The profit and loss statement (P&L) is one of the main financial statements that businesses produce. This guide will help you better understand your financial position by analyzing your profit and loss (P&L) statement.

What is a Profit and Loss (P&L) Statement?

A profit and loss statement shows whether a business is profitable or not. According to Investopedia, “a profit and loss statement is a financial statement that summarizes the revenues, costs and expenses incurred during a specific period of time, usually a fiscal quarter or year.”

This statement goes by many names, including P&L, income statement, earnings statement, revenue statement, operating statement, statement of operations, and statement of financial performance.

Cash vs. Accrual Basis

One important thing to know before you get started analyzing your profit and loss statement is whether you are on a cash or accrual basis of accounting.

With a cash basis, revenue and expenses are recognized when there’s movement of cash (for example, if you agree to pay a vendor $50 for a service in a month, you don’t account for that until the $50 leaves the bank).

The accrual method accounts for revenue when it is earned (before the money reaches the bank) and expenses when they are incurred (but before the vendors have been paid).

How are you accepting payments?

Learn all the ways to accept online payments

Click here to access the FREE [Cheat-Sheet]

Analyzing a P&L Statement

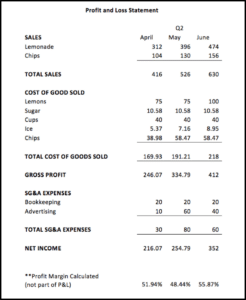

How do you analyze a P&L statement? Let’s look at an example:

Many people get overwhelmed by the numbers, but a few quick tips and tricks on where to look and why will have you feeling confident and analyzing statements like a pro.

Below are some of the easier things to analyze in your profit and loss statement:

1. Sales

This may seem obvious, but you should review your sales first since increased sales is generally the best way to improve profitability. If you see a month was particularly good, try to remember why so you can duplicate what you did in the future.

In this example, we see that June was the best month in terms of sales, gross profit, net income, and profit margin. Upon review of the other numbers, we see that this might have been due to seasonality (see more below) and/or increased marketing.

2. Sources of Income or Sales

Another factor related to sales that you should analyze are your sources of income.

Ask yourself if all of your sources of income make sense and are profitable for your business. Are any of them overly time-consuming with very low margins? In this example, the sources of income include selling lemonade and chips. Neither of these are negatively impacting the business, but if the chips weren’t selling, they should be eliminated or changed to a different type of chips, ones that are more popular, perhaps.

3. Seasonality

Seasonality is the fact that things change based on the season. This can be seen in many parts of a business including but not limited to both sales and expenses.

In the lemonade example, you see seasonality in sales. As the summer months approach and the temperatures rise, so do the sales. This example does not show seasonality in expenses, but if it were to show up it could be in increased prices of lemons because of heightened demand and lower production in the summer months. You might also see seasonality in decreased cost of lemons in the fall and winter quarters due to increased production of lemons and lower demand.

4. Cost of Goods Sold

Next you should review your cost of goods sold. It would make sense for cost of goods sold to go up as revenue goes up since these expenses are directly related to your product. The opposite would not make sense and should be a red flag.

Additionally, when you review cost of goods sold you can ask yourself questions like, “Is there a way I can reduce these expenses?” Finding ways to decrease your cost of goods sold will ultimately increase your bottom line and profit margin.

In this example, the business owner may want to consider purchasing items that won’t go bad (chips, cups, and sugar) in bulk to reduce costs throughout the year and increase their yearly profit margin.

5. Net Income

Net income is your profit and is one of the most important parts of your business if you want it to succeed and be sustainable over time.

You want to see your profit positive (also known as “in the black”) in most cases. Some exceptions where it’s acceptable to see a loss is when the company made a strategic investment during one period to decrease costs or increase sales in a later period.

In our lemonade stand example, the business owner could’ve bought chips, sugar and cups in bulk for the entire year in the month of April. If this was done it could bring the company into a loss for the month, but that expense would be recouped with savings and higher margins throughout the rest of the year.

6. Net Income as a Percentage of Sales (also known a profit margin)

Net income is simply your bottom line, but it’s important to do a quick calculation to determine your net income percentage so that you create a baseline and compare “apples to apples” across time periods and across other companies in your industry.

To determine net income as a percentage of sales simply divide net income by net revenue then multiple your result by 100. Use the lemonade stand as an example. Take $206.07 (net income in April) and divide it by $416 (total sales in April) to get 0.4954. Once you multiple that number by 100 you get 49.54%.

Once you have your net income as a percentage of sales figured out for each period you can use that information to assess if your profit margins are going up (usually a good thing), going down (usually a bad thing), or staying the same.

Additionally, once you have your profit margin figured out you can use this data to compare your profit margin to other companies in your industry. To compare your profit margin to others in your industry simply try a Google search to find that data, or review a profit and loss statement (and do the calculation discussed above) for a public company in your industry since they publish their financial statements.

—

Now that you feel comfortable with this simple example, you can start analyzing your profit and loss statement and even look at the financial statements of public companies to gain insight into their operations.