It’s all about convenience nowadays. From mobile pet groomers to in-home beauty services, nearly every industry is going mobile. It’s simply an unmatched level of convenience for customers and entrepreneurs who crave flexibility. If you’re going to hit the road, you’ll need mobile payment processing. Here’s everything you should know about getting paid while you’re on the go.

What Do We Mean By Mobile Payment Processing?

Technically speaking, mobile payment processing encompasses several different ways to pay, including:

- In-store mobile payments: This is when a customer pays for products or services at a storefront using their mobile phone with contactless payment technology, like Apple Pay.

- Mobile eCommerce: Often referred to as mCommerce, this is when customers make purchases on a website using their mobile phone internet browser. It may be through a mobile app or a version of the website that is formatted specifically for mobile phones. With how ubiquitous mobile is, though, all online stores should consider mobile in their design now.

- P2P mobile: Services such as Venmo and Google Wallet allow for peer-to-peer payment options. This is how you send money to your family members or friends (usually free of charge).

- Mobile credit card processing: This is usually what people mean when they refer to mobile payment processing. Using a mobile credit card reader as a point-of-sale system, customers and clients can pay immediately using their credit or debit card.

For the purposes of this post, we’ll look primarily at mobile credit card processing, especially for mobile workers, which allows you to accept credit card payments on your phone.

Meeting The Demands Of A Mobile Workforce

Cash is increasingly unpopular, and checks are even more uncommon. People love to use their credit cards. For starters, it’s a quick and easy method of making payments. With rewards programs on the rise, consumers are also more inclined to put everything on one card. This helps them reap the benefits of airline miles, travel rewards, and even cash back.

The fact is, if you’re not accepting credit or debit cards, you could be missing out on business. What types of businesses can benefit from mobile payment processing? Any business with the potential to operate in settings other than a normal storefront. (And even those with a normal storefront opt for mobile tablets for payments!)

For example, for mobile dog groomers or mobile car detailing companies, it’s as simple as showing up and completing the job. Once you’re finished, use your mobile credit card reader to swipe your customers’ debit or credit card and collect payment on the spot. No need to send an invoice by email and wait for payment. No need to carry a bunch of cash.

Likewise, do you sell products at swap meets or farmers markets? A mobile POS is crucial for you as well! Don’t limit yourself to cash-only transactions that could discourage potential buyers. Enable customers to make purchases, even without cash on hand.

For mobile masseuses and vets, the best mobile credit card processing apps also store important customer information. This data helps you stay in touch in the future and provide receipts after a sale.

How Does Mobile Credit Card Processing Work?

How does mobile credit card processing actually work? It depends on the provider, but the best tools are intuitive and lead you through the process, one step at a time. They should make it easy to do business.

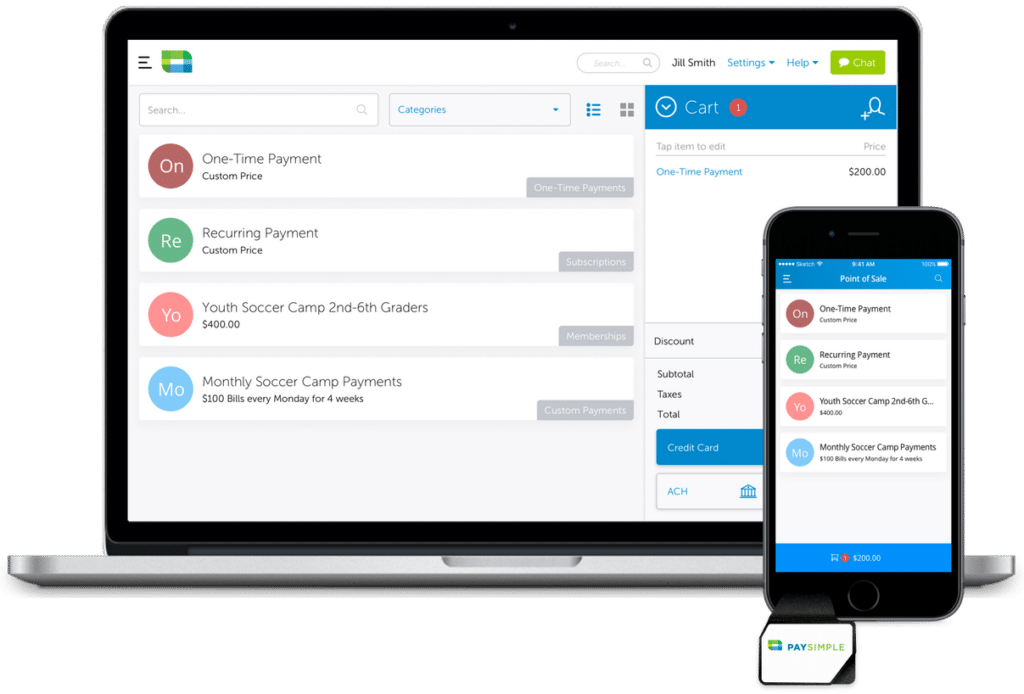

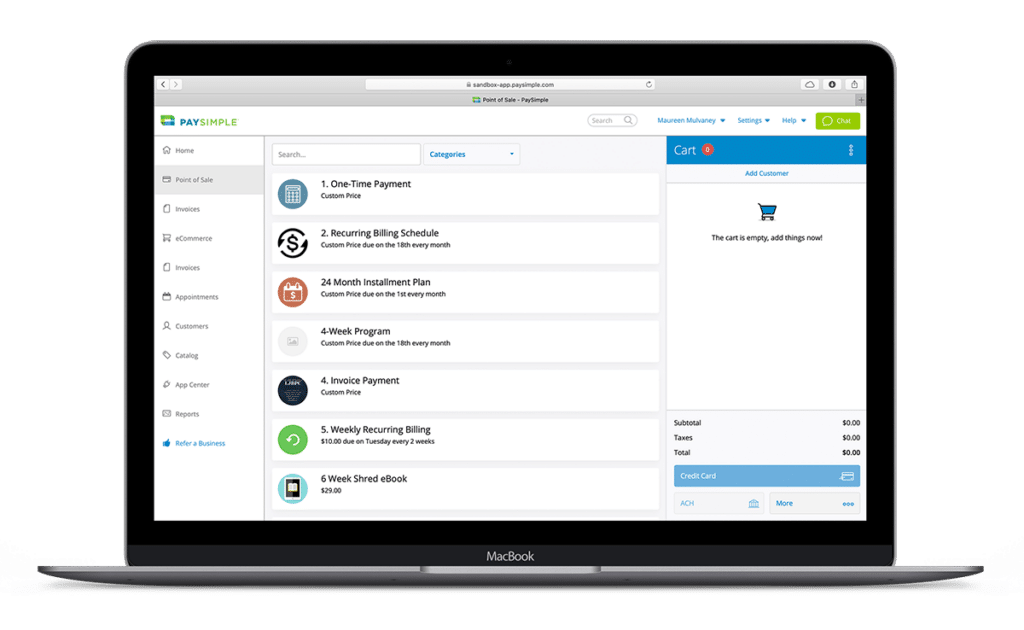

For example, PaySimple’s user-friendly mobile app breaks down every step of the process for you. It also syncs with our online platform, so your mobile and online payments are collected into one place. Here’s how it works at PaySimple:

- Log into our secure app using your smartphone or tablet and instantly access your PaySimple account

- Choose to enter a one-time payment or set up a recurring billing schedule (perfect for service-based businesses!)

- Accept one of the convenient forms of payment, including credit or debit cards

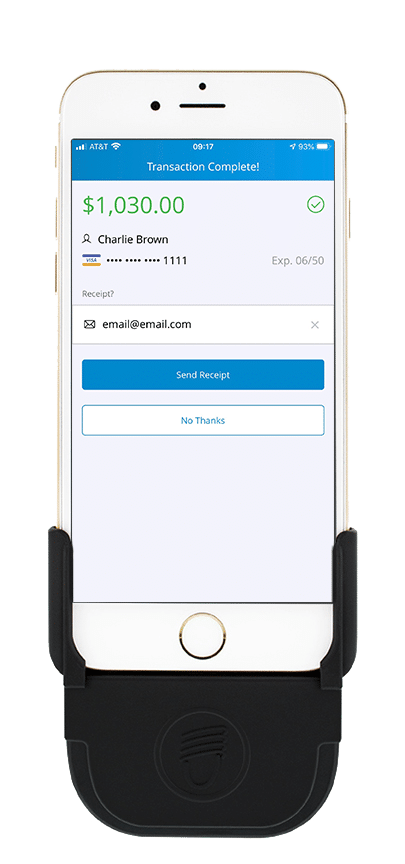

- Use our mobile swiper to easily charge your customer or key in payment details or select to use their saved payment information

- Manage your payment and billing tasks anywhere, anytime

Yes, it’s really that simple!

Want to learn more about the technical mobile payment process? Let’s get into the nitty gritty details and the features you should look for.

Dedicated merchant accounts

A merchant account is a specific type of business bank account that allows you to accept different types of payment, typically debit and credit card payments.

The type of merchant account you choose will determine the types of cards you can accept and the transaction fees you’ll owe. There are generally two types of merchant accounts: aggregated and dedicated merchant accounts. With a dedicated merchant account, your company is the only one processing transactions through the account. This can give you more security since your payments aren’t grouped with other business owners as with aggregated accounts.

You can learn more in our complete A-Z guide on merchant accounts.

Data security

It’s critical to protect your customer’s payment data today. A data breach can put your credibility at risk and your business in jeopardy. With this in mind, it is essential to find a provider that complies with all PCI requirements for small businesses.

A PCI certified company will handle all of your credit card processing, transaction history storage, and credit card account storage. Once you move all data entry, processing, and data storage to a PCI certified partner, you’re almost there. Getting to full PCI compliance after that is as simple as completing a few types of paperwork.

PaySimple is a Level 1 PCI DSS certified Service Provider, handling the majority of your PCI compliance requirements, and guiding you through the rest.

Flexible with payment acceptance

Your focus should be on providing your products or services. That means you need software and payment acceptance options that meet all of your business needs at once.

Instead of searching for different providers that require additional fees, look for an all-in-one solution. For example, are virtual terminal processing, email invoicing, recurring billing, website payments, and mobile payments included in the solution, or do you have to set these up separately? Does it accept credit cards, as well as ACH payments? The more providers you need, the more costly and complicated your experience will be. Look for one that makes it simple by providing multiple payment options within one system.

Get Started With Mobile Payment Processing

Are you ready to generate more revenue and streamline your business approach? PaySimple can help.

Our mobile app lets you run your business wherever you, your employees, and your customers are. You’ll have the ability to accept credit cards wherever you are, access and update customer information, add and manage service offerings, and see all of your reports and dashboards right from our Android or iOS app. It integrates directly with any online store fronts, allowing you to accept credit cards, ACH payments, and more online.Our user-friendly customer-focused platform gives you the ability to combine payment accounts, billing history, contact information, service notes, order management, reporting, and more. Ready to make running your mobile business even more effortless? Tie each order and payment to a customer record and allow customers to save their credit card or ACH information on-file. With just one click, they can easily pay for recurring services.