Snail mail is quickly becoming a thing of the past. Evolving technology allows for convenience in nearly every corner of our lives. From paying bills to purchasing everyday items, you can accomplish nearly anything online. Sending an invoice via email falls into the same category. It’s more convenient for your customers and clients while also streamlining your business processes. In this post, we’ll cover everything you need to know about online invoicing, and we’ll even include an invoice email sample for you to use moving forward.

Advantages of Sending Invoices Via Email

Skip the postal service and save yourself the cost of stamps. When you move to an online platform for invoicing, you save time and money. Invoices are instantly and securely delivered to your customer’s inbox with just one click of a button. But that’s not all.

Here are a few of the perks of sending an invoice via email.

Email invoices are professional and convenient

You want to appear as professional as possible when dealing with clients. An electronic invoice demonstrates that you’re technologically savvy and organized. Plus, software billing tools like PaySimple allow you to easily brand your invoice as a final touch. Whether it’s a logo or a color scheme, it takes your invoice to the next level.

Online invoicing is a convenient way for your customers and clients to find out how much they owe. You can get your invoice to them much faster than you would if you did it by mail. They don’t have to wait to receive it, and when set up, click-to-pay functionality allows them to immediately make a payment.

You have 24/7 access to the status of an invoice

When a paper invoice isn’t paid on time, you start to play a guessing game. Was it lost by the post office? Did your customer accidentally toss it out with junk mail? Did it even reach your customer?

With an online invoice, you don’t have to wait and wonder. From the moment your customer views the invoice, you are in the know. Receive an alert when it’s viewed, paid, nearing the deadline, or overdue.

Automation saves time and money

Many invoice online services, like PaySimple, let you automate your key billing tasks. Create customized recurring billing schedules to send automated invoices at set times. You can also avoid chasing down payments with automatic follow-up emails that remind customers of upcoming deadlines.

All together, these benefits can help you establish a more reliable cash flow and revenue stream. When billing is seamless and easy, you can focus on running your business.

What Do You Say In An Email Invoice?

An invoice serves multiple purposes. Not only is it a means to get paid, it also serves as a bookkeeping record for you and your clients. This is why you want to include several important details in your email invoice that will help if you’re ever searching for information down the road.

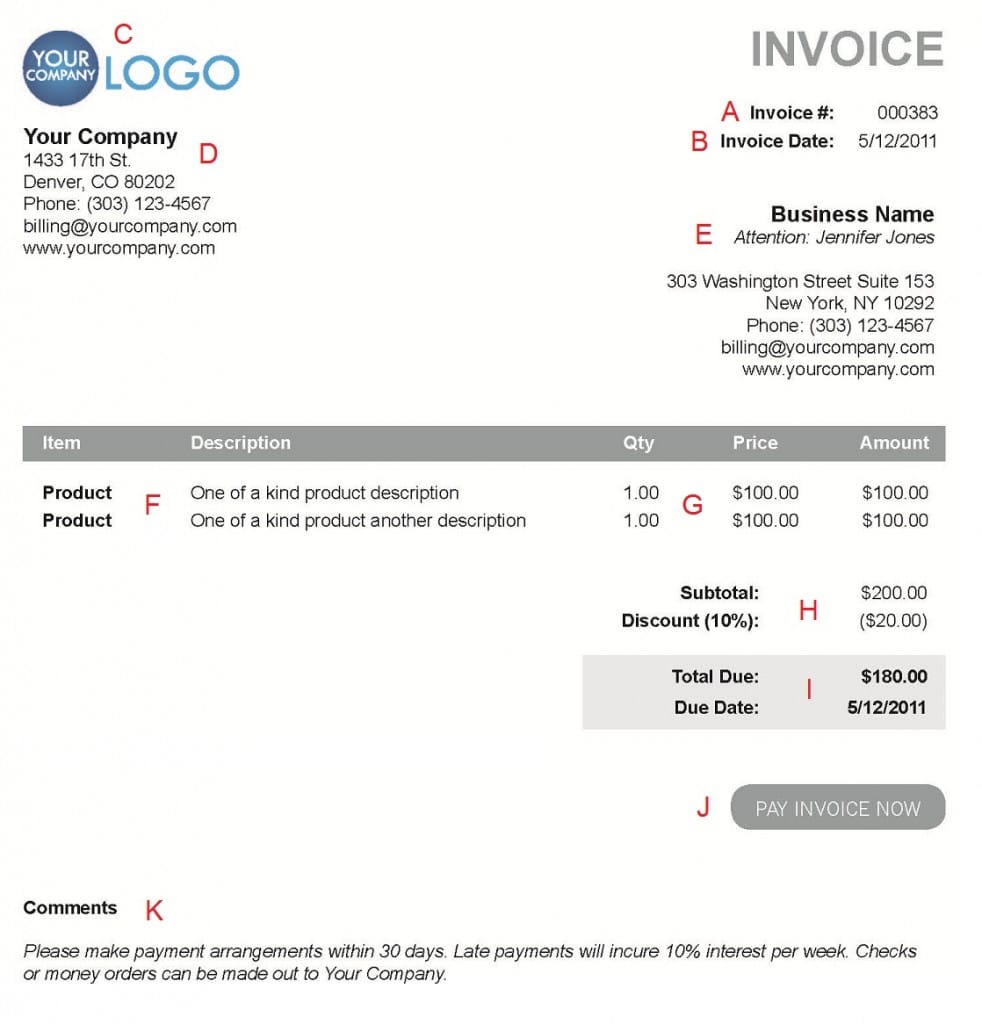

So, what do you say in an email invoice? Every company’s invoices will differ slightly, but these are some of the essential elements to include in invoices for business:

A – Invoice number: By tagging each invoice with a number, you can stay organized and easily reference that particular invoice. This will allow you to track what has been paid and what is outstanding.

B – Sent date: Always include the date on your invoice. This will help you determine a due date, depending on your policy. For example, if customers have 30 days to pay, you can easily calculate the due date as 30 days after the invoice date.

C & D – Your business name and contact information: Provide details about your business, including mailing address, phone number, and email address to allow your customers to get in contact with you if necessary.

E – Your client or customer’s name and contact information: Likewise, it is standard to include relevant information for the person receiving the invoice. This is also important for bookkeeping purposes.

F – Items and descriptions: This area is where you can list each service or product provided, along with a detailed description.

G – Item quantity, price, and amount: An online invoice template makes this part easy. Plug in the quantity and price of each product or service you provide, and it will automatically calculate the total amount.

H – Subtotal: Like most receipts, invoices will include the subtotal of all charges. This is also a common area to include taxes, if applicable.

I – Total balance due and due date: Your customer usually looks for this first. They need to know how much they owe and when it is due. Make sure this information is prominent and easy to find.

J – Click-to-pay button: An electronic invoice’s click-to-pay functionality is what makes it superior to a paper invoice. Set up a system that allows customers to click directly to a online payment form where they can provide their payment information, review terms and conditions, and simply click “Pay.”

K – Comments: This is where you may include any miscellaneous details, such as late payment terms.

Invoice Email Samples

Now that you know exactly what to include, how should you implement email invoices to customers? Sending a concise message to market your new invoicing process to your customers comes first. Here are some email templates you can use to handle this step.

When you use a tool like PaySimple, you’ll have access to email invoice builder that can be used alongside these email templates; making the process as simple as possible.

PaySimple: Your Go-To Email Invoicing Tool

Bill your clients with ease and get paid faster!

With PaySimple, you can send custom, professional invoices with click-to-pay functionality. Utilize branded templates, recurring invoices, and real-time tracking of every invoice sent and paid. Not sure why you haven’t been paid? You can even see whether or not an invoice has been viewed and set up automated reminders for any clients that tend to be forgetful.

Meanwhile, PaySimple offers a secure online payment portal, allowing you to accept credit, debit, and ACH payments from customers. Your clients will appreciate the ease of use and availability of options. For you, the ability to track your business finances and revenue is a huge advantage.