Many business analysts point to poor cash management as the number one reason that businesses go bankrupt. If your business’s cash flow could use some attention, don’t despair! Analyzing a few simple financial ratios can make a world of difference. One of the most important ones is the days sales outstanding ratio (DSO). Ready to learn more? This post discusses what this formula is, how to run a DSO calculation, and how to improve your DSO.

The Days Sales Outstanding Formula

Revenue is created any time you make a sale, but often this only means an invoice was created. It doesn’t count as cash until you actually see the money in your bank account, and this means you have to focus on collecting that cash. All too often, businesses work to increase their sales without regard to their actual cash position… and this can spell disaster for a small business owner.

With that in mind, let’s look at a few key terms to start:

- Cash sale: A sale that is settled immediately. The payment can be made by a card or other forms like actual cash, check, or eCheck. The defining characteristic is the timing of the payment being made—at the time the sale is created.

- Credit sale: A sale that is settled on a future date. Similarly, payment can be made in cash and be considered a credit sale. The defining characteristic is the timing of the payment being in the future, after services are rendered.

- Accounts receivable (A/R): The accounting term for all of the outstanding invoices owed to your company, at a specific moment in time. If you use a bookkeeper for your business, they can provide this information. If not, you can find it yourself by looking at your balance sheet and income statement.

How does the days sales outstanding formula fit in here? Your days sales outstanding ratio shows how many days on average it takes you to collect on your credit sales. Using this ratio can streamline your accounts receivable process and boost your profitability by adding predictability into your business. DSO is often calculated on a monthly, quarterly, or annual basis.

For your DSO calculation, you’ll need:

- To determine a period of time

- Your starting accounts receivable balance

- Your ending accounts receivable balance

- Total credit sales over that time period

The days sales outstanding formula is:

DSO = (Average Accounts Receivable / Total Credit Sales) x (Number of Days)

How To Calculate Days Sales Outstanding (Or DSO)

Let’s take an example to show how the days sales outstanding formula works.

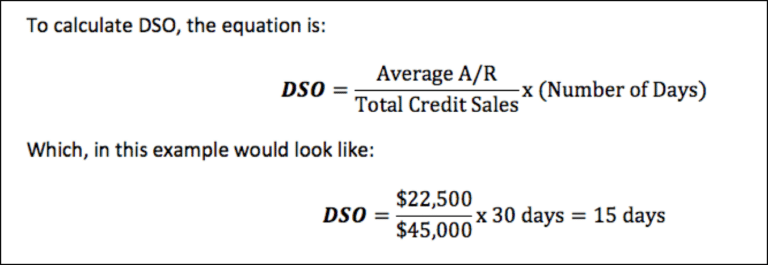

Suppose you own a business that has $25,000 in accounts receivable (A/R) on September 1st, 2019. Then on October 1st, 2019, that amount was $20,000. Additionally, let’s assume you sell $45,000 on credit over that time period.

To get your DSO calculation, first find your average A/R for the time period. The average between $25,000 and $20,000 is $22,500, so this is your Average A/R.

The next number you’ll need is your Total Credit Sales, which was given as $45,000.

Lastly, determine the number of days in the period. September has 30 days in it, so we’ll use 30 for your Number of Days.

This DSO calculation tells us that it takes this example business 15 days (on average, for this time period) to collect on a credit sale, which is pretty great for most industries. Generally, a DSO under 45 is considered low, but this really depends on your business and industry. Do a little research in your particular industry to see what is accepted as a “normal” DSO for you.

How To Improve DSO

Now that you know your DSO, you can determine if you need to improve it. If you have a healthy DSO, congratulations! Keep monitoring it on a semi-regular basis to make sure that your business remains in good financial health.

If your DSO could use some improvement, however, don’t despair. A few changes in your collection processes could make a world of difference. You can improve your DSO by:

- Whenever possible, collecting payment upfront: Many of your customers won’t resist paying upfront. All you have to do is ask!

- Offering multiple payment options to your customers: Most customers want to pay you for your services, but you have to make it convenient for them! Make sure you accept credit cards as well as eChecks.

- Making payments as automated as possible: If your customers have to rely on speaking with someone in your business to pay an invoice, you’re limiting their options and wasting time. Get set up for recurring online payments so that your business can collect invoices automatically.

Move Towards More Reliable Cash Flow

PaySimple can help you streamline your company’s payment processes to improve your overall DSO and cash flow.

Set up flexible payment options, automate your billing, and accept payments anytime, anywhere with PaySimple. If you’re interested in learning more about the benefits of using PaySimple to collect payments online, give us a try.