If you’re considering setting up ACH billing for your business, there are several important things to know before beginning the process. If you’re new to ACH billing and payments, you may wonder what it’s all about.

What is ACH?

ACH stands for the Automated Clearing House network, which moves money between bank accounts electronically. This network is specific to the U.S., and is managed by the nonprofit NACHA.

ACH is an efficient way to transfer money between back accounts without having to use card networks, cash, wire transfers or paper checks.

This system is able to handle a variety of transactions, including B2B, consumer and government. Although you may hear or read “ACH,” “ACH billing/payment,” or “ACH payment system,” all these descriptions refer to the same thing.

Types of ACH

There are two main types of ACH transactions: direct payments and direct deposits.

Direct payment ACH is used when paying bills, making a purchase or making a donation. Its focus is the electronic movement of money to make or receive a payment.

Direct to deposit ACH is used mainly for payroll, or is when when a business (or government agency) makes a payment to a consumer.

Why should I use ACH?

The main benefit of using ACH is that you, the business, are paid directly from the customer’s bank account. This removes any risk of bounced checks, declined credit cards, and the like. Not only is this convenient for you, it’s convenient for your customers. Transactions are safer, quicker, and less likely to have errors.

Using ACH can be a shift for business owners, and like any new process, there are a lot of things to know. Here, we’ll take you through the top seven ACH billing facts to consider.

1. ACH billing tends to have lower transaction fees

In most cases, ACH transactions are less expensive for merchants than credit and debit card transactions if the processor is charging a flat transaction fee.

The larger your average ticket, the more the savings.

For example, if your average ticket runs at $50, a credit card transaction fee with a rate of 2.49% can be $1.25. However, an ACH billing transaction can be a flat $0.60. For a $100 transaction, the difference is $2.49 vs. $0.60.

Another added benefit of setting up ACH billing is that you do not have to worry about incurring a non-qualified surcharge on transactions—the flat rate is the flat rate.

Takeaway:

All of this depends on the rates that your credit card and ACH processors are charging. If you’re using a gateway that charges extra per transaction, that cost should be factored in on both sides as well.

So, if based on your average transaction size and rates your providers are offering, the cost ends up being net/net, read on to learn about other factors than can weigh in on your decision.

How are you accepting payments?

Learn all the ways to accept online payments

Click here to access the FREE [Cheat-Sheet]

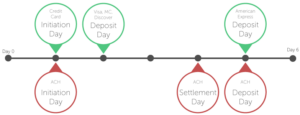

2. ACH billing has different processing times

- A credit card transaction (depending on the card) can take 2-3 business days to process.

- ACH billing takes about 3-5 business days, but most banks favor ACH transactions over paper checks when making funds available.

Check out our guide to understanding ACH and credit card funding time here.

Takeaway:

When weighing the benefits of cost-savings and customer convenience, be sure to factor in the processing time. This can make a difference when forecasting your cash flow.

3. ACH billing is different than a debit card transaction

Both ACH and debit card transactions come out of the customer’s bank account, but the process is completely different. From a customers’ perspective, they are providing you with authorization to debit their bank account with the routing and account number instead of swiping or keying in a debit card number.

For you, aside from the processing time and transaction cost difference, you’re dealing with an entirely different partner to process the payment.

Takeaway:

Unless you have a third-party software provider handling your customer support, you’ll be dealing with different chargeback policies and you’ll be contacting a different party if any issues arise on the transaction.

4. ACH billing payments can still return for NSF

ACH payments can also return as NSF (non-sufficient funds), even if the transaction initially goes through. Unless you’re set up for check verification or check guarantee (both of which typically include a hefty per transaction charge), your ACH payments can still return NSF.

When processing the transaction on the spot, the system is only checking to see if that account actually exists at that routing number—not if there are funds available for the transaction amount.

Takeaway:

Consider limiting ACH billing to certain trusted customers if you have experienced a high NSF rate with paper checks, or if you know that your customers have the tendency to have unreliable payment forms.

57 Sales Tips That Actually Work!

From the President of PaySimple to You: The Small Business Sales Guide

Click here to access the FREE guide

5. ACH transaction fees will be debited separately from your other transaction costs

ACH transactions are processed through a different merchant account and a different provider—meaning that the fees debited for the transaction and/or gateway costs will be separate.

Takeaway:

This difference will affect your bookkeeping, so be sure to remember it when working on your books.

6. ACH billing requires authorization

Similar to any payment form, you must have authorization from your customers:

- For a check, the customer signs the check before sending it to you.

- For credit card transactions, the customer signs a receipt, swipes their card, or signs a form.

- For ACH, customer authorization is a similar process. It’s usually acquired by a signed form, or can also be obtained over the phone.

Takeaway:

When setting up ACH billing, be sure to learn how to authorize your particular types of transactions. As with any customer transaction, it’s important to protect yourself from disputes and potential fraud.

If your business has one-time, recurring, or unique billing schedules, ACH billing is typically flexible enough to suit your needs. Customers can authorize payments for variable amounts, recurring amounts, varying dates, or not to exceed certain amounts.

Bonus: Download three FREE payment authorization templates here.

7. ACH billing has different dispute policies than credit cards

According to NACHA, there are only three reasons people can dispute ACH charges to their account:

- If the charge was never authorized by the account holder.

- If the charge was processed on a date earlier than authorized.

- If the charge is for an amount different than authorized.

Takeaway:

Disputing an ACH charge requires that the account holder provide notice to the bank in writing (or the electronic equivalent) that one of those three conditions exists. Note that this is very different from credit card transactions where a customer can have a charge reversed simply by claiming that the product or service received was not what they expected. In this way, ACH billing offers additional protection for the merchant from fraudulent consumers.

Learn More

Now that you know the ins and outs of setting up ACH billing, you can feel confident making the right choice for your business. For more information on ACH billing, you can learn about obtaining an ACH merchant account here, as well as complete details of how ACH works here.

Visit PaySimple.com to learn more or start your free trial today: