The post-pandemic world fostered a seismic shift in the payment landscape as businesses and consumers wholeheartedly embraced digital and contactless transactions. This transition, largely due to health precautions and quarantine measures, introduced a new wave of payment modalities, leading to an unprecedented surge in the use of contactless payments, online payments, and digital wallets. In this article, we will discuss how the change caused loyalty programs to evolve and what your business can do to stay competitive.

The Evolution of Payments

Previously, contactless and digital payments were considered a convenience. Then, the pandemic transformed them into a necessity. Traditional brick-and-mortar retailers, who previously relied heavily on cash, check or standard credit/debit card payments, found themselves rapidly adapting to incorporate safer, frictionless payment methods.

This change wasn’t just limited to retail. Industries across the spectrum, from food and beverage to personal services, were prompted to integrate contactless and online payment options, accommodating a societal shift towards a preference for no-touch transactions.

In the consumer world, a similar transition unfolded. Customers quickly adapted to this new mode of transaction, driven by both safety concerns and the convenience of digital payments. Cash was replaced with a simple tap of a card, mouse click, or mobile wallet scan, leading to a dramatic increase in the adoption of digital wallets like Apple Pay, Google Wallet, and other FinTech innovations.

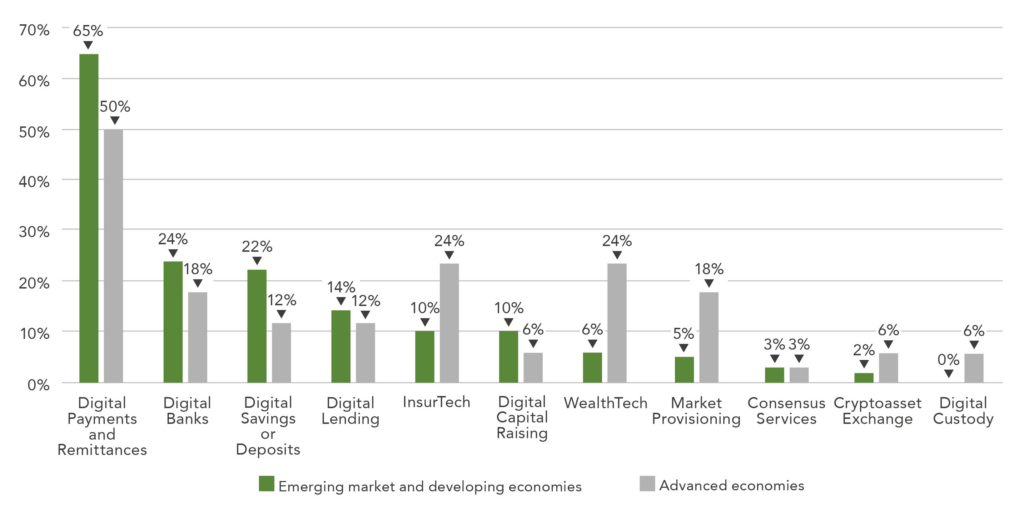

Image courtesy: https://www.weforum.org/agenda/2020/10/covid-19-financial-technology-fintech-regulation/

Global FinTech Regulatory Rapid Assessment Study

However, the transformation went beyond safety and convenience for businesses because digital and contactless payments offer unprecedented opportunities for data collection. With every tap, click, or scan, businesses and payment providers can now gather valuable information about customers’ buying behaviors, preferences, and spending patterns. This wealth of data marked a new era in consumer analysis.

Unlike traditional payment methods, which offer limited insight into consumer behavior, digital payments provide a more comprehensive overview of a customer’s spending habits. This data can be used to inform marketing strategies, optimize product and service offerings, and forecast trends. These deep customer insights pave the way for businesses to deliver personalized experiences, significantly enhancing customer engagement and loyalty. Furthermore, processing and analyzing this data in real time allows businesses to quickly adapt to changes in consumer behavior, market dynamics, and economic factors.

The Evolution of Loyalty Programs in the New Normal

Historically, loyalty programs relied heavily on a basic transactional model – the more customers purchased, the more points or rewards they accumulated. While this system had its merits, it often lacked the personal touch to drive deeper customer engagement. However, integrating advanced payment solutions has breathed new life into loyalty programs in the post-pandemic era. Now, with each digital or contactless transaction, businesses can capture data that goes beyond purchase history. From shopping preferences to buying patterns to the frequency of purchases, businesses now have access to a wide array of customer insights.

These rich data insights are redefining how businesses approach loyalty programs. With a more detailed understanding of customer behavior, businesses can curate personalized and relevant rewards. For example, customers who frequently buy organic products might receive special discounts or early access to new organic offerings. This level of personalization not only increases customer satisfaction but also enhances customer loyalty, as customers feel valued and understood.

The increasing adoption of mobile payments further enhances the effectiveness of loyalty programs. Mobile applications offer a perfect platform to integrate loyalty programs and payment processes. Customers can easily access, track, and redeem their rewards directly through their mobile wallets or digital payment apps. This seamless integration makes the experience far more convenient and engaging, encouraging greater participation in the loyalty program.

Additionally, branded mobile platforms offer businesses multiple touch points to interact with customers. Push notifications, personalized messages, and in-app experiences can be used to remind customers about their rewards, suggest personalized offers, or encourage further engagement with the brand. This omni channel approach significantly enhances the overall customer experience and fosters deeper loyalty.

As we can see, the shift towards integrated payment solutions and the rise of mobile platforms are transforming loyalty programs. This evolution enables businesses to tap into rich customer insights, curate personalized offerings, and deliver a seamless, engaging experience. As we move forward in the post-pandemic world, successful loyalty programs will be those that can leverage these opportunities to foster meaningful connections with customers.

The Impact on Merchant Payments and Customer Interaction

As businesses integrate payment solutions with loyalty programs, the dynamics of merchant payments and customer interactions are also shifting. In addition to managing customer data better, and offering personalized experiences, thanks to data-driven insights, businesses can also process payments faster and reduce friction in the buying experience. Additionally, from a merchant’s perspective, integrated payments simplify transaction management and reduce manual errors. This efficiency can drive profitability by saving time and reducing costs.

AI and ML: Enhancing Customer Personalization

As we gaze into the future of loyalty programs and integrated payment solutions, advancements in technology, specifically artificial intelligence (AI) and machine learning (ML), are set to play a pivotal role. These emerging technologies are poised to enhance loyalty programs and customer engagement in ways that were previously unimaginable. For example, AI and ML can process and analyze complex datasets far beyond human capabilities, identifying patterns and making predictive analyses. When applied to the customer data collected through integrated payments, AI and ML can provide businesses with insights into future buying behavior, preferences, and trends. This enables them to deliver hyper-personalized offerings, refining and tailoring their loyalty programs to individual customer needs and preferences.

For instance, AI could analyze a customer’s past purchase data to predict what products they might be interested in next and provide personalized recommendations. Simultaneously, machine learning algorithms could identify patterns in purchase history to anticipate when a customer might be ready to make a repeat purchase, triggering timely offers or reminders.

Real-Time Rewards, Dynamic Pricing, and Predictive Analytics: The Next Frontier

Looking further ahead, the ongoing evolution of the FinTech landscape suggests the rise of even more sophisticated loyalty program strategies.

Real-time reward redemptions, for example, are likely to become commonplace. In this model, customers earn and redeem rewards instantly at the point of sale, adding an immediate incentive to the purchase and elevating the customer experience.

Dynamic pricing is another strategy that may gain traction. Leveraging AI and ML, businesses can adjust prices in real time based on various factors such as demand, inventory, and customer behavior. This may allow businesses to maximize profitability while offering customers price points tailored to their spending habits and perceived value.

Predictive analytics will also play a significant role in the future of loyalty programs. Businesses will be able to forecast future trends and behaviors, adjusting their offerings to meet anticipated customer needs. This foresight can allow businesses to optimize their inventory, marketing strategies, and pricing, further enhancing profitability.

The Bottom Line

The COVID-19 pandemic may have upended the norm, but it also propelled us into the future of integrated payments and loyalty programs. As we navigate this new terrain, businesses that effectively harness data insights, technology advancements, and integrated payment solutions will undoubtedly lead the pack in fostering customer loyalty and driving growth. The future of loyalty programs and integrated payments is bright, promising an era of seamless transactions, personalized experiences, and enhanced customer loyalty.