Modern customers enjoy a fast and easy payment experience. From one-click shopping to automatic bill pay, they’ve come to expect easy and intuitive online transactions. When you invoice online for your small business, you’re sending the message that you understand these needs.

However, because they’re quick to create and use, online invoices also improve the turnaround time of payments on your end. When an online invoice lands in a customer’s inbox, they can pay it quickly with a simple payment button. Compare that to paper invoices that arrive along with junk mail, only to be left in a pile of clutter.

Put simply, when you invoice online, everyone wins. This guide covers the basic components your online invoice should include, major benefits, and how to transition from paper to online invoices.

What Is An Online Invoice?

An invoice is a critical document for any business. It allows you to communicate with customers or clients about the products or services you provided, and what they owe in return. It also serves as an important financial record for both of you.

An online invoice simply takes the traditional paper invoices digital. When you move your invoicing to an online platform, you not only simplify your billing management, you can also save time. An online invoice often allows customers to both view an invoice and pay through an online portal in one easy step.

So, what should your online invoice include? These are some of the basic components of an online invoice:

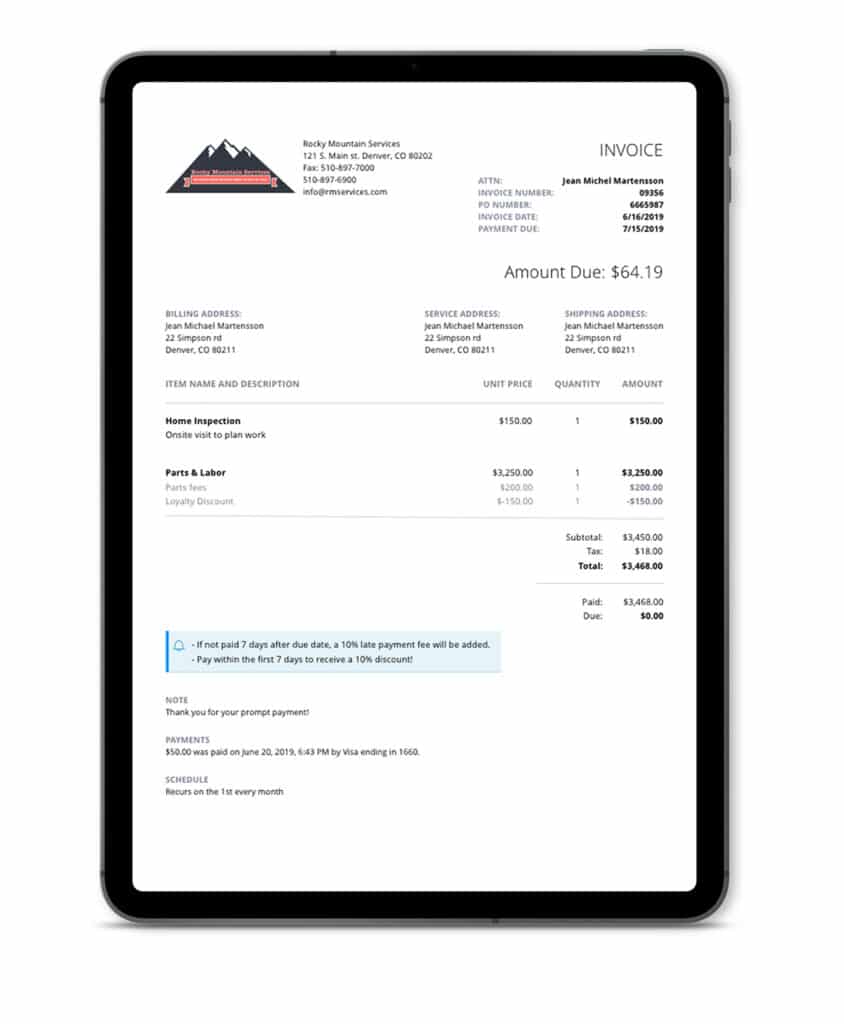

- Invoice number: By tagging each invoice with a number, you can stay organized and easily reference back to it. This will allow you to track what has been paid and what is outstanding.

- Sent date: Always include the date on your invoice. This will help you determine a due date, depending on your policy. For example, if customers have 30 days to pay, you can easily calculate the due date with the original invoice date.

- Your business name and contact information: Provide details about your business, including mailing address, phone number, and email address to allow your customers to get in contact with you when necessary.

- Your client or customer’s name and contact information: Likewise, it is standard to include relevant information for the person receiving the invoice. This is also important for bookkeeping purposes.

- Items and descriptions: This is where you can list each service or product provided, along with a detailed description.

- Item quantity, price, and amount: An online invoice template makes this part easy. Plug in the quantity and price of each product or service you provide and it will automatically calculate the total amount.

- Subtotal: Like most receipts, invoices will include the subtotal of all charges. This is also a common area to include taxes, if applicable.

- Total balance due and due date: Your customer usually looks for this first. They need to know how much they owe and when it is due. Make sure this information is easy to find.

- Click-to-pay button: An electronic invoice’s click-to-pay functionality is what makes it superior to a paper invoice. Customers are taken to a payment form where they can provide their payment information, review terms and conditions, and simply click “Pay.”

- Comments: This is where you may include any miscellaneous details, such as late payment terms.

How are you accepting payments?

Learn all the ways to accept online paymentsClick here to access the FREE [Cheat-Sheet]

Benefits Of An Invoice Online

If you need proof that moving to online invoice software can transform your business, these are some of the major benefits of an invoice online.

They’re more convenient

Both you and your customers reap the benefits of the switch from paper to online invoices.

Customers receive the online invoice directly in their inbox, and can often pay instantly via a click-to-pay button. Best of all, they can pay the way they prefer. From credit to debit (and even ACH) payment is easy when you invoice online.

These online payments are also often more secure. You can learn more about creating a stellar customer payment experience here.

You’ll always know the status of an online invoice

Many online invoicing services, like PaySimple, automatically track each invoice you send out, so you know exactly when a customer sees it, when it’s due, and when payment is late.

There’s no more waiting and wondering whether a paper invoice has arrived. From the moment customers access the invoice to the moment they make a payment, you’ll always be in the know.

Online invoices help you look more professional

Online invoices have a clean, professional design that you can customize as your business needs evolve.

With many programs, all you have to do is add your brand, logo, and colors for the right personalization. Many also contain preset essentials like invoice items, payment terms, and taxes.

Automate the way you get paid

Invoicing online means customers can pay you online, any time, 24/7. And, you’ll have a digital record of how much you can expect on your outstanding invoices.

Many invoice online services, like PaySimple, also let you automate your key billing tasks. Create customized recurring billing schedules to go out at set times with automated invoices. You can also avoid chasing down payments with automatic follow-up emails that remind customers of upcoming deadlines.

Together, these benefits can help you establish a more reliable cash flow and revenue stream.

Save valuable time

Skip the postal service and save yourself the postage fees. Invoices are instantly and securely delivered to your customer’s inbox with just one click of a button.

All together, these benefits make billing easier and more seamless so you can focus on running your business.

How To Invoice Online After Paper Invoices

Unfortunately, after years of traditional invoicing, you probably have a lot of paper invoices tucked into filing cabinets. You may be wondering where to begin or just overwhelmed by the work you’ll have to do.

While it may feel daunting, the transition from a paper invoice to an invoice online system is easier than you think. Here are a few recommendations for getting started.

1. Record all of your previous paper invoices

This will likely be the most time-consuming aspect of switching over to an online invoice software, but the rewards are worth it.

Depending on how many paper invoices you have, you’ll likely want to scan them into your computer. This will allow you to have a digital archive of every invoice, just in case you ever need to refer back to them. Once you have them reliably stored online, you can shred them.

Do this task yourself or see if you can outsource this to someone on your team or a local contractor.

2. Aim for a convenient start date

Consider kicking off the new year (or even the fiscal quarter) with a new automated invoice software.

While this isn’t necessary, it can help business transitions feel like a fresh start, rather than an inconvenience. It may also make things easier in terms of bookkeeping and taxes. Customers also generally expect more changes at the beginning of the year, so it’s easier for them to make the transition.

3. Find the best online invoice software

Shopping for the best online invoice software is easy once you know what to look for.

First, you should always have the option to customize your invoice online for a professional look. By tailoring your invoice to match the branding of your business, you’re sending a message of consistency and reliability.

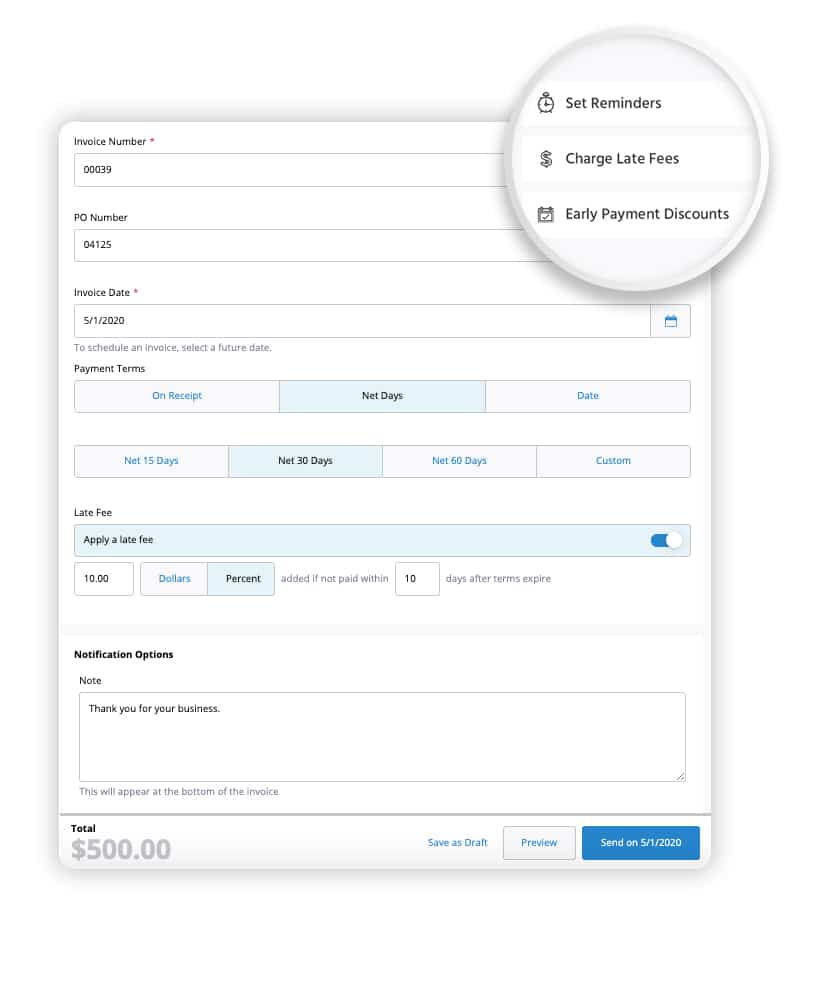

It’s also important to look for automated capabilities if you want to enjoy the simplicity of online invoice software. This will allow you to set up recurring invoices, reminders, and payment systems.

Also find options that allow for multiple payment options to make it easier on your customers. Credit card and eCheck payments are particularly important, but you can find all of the ways to accept payments online here.

Finally, easy and reliable financial tracking is a must. The best types of invoicing software will allow you to quickly see where payments might be missing or overdue.

4. Invoices at the click of a button

After you choose the right software for your business, it’s time to get started!

In most cases, easy online tutorials can help you get acquainted with your new system. The best companies also value customer service, so you always have access to a representative when questions come up.

5. Notify your clients and customers

Finally, notify your clients and customers about this exciting change! They’ll be happy to know they have even more flexibility and convenience when it comes to paying.

They want to use a credit card? Of course! Have to pay late at night? Not a problem. Be sure to communicate with them about the range of new benefits.

Confirm that you have the correct email address for each of your customers and then you can begin using your new system right away.

Create An Invoice Online With PaySimple

Online invoicing options offer huge benefits, but it can be hard to make the transition. At PaySimple, we’re here to help. With our automated invoice software, you will always feel confident and ready to tackle your billing tasks.

You can also create online invoices for business with your unique branding for a truly professional look. Ready to automate your business? Set up recurring billing and invoicing to get paid faster. Our software will also allow you to create predictable cash flow through automated invoice tracking.

Find out why so many small businesses and freelance workers choose PaySimple for their online payments. Start your free trial today!

Start My Free Trial