Roughly 7 in 10 people in the U.S. have at least one credit card, according to recent surveys. When shopping in stores, many consumers prefer credit cards over other payment options. No one wants to fumble with cash or a loose pile of coins, and making purchases online requires you to have a credit card. Simply put, if you aren’t accepting credit card payments for small business transactions, you’re probably missing out on sales.

Fortunately, there are many easy ways to accept credit cards no matter where you and your customers are. Here’s how to find the right option for your business.

What Are The Benefits Of Accepting Credit Card Payments?

As a small business owner, your goals are simple. You want to grow your business and boost revenue by keeping your customers satisfied. One way to do this is by making it simple to pay. Accepting credit cards is the best way to provide a fast and easy way to make purchases.

But it isn’t just about happy customers. Various methods of accepting credit card payments can also help you as a business owner. Many card processors allow you to easily track your sales, financial data, and overall financial health of your business in one, online system. They create a digital paper trail of receipts, as well as store important customer data.

The benefits of accepting credit card payments can’t be overstated—in today’s competitive marketplace they’re increasingly more expected and necessary.

How To Accept Credit Card Payments For A Small Business

There are many methods of accepting credit card payments. Depending on the type of business you own, you may want to choose one, two, or all of the following options.

1. Find a point of sale (POS) system

Whether you’re operating a traditional physical storefront or an online business, you’ll need a point of sale (POS) system. A flexible solution helps you manage customers and accept multiple forms of payment, including credit cards. If you do a lot of your business on the go, especially as a service-based businesses, a virtual credit card terminal is another great option.

No matter which approach you take, you should streamline business operations and reduce costs by using a platform that combines payment accounts, billing history, contact information, service notes, order management, reporting, and more.

The right system will also allow you to initiate transactions for all types of sales from one integrated system, whether purchases are made in-person, by phone, or online. Many tie each order and payment to a customer record and allow customers to log-in or call to pay with an account on file.

2. Invest in mobile credit card processing

Does your business occasionally take you outside of your usual brick-and-mortar location? Not a problem. Swiping a credit card on a mobile device is becoming the norm for many customers and businesses. Their payment is confirmed on the spot, and an emailed receipt is sent immediately.

Add to that the ability to access cash flow reporting, manage customer accounts, and send invoices from anywhere you have a signal, and you start to see the benefits of using a mobile payment app for your business.

A mobile app works in combination with a mobile card reader, which allows you to run your business wherever you and your customers are. Be sure to look for providers that sync your mobile and in-person payments to reduce future accounting headaches.

3. Send click-to-pay invoices

When you’re operating a service-based business, each month looks different, but your needs are the same. You want to receive payments in a timely manner while offering convenient payment options to your clients.

A click-to-pay email invoice gives your clients the ability to pay their bills online and receive a receipt in seconds. When a customer clicks and makes an online payment, the invoice is marked as paid in your system automatically.

Email invoicing is one of the methods of accepting credit card payments that can save both you and your customers time and money.

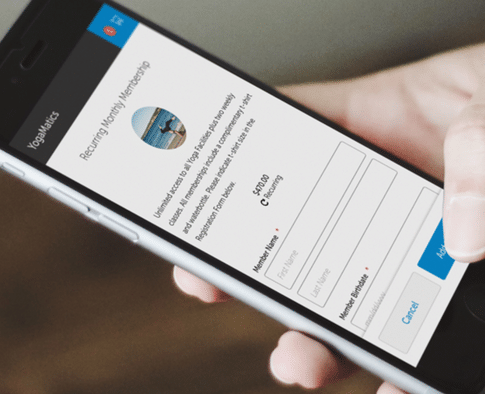

4. Schedule recurring credit card payments

Organization is at the top of mind for many consumers. When it comes to paying monthly bills, it can be difficult to keep track of due dates. This is why one of the most popular methods of accepting credit card payments is recurring billing. From childcare to house cleaning services, this option is a game changer for many service-based small businesses.

It’s not only more convenient for your customers, it also better guarantees that you will be paid on time. By billing on a recurring basis, you can make your customers’ lives easier while ensuring a more reliable revenue stream for your business.

5. Create an online storefront

Setting up an online store allows you to accept payments online and generate new orders 24/7. For eCommerce and subscription-based businesses (or really any business), an online store that accepts credit card payments isn’t only convenient, it’s vital. For service-based businesses, it’s increasingly important.

For example, if you own a lawn care business, you can create a storefront that displays all of the routine services you offer that allows customers to add services to their “cart.” From there, they pay you online using a credit card. In less than five minutes, you’ve secured your next appointment and have already been paid. Returning customers can even create accounts to save their payment information for fast and easy future payments.

Learn More About Accepting Credit Card Payments

At PaySimple, we understand how important it is to provide your customers with a range of convenient payment options for small businesses.

When you choose PaySimple for your payment processing, you’ll enjoy access to all of the credit card payment options discussed here, along with eChecks by ACH and other methods. Our mobile, in-person, and web payment tools sync seamlessly and payments from all sources are stored in one easy-to-use system. No reconciliation needed.

PaySimple also offers small business payment options for one low monthly price, with no contracts and no cancellation fees.