Virtual credit card terminals are great solutions for many businesses operating today. Providing flexibility to nearly every industry and especially to service-based businesses, virtual credit card terminals allow you to process payments without a physical card reader. Though some can be used with one.

If your business feels limited by charging physical cards on the spot, either because of your business model or location, consider setting up a virtual credit card terminal.

In this post, we’ll discuss the many benefits of a virtual terminal and how it can help you optimize your business.

What Is A Virtual Terminal For Credit Card Processing?

Many businesses today offer all or portions of their services in-home, online, or on the go with mobile set-ups. Whether completely online or not, a virtual credit card terminal is the solution for businesses that want to accept credit card payments quickly without relying on a card reader.

Especially popular with service-based businesses, virtual terminals can process mailed-in, called-in, or keyed-in payments from in-person clients. All at a reasonable cost to the business.

Online virtual terminals can also handle recurring billing for clients; a function many service-based businesses need.

In short, for many of today’s service-based businesses, an online virtual terminal simply is the best choice.

This technology works for businesses both large and small. From independent contractors like accountants to large nonprofits who host fundraising campaigns, there are a range of industries that need virtual payment solutions.

How are you accepting payments?

Learn all the ways to accept online paymentsClick here to access the FREE [Cheat-Sheet]

How Does A Virtual Credit Card Terminal Work?

So, how does virtual terminal credit card processing work? This is a typical transaction from start to finish:

- Your customer or client provides credit card, debit card, or ACH details by email, physical mail, or phone

- You log in to your virtual payment terminal and enter in the necessary information

- The payment is processed through the virtual terminal

- You complete the form and all parties receive confirmation of a successful transaction

It’s really that simple with virtual terminal credit card processing. All you need is access to a computer, tablet, or smartphone.

What Are The Major Virtual Credit Card Terminal Benefits?

Virtual credit card terminals give mobile dog groomers, landscapers, accountants, lawyers, chiropractors, gym owners, nonprofits, daycare centers, consultants, contractors (and the list goes on and on) the ability to accept credit cards at a reasonable cost. No more excessive fees or chasing down late payments.

Here are some of the major benefits of a virtual terminal for your business.

1. Process payments at lower rates

A virtual credit card terminal allows you to process payments with ease, whether you receive information by phone, email, or physical mail. With this solution, your merchant account will be set up to accept “card not present” transactions at a qualified rate. This is often a full percentage point lower than a non-qualified rate on a card reader, which can save you hundreds (or thousands) of dollars every month, depending on your payment volume.

Processing a payment on a virtual terminal is as simple as logging in to your account and typing in the credit card information. Once you submit the payment, the transaction is processed, and funds are deposited into your bank account within a few business days. For businesses that accept and process payments remotely, an online virtual terminal is a necessity.

2. Set up recurring credit card payments

One of the biggest advantages of online virtual terminals over physical card terminals is that many include recurring payment functionality.

Simply enter the credit card information, set a recurring payment date, and let the virtual terminal do the rest. For businesses that rely on recurring payments, tracking down members or clients each month to get payment information can be a struggle. If you’re currently using a card reader to process payments, you’re likely familiar with this issue.

By making the switch to a virtual terminal, you’ll enjoy the improved and more reliable cash flow that recurring billing provides, while providing a convenient service for your customers.

3. Securely store customer data for future transactions

Managing your customer’s financial information is an important issue that all business owners should prioritize. If you’re physically storing customer credit card information for future purposes, you might be violating PCI DSS compliance rules.

By using a secure online virtual terminal provider to handle and store credit card data, you’ll be set up to comply with PCI DSS regulations. The virtual terminal provider securely stores customer data for future purchases and doesn’t put your business at risk for data breaches.

The last thing you want to worry about is losing sensitive credit card information. By securely storing it with a trusted provider, you can feel confident that your customers’ payment information is safe.

4. Gain 24/7 access to your records

With a virtual credit card terminal, you have complete control of the payment process from start to finish. That means you also have access to your records 24/7.

Owning a small business is no easy feat. There are late nights and busy weekends. Chances are, you’re tying up loose ends outside of the typical workweek hours. When you have a virtual payment terminal, you can easily balance your budget anywhere at any time.

As long as you have a computer, tablet, or smartphone, you can access your payment records and important customer data. As a business owner, this type of access can boost your efficiency and give you peace of mind.

5. Improve cash flow and reduce costs

Virtual terminal credit card processing is cost effective and flexible enough to keep your business running smoothly.

There is nothing more frustrating than chasing down late payments. Processing checks can lead to insufficient funds, late payments, and a lack of clarity when it comes to your cash flow. This is a headache for business owners who are still operating on a paper basis, especially when you consider invoicing costs.

The benefits of a virtual credit card terminal include fast and easy payments to keep your business running smoothly.

Set Up A Virtual Credit Card Terminal For Your Business

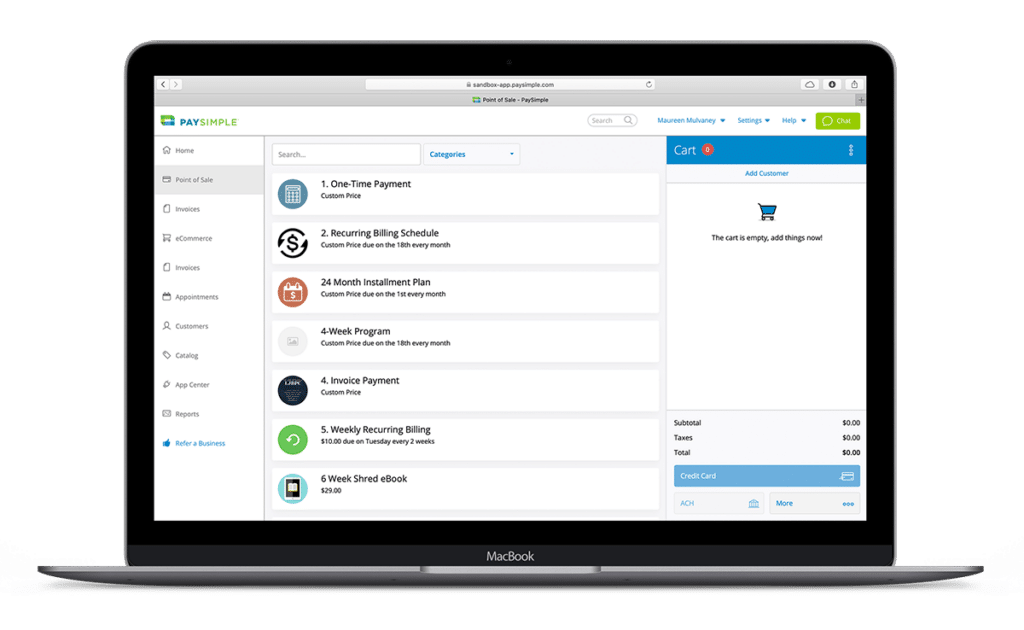

PaySimple is an award-winning virtual credit card terminal provider that enables businesses to process credit cards, ACH, mobile, mailed, phone, or recurring payments easily and cost effectively. We give your business the flexibility to compete in an increasingly mobile and on-the-go world.

We make payments simple. PaySimple can help you find the right payment solution for your unique business, whether that’s with a virtual terminal or accepting payments directly online. Get started with our free payments evaluation guide.

> Supporting Post: Credit Card Reader for Business