The global payments industry is transforming with technological advancements, evolving consumer preferences, and regulatory changes. Based on the insights from the 2023 Global Payments Report by Worldpay from FIS, this article explores the key trends shaping the future of payments, providing a comprehensive understanding of the current landscape.

By understanding these trends, small businesses can position themselves to thrive in this rapidly evolving environment.

The A2A Transfer Revolution

Account-to-account (A2A) transfers refer to the direct movement of money between two transaction accounts, often held at different financial institutions. These transfers can be executed electronically, allowing quick and secure transactions without needing physical checks or cash. A2A transfers are revolutionizing the payment landscape, driven by the implementation of real-time payments (RTP).

In 2022, A2A payments accounted for nearly $525 billion in e-commerce transaction value, with a projected compound annual growth rate of 13% through 2026.

A2A transfers offer several advantages to merchants, including lower costs and immediate availability of funds. Unlike traditional card payments, A2A transactions are not subject to interchange fees, reducing the cost of payment acceptance. Additionally, A2A transfers offer immediate settlement of funds, improving cash flow for merchants, which is beneficial for businesses that require quick access to capital.

Digital Wallets

Digital wallets, or e-wallets, are electronic tools that securely store a user’s payment information, such as credit and debit card details, enabling quick and convenient electronic transactions. They can be used for online shopping, in-store purchases, and peer-to-peer transfers through smartphones or computers. Digital wallets offer a streamlined and secure alternative to traditional physical payment methods with features like encryption and biometric authentication.

Image courtesy https://www.nfcw.com/2020/10/09/368511/digital-wallet-user-base-to-increase-to-4bn-by-2024/

Digital wallets like Apple Pay are extending their dominance, accounting for approximately $18 trillion in consumer spending. They are the leading payment method globally in e-commerce (49% share) and at POS (32% share). While digital wallets are among the fastest-growing payment methods, with a forecasted compound annual growth rate of 15% at POS and 12% annual growth in e-commerce through 2026, they are also marked by intense competition among various players, including fintech, banks, neobanks, super apps, Big Tech, and device manufacturers.

It’s important to note that globally, 22% of digital wallet users typically use a credit card to fund their digital wallet purchases, making credit cards an essential part of the digital wallet ecosystem.

BNPL Options

Buy now, pay later (BNPL) is a financial service that allows consumers to purchase products and pay for them over time, often in installments, and sometimes without interest or fees for a promotional period. It is popular for high-ticket items but can be used for everyday purchases like clothes at many common retailers.

Image courtesy https://www.grandviewresearch.com/industry-analysis/us-buy-now-pay-later-market-report

Despite facing regulatory scrutiny, interest rate pressure, and intense competition, BNPL remains popular, representing 5% of 2022 global e-commerce spend. BNPL continues to be popular among consumers because it offers flexibility and diverse options. Because of this, it is projected to rise to 6% by 2026.

The forecast through 2026 indicates sustainable growth for BNPL; however, it’s important to note that the sector is transforming, and the future landscape may see more regulation and consolidation.

Growth of Credit Card Transactions

Credit card transaction values grew 6% in e-commerce and 12% at point-of-sale (POS) year-over-year from 2021 to 2022 (page 12). Additionally, global credit card transaction values continued to rise, exceeding $13 trillion across all channels in 2022. Moving forward, the future of credit cards looks promising, with a projected growth of 4% compound annual growth rate through 2026.

This growth reflects the enduring appeal of credit cards as a convenient and widely accepted payment method. It’s no surprise that credit cards will continue to be a significant payment method in the coming years. However, it is important to note that different regions exhibit varying growth patterns for credit card usage.

For example, in mature markets like the United States and Europe, credit cards are a well-established payment method, while in emerging markets, credit card adoption is growing rapidly as financial services expand.

Expansion of Credit

As consumers seek more flexible and convenient ways to access and utilize credit, innovative solutions are emerging to meet these demands. From the integration of credit cards with digital wallets to the rise of alternative credit options, the expansion of credit is reshaping how consumers shop and pay.

For example, digital wallets allow consumers to link their credit cards and use them for digital payments, combining the convenience of digital wallets with the benefits of credit cards. Additionally, BNPL services are another avenue through which credit is expanding. These services enable consumers to make purchases and pay for them over time, often without interest. BNPL represents a modern take on traditional credit, appealing to younger consumers who may be wary of traditional credit cards.

Finally, POS financing allows consumers to apply for and receive credit at the point of purchase. This form of credit is often used for larger purchases and provides consumers additional flexibility in payment terms. Together, these trends reflect a broader shift towards more accessible and consumer-friendly credit options catering to diverse needs and preferences.

The Decline of Cash

Cash is projected to decline at -6% compound annual growth rate through 2026. However, while cash use is declining due to the rise of digital payment methods, government initiatives to promote cashless transactions, and changing consumer preferences, our analysis shows that cash continues to play a vital role in the global economy.

For example, cash still plays an essential role in most economies, accounting for over $7.6 trillion in global consumer spending in 2022. Cash remains a preferred payment method for many consumers, particularly for small-value transactions and regions with limited access to banking and digital payment services.

Cash also provides privacy and security that digital payments cannot offer. Some consumers prefer cash because it does not leave a digital trail and is not susceptible to cyber threats. Additionally, cash serves as a reliable backup in situations where digital infrastructure is compromised, such as natural disasters or cyber-attacks. It ensures that transactions can continue even when electronic payment systems are unavailable.

The future of cash is likely to be characterized by a gradual decline rather than a sudden disappearance. Cash will likely remain a vital part of the payment ecosystem as digital payments continue to grow, reflecting a complex interplay of technological advancement, consumer behavior, economic conditions, and societal needs.

Role of Cryptocurrency

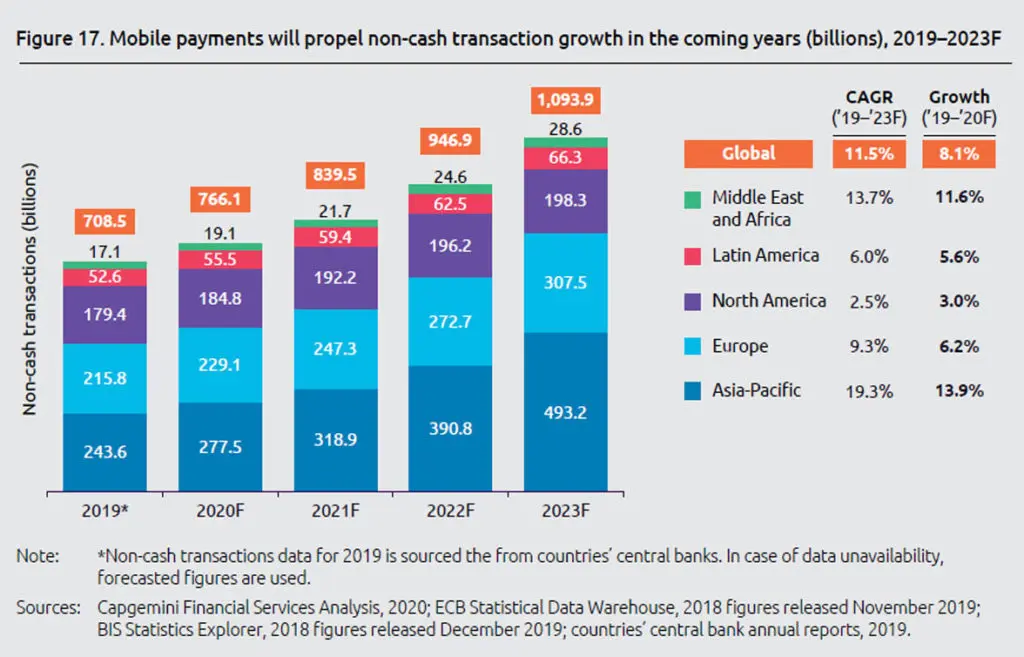

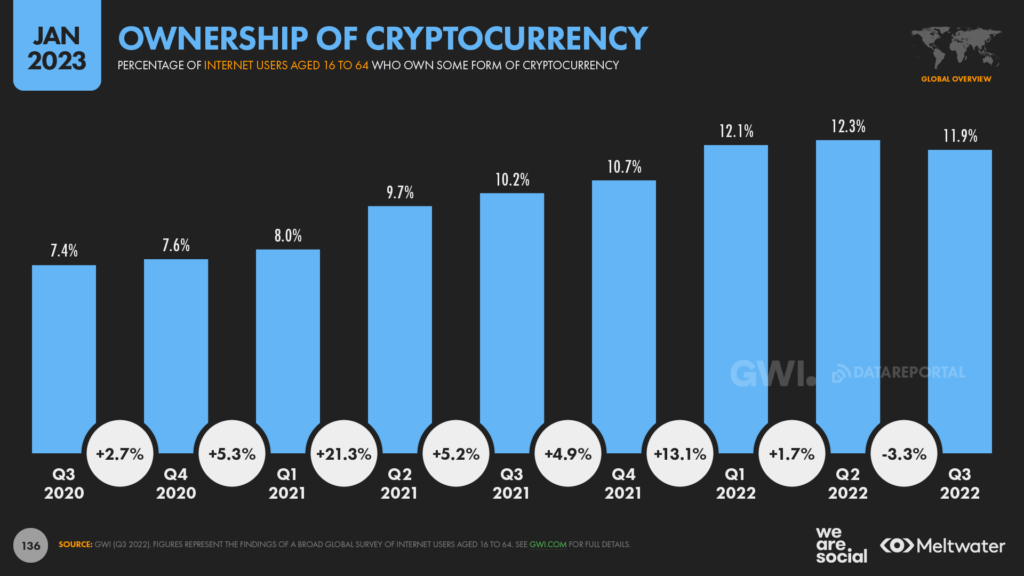

The role of cryptocurrencies in person-to-business (P2B) payments is an emerging trend that reflects the broader evolution of the global payments landscape. They are emerging as a viable person-to-business (P2B) payment option, with over $11 billion in 2022 global transaction value. This growth indicates the increasing acceptance of cryptocurrencies as a legitimate form of payment.

This adoption is driven by consumer demand, technological advancements, and the potential to reach new markets. By accepting cryptocurrencies, merchants can reach new customers, particularly those who prefer to use digital assets for transactions. This can help businesses tap into niche markets and expand their customer base.

Image courtesy https://datareportal.com/reports/digital-2023-deep-dive-blockchains-roadblocks

Cryptocurrencies can benefit merchants because they offer lower transaction costs compared to traditional payment methods. By bypassing traditional banking channels, merchants may save on fees and enjoy quicker settlement times. Additionally, cryptocurrencies enable cross-border transactions without needing currency conversion or international banking fees. This can make international sales more accessible and cost-effective for businesses.

Crypto Opportunities and Threats

While cryptocurrencies offer unique opportunities, they aren’t without threats and risks. The volatility of cryptocurrencies can pose challenges for merchants. Fluctuations in value can impact pricing and profitability, requiring careful management and consideration of potential risks. Additionally, security is a significant concern in the cryptocurrency space.

Merchants must ensure their cryptocurrency handling practices are secure to prevent theft or fraud. Finally, the regulatory environment for cryptocurrencies varies widely across jurisdictions. Merchants must know and comply with local regulations, including licensing, reporting, and taxation requirements.

Businesses interested in exploring cryptocurrencies as a payment option should carefully consider the opportunities and challenges carefully, seeking expert guidance and leveraging intermediary services as needed. By doing so, they can position themselves to capitalize on this emerging trend and stay ahead in the rapidly evolving world of payments.

The Bottom Line

The global payments landscape is rapidly evolving, with significant shifts in consumer behavior and the adoption of new technologies. Merchants must understand and adapt to these trends to remain competitive. To recap, here are the trends and strategies small businesses should consider to remain competitive:

- A2A transfers: Leverage the cost benefits and immediate availability of funds offered by A2A payments.

- Digital wallets: Recognize the growing dominance of digital wallets in e-commerce and POS.

- Understand credit card dynamics: Despite modest share declines, credit cards remain strong, and alternate credit products are expanding.

- Evaluate BNPL options: Assess the opportunities and challenges of BNPL as it continues to evolve.

- Consider cryptocurrency: Explore the potential of cryptocurrencies as a P2B payment method, but understand the risks and limitations.

- Acknowledge the ongoing important role of cash: While digital payments are rising, cash plays an essential role in the economy.

By staying abreast of these trends and adapting strategies accordingly, merchants can navigate this rapidly evolving payments landscape and position their businesses for future growth.