The holiday season is a time of joy and celebration for many. However, it can also be a time of increased vulnerability regarding financial transactions. Why? Because statistically, the increased number of transactions during this time of year increases the odds of fraud.

As a business owner, ensuring the security of your customers’ payments should be a top priority. Luckily, integrated payments have emerged as a powerful solution to safeguard customer information and enhance transaction security. In this article, we’ll explore the specific ways integrated payments provides more security to your customers during the holidays.

Streamlined and Secure Transactions

Integrated payment systems provide businesses with a streamlined approach to processing transactions, offering significant advantages in terms of efficiency and security. By integrating your payment processing with your point-of-sale (POS) system, online store, or mobile app, you can eliminate the need for manual data entry and reduce the chances of human error.

In addition to reducing errors, integrated payment systems enhance security by minimizing the exposure of customer data. For example, with manual data entry, there is always a risk of data leakage or interception, especially if multiple individuals or systems handle sensitive payment information. However, by integrating payments directly, you can limit the access points and pathways through which customer data flows, reducing the potential vulnerabilities and points of attack for cybercriminals.

Moreover, integrated payment systems often have built-in validation checks that help detect and prevent data entry errors in real time. These checks can include verifying the credit card number format, expiration date, and security code, ensuring that the payment information entered is accurate and valid. By automating this validation process, businesses can significantly reduce the likelihood of transaction errors, creating a smoother and more secure payment experience for customers.

Encryption and Tokenization

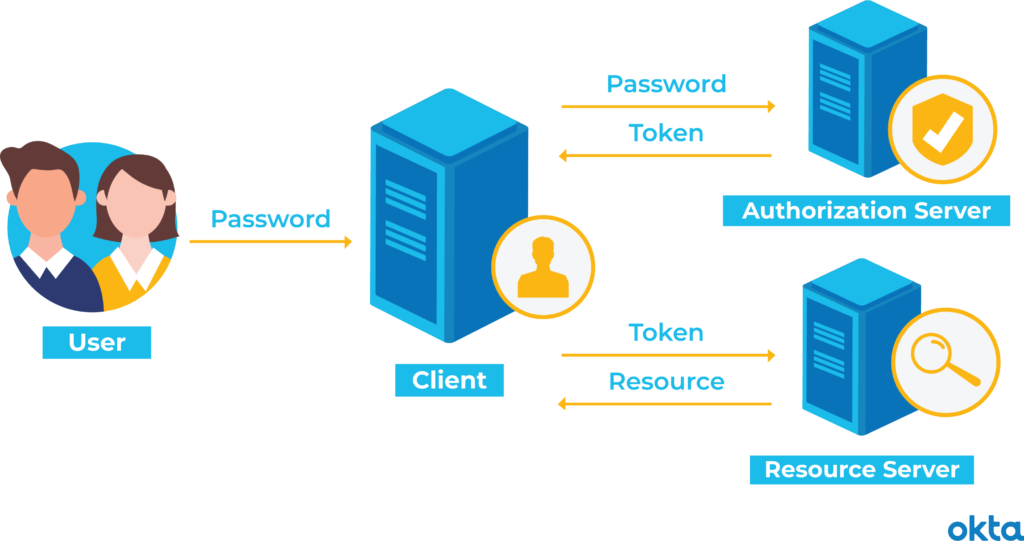

Integrated payments utilize encryption and tokenization to enhance customers’ security all year round, but this is especially helpful during the busy holiday season. Specifically, encryption technology ensures that sensitive customer data, such as credit card numbers and personal information, are protected during transmission. By encrypting the data at the point of capture and throughout the transaction process, integrated payment solutions ensure that, even if intercepted, the information remains unreadable to unauthorized individuals. This robust encryption mechanism adds a layer of security, safeguarding customer data from potential breaches and instilling confidence in the security measures of businesses during the holiday rush.

In addition to encryption, integrated payment solutions employ tokenization to bolster security further. Tokenization replaces sensitive cardholder data with unique tokens, rendering the original data meaningless to anyone who might gain unauthorized access. These tokens are used for transaction processing, while the actual customer data is securely stored off-site in a token vault. This method significantly reduces the risk of data theft, as the stored tokens hold no valuable information for potential attackers. By leveraging tokenization, integrated payments ensure that customer data remains highly secure, helping to prevent a client from having to deal with the frustrating process of canceling their credit card when they plan to use it most to purchase gifts for their friends and family.

Enhanced Fraud Detection

Some Integrated payment systems also leverage enhanced fraud detection measures to provide heightened security for customers during the holiday season. For example, these systems incorporate advanced technologies such as artificial intelligence (AI) algorithms and machine learning to analyze real-time transaction patterns, customer behavior, and historical data. By continuously monitoring and analyzing these factors, integrated payment solutions can quickly identify and flag potential fraudulent activities.

Additionally, integrated payment solutions often collaborate with established fraud detection networks and share data across the industry. This collaboration allows for multiple businesses’ collective knowledge and experience to be pooled together, creating a robust network of fraud intelligence. By tapping into this network, integrated payment systems can access real-time information and alerts about fraudulent activities, helping businesses identify and mitigate risks more effectively. Ultimately, this collaborative approach to fraud detection adds an extra layer of security and peace of mind for customers during the holidays.

Compliance with Industry Standards

Integrated payments prioritize compliance with industry standards to provide enhanced security to customers. One crucial standard that integrated payment solutions adhere to is the Payment Card Industry Data Security Standard (PCI DSS). Compliance with PCI DSS ensures that businesses follow a set of best practices and security measures to protect customer payment data. By implementing an integrated payment system that is PCI DSS compliant, businesses demonstrate their commitment to data security and the protection of customer information, instilling confidence in customers during the holiday shopping period.

Moreover, compliance with industry standards extends beyond PCI DSS. Integrated payment solutions often undergo rigorous third-party audits and certifications to ensure adherence to other relevant security and compliance standards. These standards may include ISO 27001 for information security management, SOC (Service Organization Control) reports, or GDPR (General Data Protection Regulation) compliance for businesses operating in the European Union. By aligning with these standards, integrated payment solutions provide an additional layer of assurance to customers that their data is being handled and protected by industry-recognized security practices, creating a secure environment for transactions during the holidays.

Secure Mobile Payments

With the increasing popularity of mobile commerce, customers expect the convenience of making payments using their smartphones, especially during the holidays. Integrated payment systems ensure these mobile transactions are conducted securely by implementing various security measures such as tokenization in mobile payments.

For example, when customers pay using a mobile app or mobile-optimized website, their sensitive payment information is replaced with tokens (as discussed previously). This ensures that the customer’s sensitive information remains protected even if the mobile device or app is compromised. By employing tokenization, integrated payments provide a higher level of security for mobile transactions, giving customers the confidence and convenience to shop on their phones safely during the holiday season.

Adding Additional Security for Your Customers

While integrated payments provide more security to your customers during the holidays, it’s crucial to also educate merchants on payment security best practices. By educating merchants on payment security, businesses can ensure consistent adherence to security protocols and reduce the risk of vulnerabilities that may compromise customer information.

Specifically, training programs and resources provided by integrated payment solution providers equip merchants with the knowledge and skills to recognize potential security threats, implement secure practices, and respond effectively to incidents. By prioritizing education and fostering a security-conscious culture among merchants, businesses can provide additional protection for customers during the holiday season and beyond.

The Bottom Line

During the holiday season, when customer transactions peak, it is crucial to prioritize the security of your customer’s payment information. Integrated payment solutions offer a comprehensive and robust approach to safeguarding customer data, providing enhanced security features like streamlined transactions, encryption, tokenization, compliance with industry standards, and fraud detection.

While integrated payments can automatically add more security for your customers, it’s also important to train your employees on security best practices. At the end of the day, by implementing an integrated payment system and training your employees, you not only protect your customers’ sensitive information but also build trust and confidence in your business, ensuring a positive holiday shopping experience.