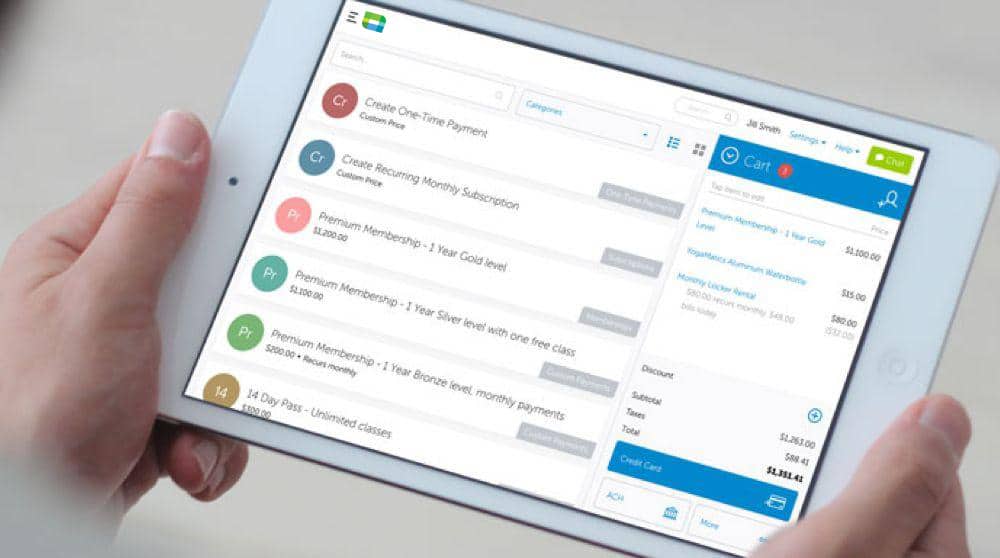

ACH Payments Anywhere

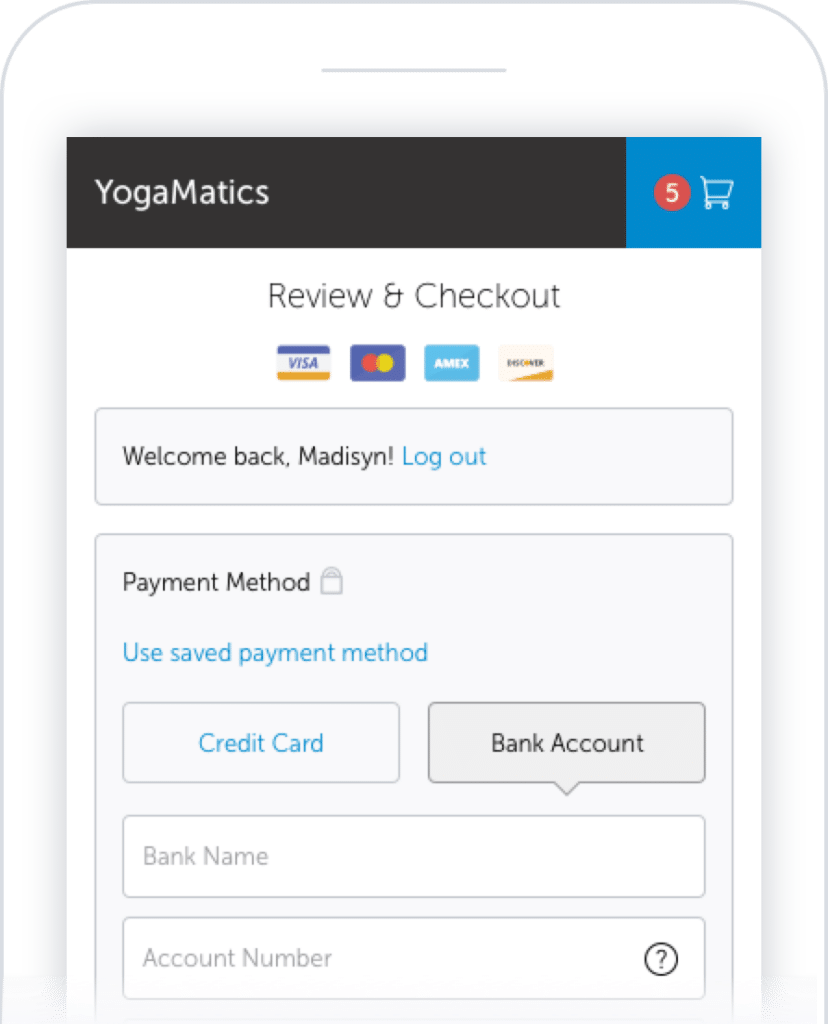

Accept ACH payments online, in-person, over the phone, or on your mobile device.

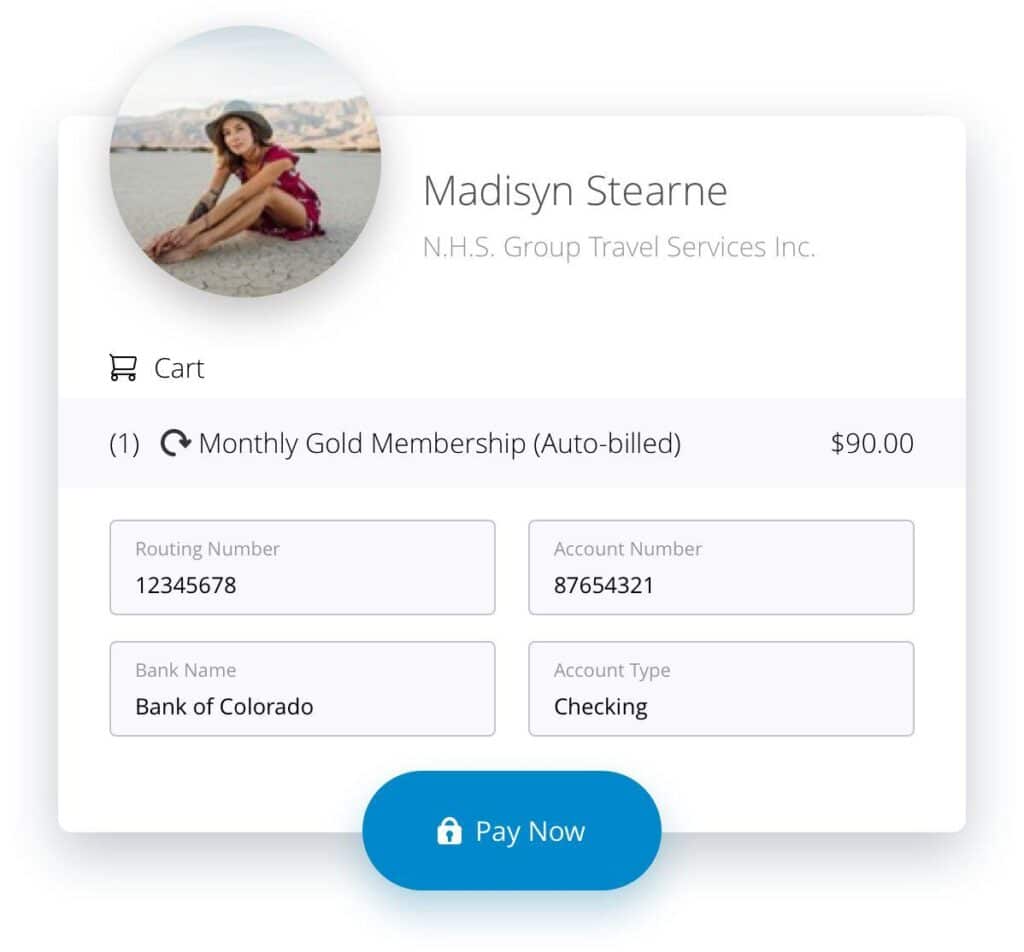

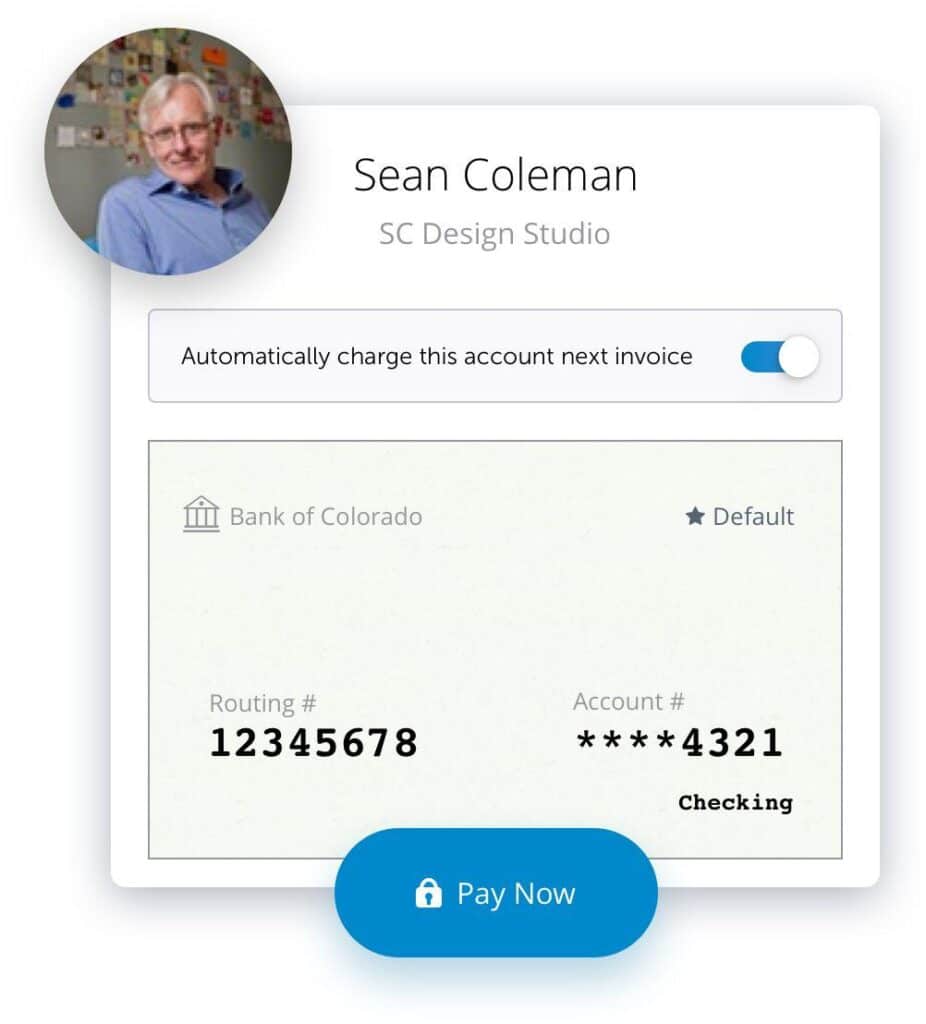

Recurring ACH Payments

Improve cash flow and create predictable revenue by collecting ACH information once and automating future payments.

Competitive Processing Rates

Save more of your hard earned money with ACH processing rates as low as 60c + 0.2% per transaction.

Get Paid Faster with ACH Payment Processing Software

Cut out time tracking paper checks and stop making trips to the bank by accepting ACH payments for all of your services.

Save Money with ACH Processing Fees

With ACH payment processing, you reduce the number of processing fees you pay compared to credit cards and collecting and depositing paper checks.

The Guide to Accepting ACH & eCheck Payments

Everything you need to know about safely accepting ACH and eCheck payments for your business.

Download Your Guide

Offer Flexible Payment Options

Earn and keep loyal customers by offering flexible payment options that work best for them. Accept ACH payments for a hassle-free experience and a happy customer.

Create Reliable Revenue with Recurring ACH Payments

PaySimple’s ACH payment software allows you to collect ACH payment information once and then automate future payments with a recurring ACH transfer.