techniques, businesses can set up profiles of users with a high chance of being people who will commit fraud.

Then, once these profiles are established, techniques can be leveraged and automated to give these high-risk users more friction in their checkout experience. For example, if the person is a fraudster, they may notice the additional friction, like an additional authentication method, which may scare them away or prevent them from committing fraud altogether.

Manual Reviews of Data

As the business world moves to use data science, artificial intelligence, and machine learning more and more, it’s important for businesses not to entirely eliminate the use of manual reviews when it comes to fraud. While manual reviews may be expensive and time consuming, they can be made more efficient by marrying AI tools.

For example, models can be trained to flag certain cases that need human review, such as when an algorithm cannot easily assess the risk potential. Furthermore, manual reviews by experienced fraud analysts can be done to audit a risk assessment algorithm, catch suspicious transactions that may have been missed, and be used to help make it more accurate.

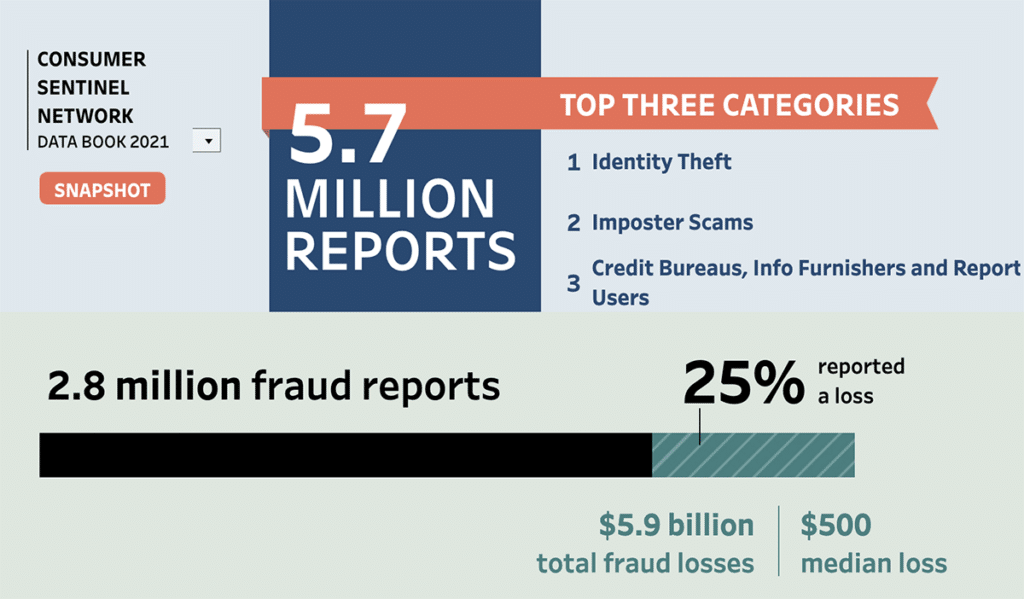

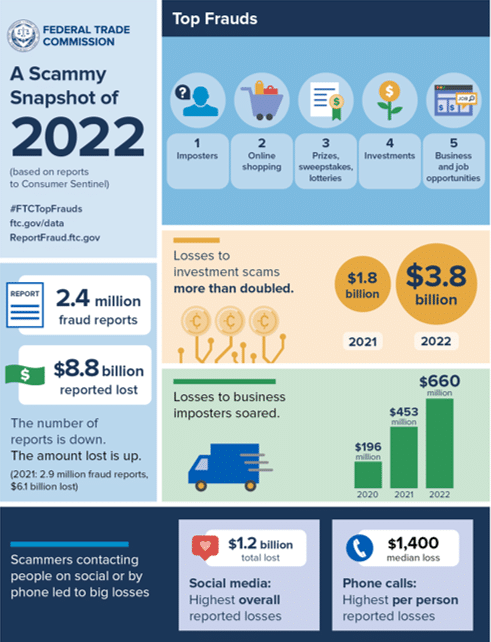

Image courtesy United State Federal Trade Commission

Employee Training

Finally, it’s important for people and businesses to not to always rely on machines to flag fraud. This can be done by training employees and ensuring employees who handle customer transactions know how to recognize the signs of potential fraud, such as mismatched billing and shipping addresses, multiple transactions from the same IP address, or purchases from high-risk countries. You also should not ignore the importance of identity verification.

The Bottom Line

Preventing online payment fraud is not an impossible task. With the right tools, technology, and processes, online merchants can identify potential threats and enable a great customer experience for good users. By deterring bad users, authenticating good users, detecting potential fraud, providing customized experiences, doing manual reviews, and providing employee training, business owners can combat online payment fraud and maintain their customers’ trust.