As a small business owner, you’re probably wearing many different hats. Making payments easier for your customers and team is just one of your many crucial tasks. When it comes to small business payment options, it pays to make it simple. Make it easy for customers to pay. Make it easy for your team to manage payments. Make it easy to find all of your financial information, whenever and wherever you need to access it.

Are you ready to expand your small business payment options? Here are nine types of payments to accept and how to set them up successfully (with no more paper trails or file cabinets!).

1. Accept Credit Cards Securely

Whether your customers are purchasing online or in person, 75% of customers say they prefer to use a debit or credit card.

To accept cards, you’ll need to ensure a secure process. Look for a small business payment system that ensures PCI compliance at every step of the transaction so you can keep your customer’s information safe. A PCI certified company will handle all of your credit card processing, transaction history storage, and credit card account storage.

It’s important to mention that the best small business payment systems have roles and permissions functionality. This feature allows you to control who on your staff has access to view secure payment details preventing unwanted security breaches.

2. Explore Mobile Payment Options For Small Business

Many small businesses are jumping on the mobile bandwagon and for great reason! More people are spending time at home, but still want to enjoy certain services.

From in-home massage services to pet grooming, mobile payment options for small business are crucial. Use a credit card reader to swipe your customers’ debit or credit card and instantly collect payment.

The best mobile point-of-sale system will also securely store important customer information making future payments a breeze. This data can also send automatic receipts for your customers’ records!

3. Offer Affordable ACH, or eCheck, Options

Some small businesses require costly or more frequent payments, like home contractors or childcare providers. In these cases, one of the best small business payment options is through a direct withdraw from your customer’s bank account using an eCheck through ACH payment processing.

This small business payment option allows your client to input information from a paper check (routing and account number) into an online payment form. The payment processes electronically, without the physical presence of a paper check.

One of the biggest perks of ACH is that the information does not expire which can happen with credit and debit cards.

How are you accepting payments?

Learn all the ways to accept online paymentsClick here to access the FREE [Cheat-Sheet]

4. Add Easy Email Invoicing

Are you a service-based small business? Perhaps you work as a chiropractor or house cleaner, or you own a landscaping business. In cases like these, email invoicing is one of the most efficient small business payment options.

Click-to-pay invoices gives your customer the ability to see how much they owe and instantly enter their payment information. Even better? They will automatically receive a receipt in a matter of seconds. When you have a fully integrated system for your payments, all of your financial reports and data will be conveniently saved in one location.

No more fumbling over paper invoices after an appointment or chasing down checks!

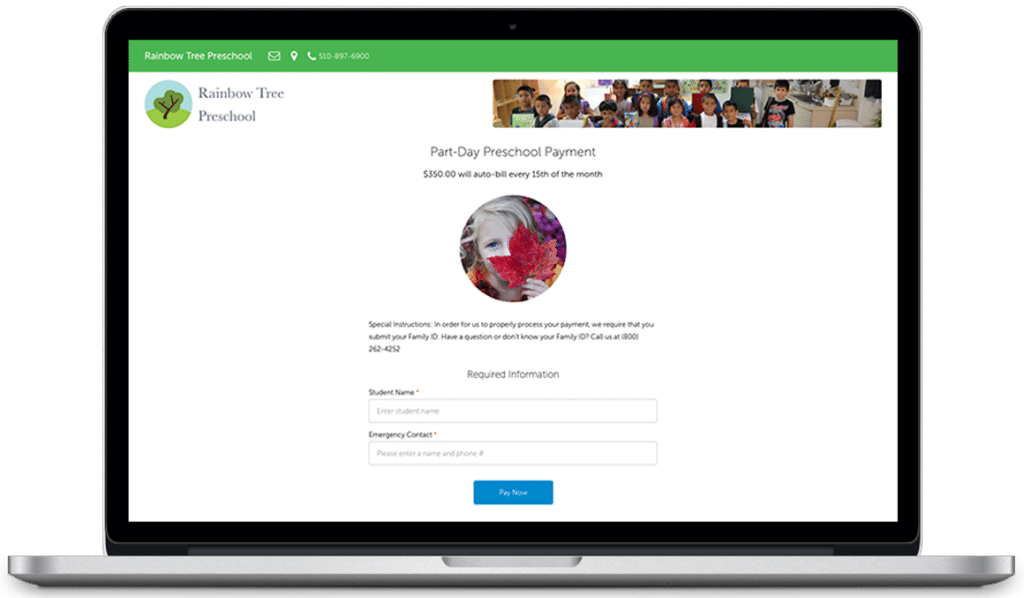

5. Set Up An Online Storefront

An online storefront allows you to sell one-time and recurring products and services. You can even accept event registrations or donations.

The advantage here is the ability to generate business online 24/7, freeing you up to focus on your passion. Whether you’re selling weekly meal plans or providing subscription-based services, an online storefront makes the process seamless for you and customers.

6. Create An Online Payment Gateway

Likewise, for service-based businesses with fixed rates, an online payment gateway offers features that make it easy to sell your services online. Mobile car detailers, dog walkers, and many other small businesses can reap the benefits.

This is how the process looks. Potential clients visit your website, book an appointment, use a simple online payment form, and can even save their information for future purchases. It’s really that easy! By offering online payments your clients are given complete flexibility in the payment process which is a big win for your business revenue.

7. Make It Easier With Recurring Payments

Let’s face it, everyone is busy nowadays. The ability to “set it and forget it” is incredibly valuable to your customers and clients.

Recurring payments allow for ACH or credit/debit payment on a routine basis. For businesses like dance studios, gyms, and daycares, this is perhaps the most crucial of small business payment options. Once your clients choose the payment plan and frequency from your options they’re all set! Not only will they love not having to handle another payment to-do, but you’ll never have to chase down a missed payment from them. A win-win!

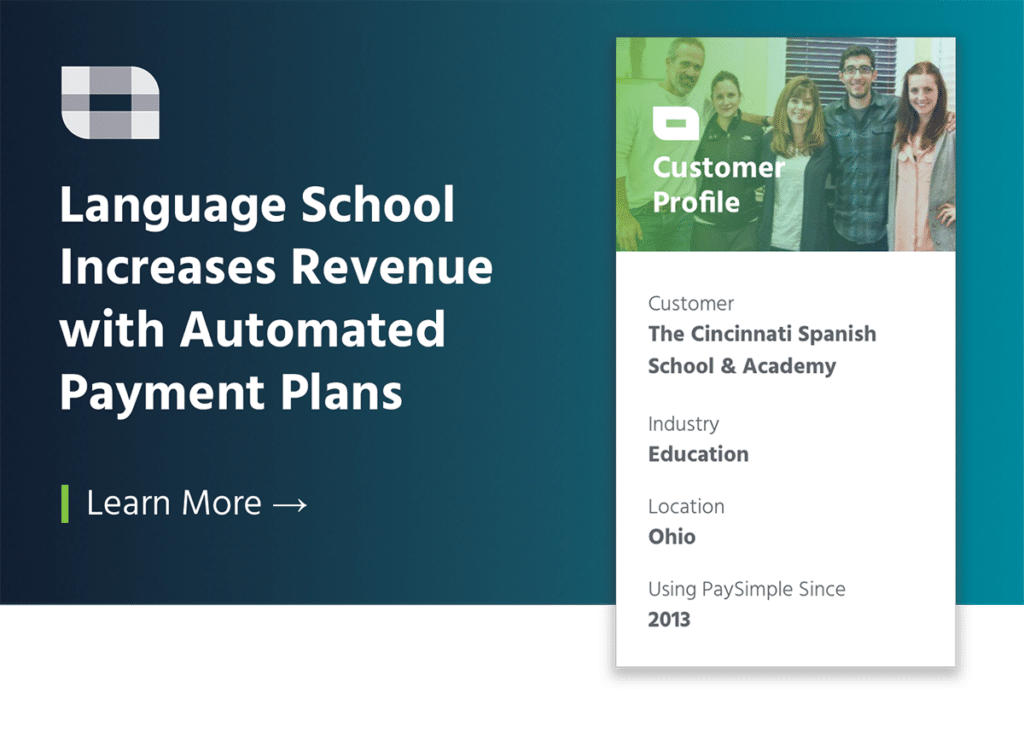

8. Consider Payment Plans For Small Business

Many families are on a budget. When it comes to costly services, such as contractor services or learning academies, payment plans for small business can help.

Some software solutions for small business payment options make it easy to divide up payments. For example, if a class is $500, families can pay it over six months, a little bit at a time. The key for a small business though is in an automated solution. As a business owner, tracking and following up for payment plans can be a challenge. Instead, find a payment tool that will automatically debit clients or send invoice reminders.

Your customers or clients will appreciate this increased flexibility, which means you can attract more business and reach an even wider range of clients.

9. Integrate These Payment Options Into Your Custom Mobile App

If you’re a small business that has developed a mobile app then you understand how valuable it is to provide a complete experience to users. If accepting payments through your application is missing then both you and your customers are missing out. Instead of pushing customers to another solution or a website from your app, considering integrating payments with PaySimple.

By integrating payments within your mobile application, customers will be provided with a streamlined and secure payment experience without ever leaving your solution. This capability not only delivers more value to your users, but also organically increases revenue for your business.

Explore Your Small Business Payment Options

If you’re looking for a way to accept payments online and in-person anywhere, anytime, the choice is easy. PaySimple combines multiple forms of payment acceptance and scheduling within one tool.

Find options for in-person, online, or mobile payments, with secure dedicated merchant accounts for businesses and affordable rates. No more fumbling between different tools to synch up in person or online payments. No more balancing different providers for credit cards and ACH payments. With PaySimple, it’s truly payments made simple.

We offer small business payment options all for one low monthly price, with no contracts and no cancellation fees. At PaySimple, we know that small businesses are essential to communities. Our goal is to provide you with the tools you need to grow and succeed. You’ll be supported every step of the way with our industry-leading customer service team.

Contact our team today to learn more and start your free trial today!