The financial world is undergoing a transformation that is redefining the way businesses transact and manage their financial operations. At the heart of this transformation lies Real-Time Payments (RTP), a system that enables the immediate transfer of funds, breaking free from the delays and inefficiencies of traditional payment methods, such as credit cards or paper checks.

But RTP is more than just a faster way to move money. It’s a reflection of a broader shift towards real-time responsiveness in business, a trend that’s reshaping everything from data analytics to customer engagement. In the complex landscape of B2B transactions, RTP offers not just speed but a new paradigm of efficiency, transparency, and strategic agility.

This article delves into the world of RTP, exploring its underlying technology, its alignment with emerging business trends, and the key factors driving its success. From the Federal Reserve’s FedNow Service to the shift from accrual accounting to real-time ledgers, we uncover how RTP is not only transforming finance but also laying the groundwork for a more interconnected and dynamic business environment.

What Are Real-Time Payments?

Real-time payments (RTP), as the name suggests, enable the immediate transfer of funds between parties. Unlike traditional payment methods that may take days to process, RTP offers instant settlement. This immediacy is not just a matter of convenience; it represents a fundamental shift in how financial transactions are conducted.

Furthermore, RTP’s instant settlement aligns with the broader trend towards real-time data and analytics in modern business operations. Just as businesses today expect real-time insights into their operations, markets, and customers, they also seek real-time control over their financial transactions. RTP fits naturally into this real-time ecosystem, acting as the financial nerve system that connects and empowers various business functions.

Factors Driving RTP Success

The FedNow Service is an initiative by the Federal Reserve in the U.S. to develop a new, round-the-clock real-time payment and settlement service. Launched in July of 2023, this service aims to modernize the country’s payment system and provide a safe and efficient way for financial institutions to conduct real-time payments (RTP).

However, the success of RTP hinges on three key factors: interoperability, simplicity, and reduced costs.

Interoperability

Interoperability refers to the ability of different systems, devices, or applications to connect and operate in unison without special effort from the user. In the context of real-time payments (RTP), interoperability means that different payment systems can communicate and work together seamlessly, allowing for smooth and efficient transactions across various platforms and financial institutions.

For example, if a business uses one bank’s RTP system and wants to send a payment to a business that uses a different bank’s RTP system, interoperability ensures that the payment can be processed without any issues or delays. Without interoperability, the two systems might not be compatible, leading to delays, additional costs, or even the inability to complete the transaction.

Simplicity

In real-time payments (RTP), simplicity refers to the ease with which users can understand and navigate the system. Simplicity is a critical factor that can either facilitate or hinder the adoption of RTP, especially in the complex landscape of B2B transactions. Here are the various dimensions of simplicity and why they’re so vital for the success of RTP:

1. User Interface (UI) Design

The user interface is the gateway through which users interact with the RTP system. An intuitive and user-friendly interface can significantly reduce the learning curve, enabling users to perform transactions without unnecessary complications.

2. Onboarding Process

The initial setup and onboarding process must be straightforward. If businesses find it cumbersome to integrate RTP into their existing systems or if the registration process is filled with bureaucratic hurdles, they may be discouraged from adopting it altogether.

3. Integration with Existing Systems

For businesses, RTP must easily integrate with existing accounting, invoicing, and financial management tools. If integration requires extensive customization or specialized technical knowledge, it can become a barrier to adoption.

4. Transparency and Accessibility

Simplicity also extends to transparency in pricing, terms, and conditions. More fees or complex pricing structures can deter users. Accessibility ensures that the system is usable by people with varying levels of technical expertise, not just those with specialized knowledge.

Reduced Costs

The allure of reduced costs with RTP is particularly pronounced in the B2B sector. With large transaction amounts for being a common occurrence, even a marginal percentage of savings can accumulate into substantial financial benefits. Here’s a comprehensive look at how reduced costs are shaping the adoption of RTP in this landscape.

1. Lower Transaction Fees

Traditional payment methods often involve a series of intermediaries, each adding incremental costs. RTP, by contrast, streamlines this process, often reducing or eliminating these additional fees. These savings can be significant in the B2B sector, where transactions are substantial.

2. Operational Efficiency

RTP not only reduces direct transaction costs but also enhances operational efficiency. Businesses can save on administrative overhead, labor, and time by automating and accelerating payment processes.

3. Enhanced Cash Flow Management

The immediacy of RTP allows businesses to have better control over their funds, reducing the need for large working capital buffers. This efficient cash flow management can lead to savings in interest and provide more flexibility in investment and operational decisions.

4. Cross-Border Savings

For businesses engaged in international trade, RTP can minimize costs associated with currency conversion, international transfer fees, and compliance with various regulatory regimes.

5. Competitive Pricing and Value Addition

The cost savings from RTP can be leveraged to offer customers more competitive pricing or invest in value-added services. This can be a differentiating factor in a competitive market, much like a retailer offering free shipping or enhanced customer service to stand out from the competition.

The Shift from Accrual Accounting to Real-Time Ledgers

Adopting real-time payments (RTP) is transforming the way businesses transact and reshaping the very foundation of financial management. One of the most profound changes is the shift from traditional accrual accounting to real-time ledgers.

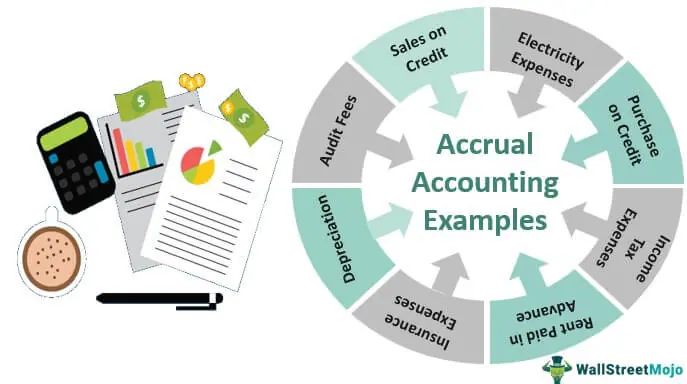

Accrual accounting is a method where revenue and expenses are recorded when they are earned or incurred, regardless of when the money is received or paid. This method provides a comprehensive view of a company’s financial health but can lead to complexities in tracking cash flow.

Image courtesy https://www.wallstreetmojo.com/accrual-accounting-examples/

Real-time ledgers, facilitated by RTP, provide an up-to-the-minute view of transactions as they occur. Unlike accrual accounting, where there may be a lag between a transaction’s occurrence and its recording, real-time ledgers capture financial activities instantly.

The transition from accrual accounting to real-time ledgers offers several key benefits. For example, improved cash flow management can allow real-time visibility into transactions enabling better cash flow management. Furthermore, by reducing the time lag between transactions and their recording, real-time ledgers minimize the risk of errors and discrepancies which can also save staff time and labor costs.

Trending Transition To Digital Tools

The digital transformation that’s sweeping across various industries is having a profound impact on the way businesses conduct transactions. This ongoing transition towards digital tools is not only reshaping traditional practices but also accelerating the adoption of real-time payments (RTP). From invoicing to reconciliation, digital tools are streamlining processes, making RTP a natural fit. Here are some examples of how RTP will be complimented by digital tools.

1. Digital Invoicing

Digital invoicing has replaced traditional paper-based invoicing in many businesses. This shift allows for instant creation, sending, and tracking of invoices. RTP complements this by enabling immediate payment upon invoice receipt, thereby closing the loop in a seamless digital process.

2. Automated Reconciliation

Reconciliation has historically been a time-consuming task. Digital tools automate this process, and RTP ensures that the data being reconciled is real-time and accurate.

3. Customer Experience and Expectations

As consumers increasingly embrace digital tools in their personal lives, they expect the same level of convenience and immediacy in their business interactions. RTP aligns with this expectation, offering a payment experience that matches the speed and convenience of other digital interactions.

The Bottom Line

The landscape of financial transactions is undergoing a seismic shift, driven by the convergence of technological innovation, evolving business needs, and a global push towards real-time responsiveness. Real-time payments (RTP) stand at the epicenter of this transformation, redefining how businesses, especially in the B2B sector, transact and manage their financial operations.

The success of RTP is not an isolated phenomenon but a complex interplay of factors such as interoperability, simplicity, reduced costs, and alignment with broader trends like digital transformation and real-time data analytics. The Federal Reserve’s FedNow Service exemplifies the institutional support and strategic vision that are propelling RTP from a novel concept to a foundational element of modern finance.

The transition from traditional practices like accrual accounting to real-time ledgers and the integration of digital tools such as digital invoicing and automated reconciliation further underscore the holistic nature of this transformation. It’s not merely about speeding up transactions; it’s about creating a more agile, transparent, and efficient financial ecosystem that resonates with the pace and dynamism of today’s business world.

In a way, RTP is to finance what the internet was to communication—a game-changer that transcends technology to impact how we conduct business, interact with each other, and envision our financial future. The journey towards RTP is not without challenges, but the potential benefits are compelling, offering a glimpse into a future where money moves as swiftly and seamlessly as information does today.

As we stand on the cusp of this new era, businesses, financial institutions, regulators, and technology providers must collaborate and innovate to harness the full potential of RTP. The roadmap is complex, but the destination is clear—a world where financial transactions are not bound by delays, inefficiencies, or barriers but flow in real-time, mirroring the immediacy and connectivity of our digital age.