Donations are the lifeblood of any nonprofit organization. Without a steady stream of charitable giving, you can’t continue to work towards your mission. Fortunately, technology is on your side. It’s easier than ever to maximize donations using low-cost ACH payment processing for nonprofits. How do you benefit from this technology and boost revenue? Here is your complete guide to getting started with ACH for nonprofits.

What Is ACH Processing?

In simple terms, an ACH transaction is the electronic transfer of funds from one bank account to another. The money travels through the ACH (Automated Clearing House) network, which connects thousands of banks across the country. It is fast and secure, allowing the money to show up in your organization’s bank account as a direct deposit.

How does it work? First, a customer initiates the payment with an (often online) ACH authorization form. They provide information about their bank account, including the account number, routing number, and financial institution. From there, they can decide on the amount and whether this is a one-time payment or recurring donation.

After authorization, your bank account will pull the payment from your donor’s bank account. In the past, this entire process would take anywhere from 3-5 days. However, new rules are reducing this wait time. In fact, same-day processing is available in some cases.

It’s important to note that not all electronic payments are ACH payments. For example, eChecks and wire transfers may use electronic technology, but they aren’t the same as an ACH transaction. The Automated Clearing House serves as a sort of highway between different banks. This eliminates the need for financial institutions to “build” their own road to facilitate payments. ACH automates the flow, which makes it easy and more affordable for you!

Benefits Of Using ACH Nonprofit Payment Processing

There are so many reasons to accept payments for your nonprofit. First and foremost, donations keep you up and running! Beyond this, most nonprofits also host events and fundraisers that require ticket sales. Merchandise is another way to bring in additional revenue.

For all of these purposes and more, ACH for nonprofits can help. Here are some of the benefits of this nonprofit payment processing tool.

Convenience and speed

Remember the days of bringing a roll of cash or pile of checks to the bank? Nonprofit payment processing is easier than ever with ACH. Charitable organizations are typically strapped for time and resources. This benefit can free up more time for your team to focus on what really matters. The money will appear in your bank account without you having to lift a finger.

As for your donors, the process is also quick and easy! After completing the initial authorization, the money is taken directly from their bank account. No need to worry about waiting for a check to be processed. Plus, if they want to make recurring donations, they can easily set it and forget it.

Lower transaction fees

While credit and debit cards are still an important part of nonprofit donation processing, these can come with higher fees.

Rates vary, but let’s assume you have a $0.10 transaction fee at a 1.9% rate. A $500 donation will carry a $9.60 fee. On the other hand, ACH transaction fees can be as low as $0.60 at a 0.1% rate. In this case, the fee for that same $500 donation is just $1.10! Over the course of time, this results in serious savings.

The proof is in the numbers. The more you earn in donations, the more you’ll feel the sting of transaction fees. With ACH payment processing for nonprofits, you can keep more of the donations you’re accepting.

Safe and secure charitable giving

It can certainly feel daunting to hand over your banking information. However, for donors who like to pay with a paper check, ACH is actually a safer option.

Checks containing account and routing information can be passed from person to person or exposed in the mail. When you use ACH processing software and a trusted authorization form, your donors can have confidence knowing the transaction is secure.

Recurring donations

When you improve cash flow, you can plan for the future. Predictable revenue is one of the best ways to improve your organization’s impact for years to come.

The beauty of ACH payment processing for nonprofits is that donors only have to do the work once. When they provide all of their important financial details on an authorization form, be sure to offer them a recurring option. Whether it’s $25 per month or thousands of dollars per year, every cent makes a difference.

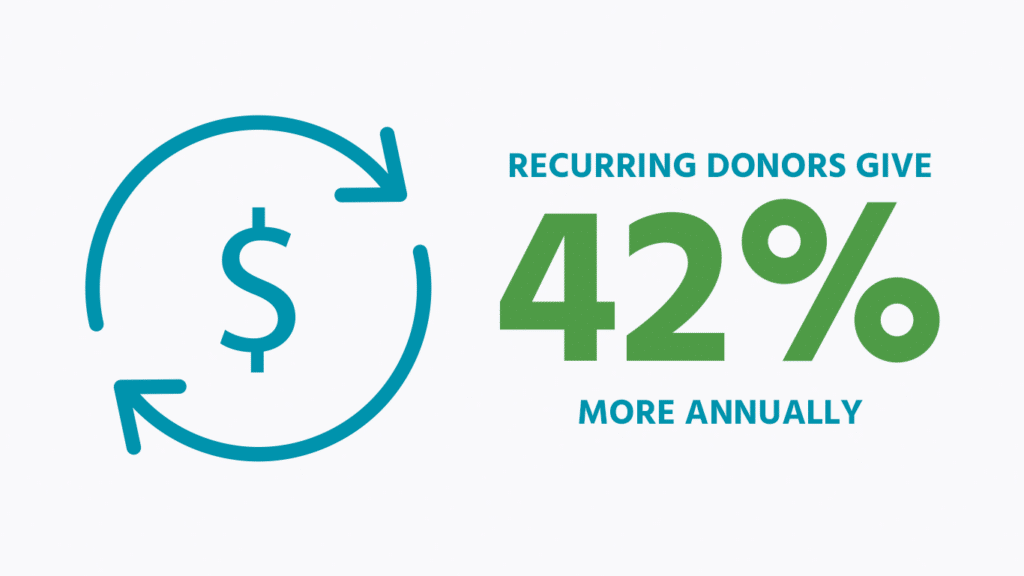

According to charitable giving data, donors that set up recurring donations give 42% more annually than one-time donations.

Easily Set Up ACH Payment Processing for Nonprofits With PaySimple

Stop counting cash and tracking paper checks. When you partner with PaySimple, you can collect ACH payment information once or automate future donations with a recurring transfer.

Whether you’re in the office or out in the field, you can process an ACH donation wherever you need to. PaySimple offers an easy to use point-of-sale system, as well as a mobile app, so you’re always prepared to accept a donation. No matter where your nonprofit takes you, PaySimple can give you the tools you need to keep the revenue coming.

Even better? PaySimple tracks all of your important donor information for safekeeping within a single integrated solution. It will even sync with your other incoming donations, like those from ticket sales or merchandise. This gives you 24/7 access to financial reporting that allows you to make informed decisions.

> Supporting Content: Accepting ACH Payments