If you’re a small business owner who does your own accounting, then you know what a burden this can be. Not only is the process of keeping your books clean a major time-suck, there is a significant amount of pressure to get things right. After all, if you were ever to apply for a business loan, go through the Mergers and Acquisitions process or sell your business, accounting discrepancies could be disastrous.

Still, you started a business to focus on your passion, not stare at spreadsheets (unless you run an accounting business, of course), so how do you shave time off the accounting side of things so you can focus on what really matters?

How are you accepting payments?

Learn all the ways to accept online paymentsClick here to access the FREE [Cheat-Sheet]

The key is to automate what you can and set up integrations that allow you to see your full financial picture in one, easy-to-interpret place.

So, how do you make that into reality?

Most business owners consider QuickBooks Online to be the gold standard of small business accounting software, so we’ll focus on some efficiencies you can create with that tool

How to Save Time by Automating Your QuickBooks Online Account

1. Integrate All of Your Financial Systems into One Flow

One of the most powerful ways to streamline your accounting practice is to integrate your payment platform with your accounting tool. Luckily, QuickBooks Online understands this and makes this possible with numerous integrations with companies like PayPal, Square, and PaySimple (coming soon!)

Integrating your payment platform with your QBO account will save you a ton of time and reduce the risk of human errors.

To find and integrate a payment solution in QuickBooks Online:

1. Visit https://apps.intuit.com/category/payment-processing

2. Look to find your preferred payment processor

3. Double check the reviews and see if you can avoid similar outcomes

4. Login to your QuickBooks Online Account

5. Find the APPS tab on the left-hand menu

6. Search and select the app you’ve researched

7. Click the “Get App Now” button

8. Authorize and begin syncing your accounts

2. Automate Your Invoices to Free Up Time

Now that you have a reliable, integrated financial flow, it’s time to speed things up. By adding small automations to your system you can remove the most significant bottleneck, you.

Every time you interact with your financial flow, take notice of where are you spending your time.

Is collecting payments, generating invoices, running payroll, or reconciliation taking you the longest? Then you can create a flow that grows with you instead of bogging you down. A quick win that takes less than 30 seconds is to generate automatic invoices in your QuickBooks account.

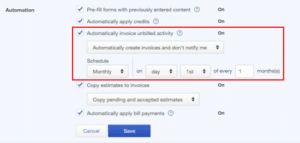

To do this in QuickBooks Online:

1. Click on the Gear menu in the top-right corner

2. Select Account & Settings (or Company Settings)

3. Within the Settings menu, select Advanced > Automation

4. Place a check-mark (✓) next to Automatically invoice unbilled activity

Note: This will display a set of options for how you wish to automate invoice creation

5. After adjusting your settings, click Save

3. Put Financial Visibility in Your Inbox with Recurring Reports

It can be challenging to provide your team the visibility they need without giving your login information to everyone. Creating consistent visibility into the metrics of the organization not only helps maintain focus on what is driving the business, it can also enable more autonomous decision making.

With scheduled email reports, you can easily keep people in the know while saving time.

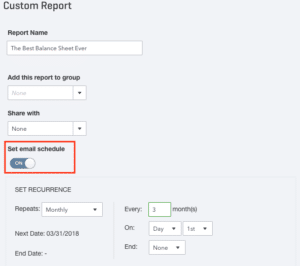

To do this in QuickBooks Online:

1. Click “Reports”

2. If you don’t have a custom report saved yet, click the report needed and “Save Customization”

3. In “Custom Reports” click the “EDIT” button next to the report to be emailed

4. Toggle “Set Email Schedule” and choose the frequency, content and contacts to receive the report (Pro-tip: Keep text to a minimum since it will repeat)

5. Click “Save and Close”

> Supporting Post: Small Business Accounting Questions

Conclusion

Taking the time to optimize your financials for every possibility can feel overwhelming, draining and stressful at the very least. Instead of trying to get everything right up front, instill the little habit of asking “What is the smallest thing that I can speed up?” This creates an automation snowball that will allow you to not only streamline your financial flow, but keep it flexible and dynamic as your business grows.