When it comes to convenience, credit cards can’t be beat. Not only do they eliminate the need for cash, they also allow consumers to rack up points and rewards. If you’re a small business owner, it’s essential to find credit card merchant services that work for you. This post will cover everything you should know about merchant credit card processing and how to select the best credit card merchant services partner for your business.

What Are Credit Card Merchant Services?

A credit card merchant account is a type of bank account that allows your business to securely accept payments. If you want to accept credit cards, debit cards, and other types of electronic payments, you’ll need a merchant account.

Through this account, payments are authorized, approved, and verified before being deposited into your bank account. A merchant account can also help keep your business secure from fraud and failed payments.

There are two different types of merchant services accounts: dedicated and aggregated accounts. The main difference is in how many entities “share” the account. This is how it works.

Aggregate merchant account

An aggregate credit card merchant (such as PayPal) uses a single merchant account to provide credit card processing for a group. Your small business is added to a pool of other companies within a larger merchant account. While it’s usually faster to sign up, there are some risks.

The disadvantage of using aggregate credit card merchant services, for example, is that they can make and change the rules, giving you less control when it comes to rates and fees. Plus, it may take longer for your money to be disbursed back to your bank account, and you may have to specifically request the transfer. For this reason, it’s important to pay close attention to the contract terms of these types of accounts.

Dedicated merchant account

Unlike the aggregate model, dedicated credit card merchant services work for your business specifically. After processing a customer’s payment, the funds will be automatically deposited into your business bank account. No need to request the funds from the merchant.

It’s important to note that you’ll have to go through an underwriting process to open a dedicated merchant account. This allows the provider to assess your financial risk, but it will also allow for more control of your money. The rates you’ll be charged will also be determined based on your sales volume and other factors, allowing you to find a set-up that works best for your business.

Finally, your dedicated credit card merchant can even correct errors, react to potential fraud, and debit your account for customer “chargeback” claims on your behalf. For many business owners, this type of security and customer service can offer peace of mind. The only company processing credit card transactions through a dedicated merchant account will be yours. With a dedicated account, you are always in control.

Why Your Business Needs Merchant Credit Card Processing

Credit card merchant services make it easier for you to accept payments for your business. Not only do they streamline and simplify the process for customers, they help you keep secure information. In some cases, your credit card merchant may also offer flexible options for payments across mobile and POS systems, along with multiple payment methods.

Merchant credit card processing first allows you to accept multiple convenient methods of payment from customers. Your provider will service the technology that verifies credit card payments before being deposited into your bank account. This keeps your business secure from fraud, bounced checks, and other failed methods of payment.

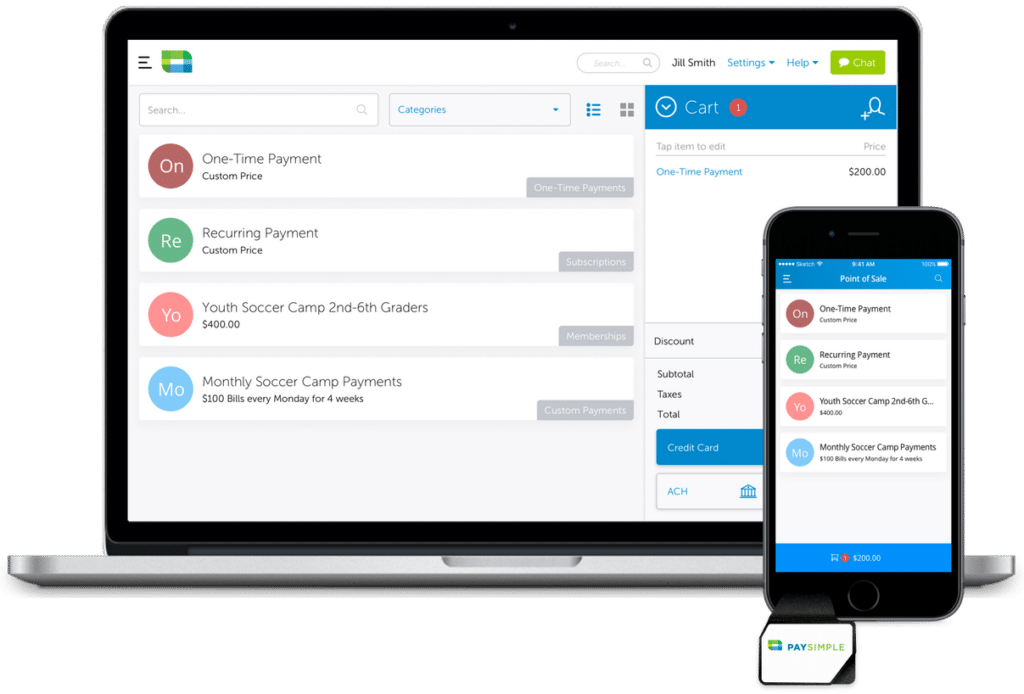

Some providers offer additional payment tools, too. For example, integrated online payment portals and forms allow businesses to accept credit card payments on their website. Depending on the merchant, automatic and recurring payments may also be possible for businesses that need it. Most merchant credit card processing providers also offer full-scale point of sale (POS) systems. These come with both in-store and mobile payment tools, allowing you to track inventory and sales over time.

Finally, working with a credit card merchant can help you keep your customers’ information secure. With identity theft and data breaches on the rise, this is a critical part of your reputation as a business.

Take Your Small Business From Scrappy to Successful

Lessons on growing up a business from entrepreneurs like you.Click here to access the FREE [eBook]

How To Find The Best Credit Card Merchant Services Provider

When you’re searching for credit card merchant services, there are a few ways to evaluate providers.

First, consider the size of your business and how many sales you process on a monthly basis. Crunch the numbers when it comes to rates and fees associated with each provider. Make sure you find a provider who operates in a PCI-compliant manner every step of the way to protect your customers’ information. You’ll also want a team that can respond quickly to questions or issues that may arise. When possible, look for a customer service team that consists of real-life humans rather than automated bots.

As you compare providers, also look at your specific needs now and potential needs in the future. From price to reliability, take some time to jot down features that are important to you and your business. Keep that list handy as you research providers.

Find More With PaySimple

With PaySimple, you’ll get a dedicated merchant account for your business. This gives you more freedom and better stability with your credit card processing since it won’t be grouped with other business owners. We also set up reliable and straightforward payment tools for your customers, while keeping you in control.

Worried about the underwriting process? Don’t be. At PaySimple, we have a straightforward process, and then work directly with you to get the best rates for your business. Our award-winning support team can help you secure dedicated credit card merchant services for your business.