As businesses increasingly pivot towards subscription-based models, the associated risks, such as chargebacks and friendly fraud, also rise in frequency and impact. The software-as-a-service (SaaS) industry, in particular, faces a unique set of challenges around chargebacks, given its dependence on recurring billing cycles. Because of this, understanding and effectively managing chargebacks is critical to maintaining a successful subscription business.

What are Subscription Chargebacks?

Simply put, a chargeback is a transaction reversal meant to serve as a form of consumer protection from fraudulent activity. In a subscription model, chargebacks happen when a customer disputes a charge from your business with their card issuer. This leads to funds being returned to the customer, causing a loss of revenue for the business. Chargebacks can occur for various reasons, including unauthorized credit card use, dissatisfaction with a product or service, or misunderstanding about billing policies.

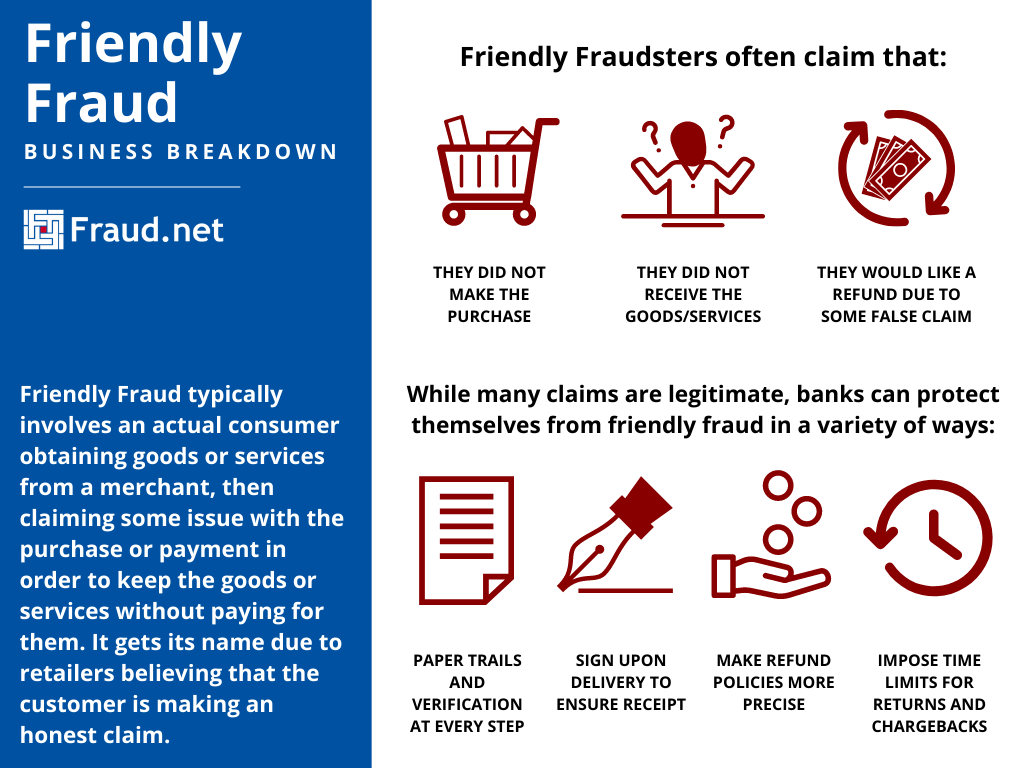

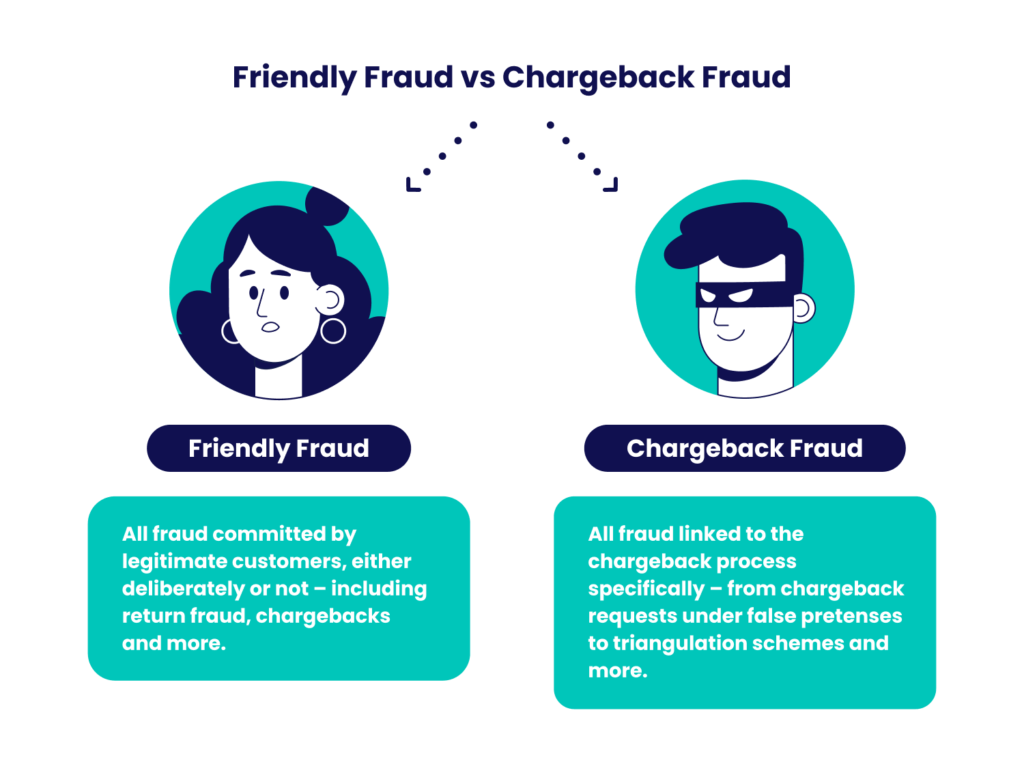

What is Friendly Fraud?

Friendly fraud, also known as chargeback fraud or first-party fraud, is a deceptive practice where a customer makes an online purchase with their credit card and disputes the charge with their credit card issuer after receiving the goods or services. The customer claims the purchase was unauthorized or the product or service was never received, even though this is false.

Image courtesy https://fraud.net/d/friendly-fraud/

At its core, friendly fraud is a misrepresentation of circumstances by a legitimate customer rather than an act perpetrated by a conventional fraudster or cybercriminal. Customers who commit friendly fraud may not necessarily understand they’re committing fraud. Sometimes, they might have simply forgotten about the purchase, or perhaps a family member purchased it without their knowledge.

Impact of Chargebacks and Friendly Fraud on Your Business

Chargebacks and friendly fraud can be significantly damaging to your business. Besides revenue loss, excessive chargebacks can harm your relationship with payment processors, potentially leading to higher processing fees or even the termination of your account. In addition, handling chargeback disputes can consume valuable resources and time. Additionally, friendly fraud is often complex because the onus is on the merchant to prove that the disputed transaction was legitimate and that the goods or services were delivered as promised.

Tackling the Problem of Subscription Chargebacks

While tackling the problem of subscription chargebacks is complex, there are strategies you can take to combat this problem and successfully navigate this terrain.

Start with Clear Communication

First, clear, concise, and transparent communication is crucial to reduce subscription chargebacks. Start by ensuring that customers understand what they’re subscribing to, how much it costs, and when they’ll be charged. You should use easily understood terms and conditions and consider confirming subscription details via email or message after sign-up.

Allow Customers to Unsubscribe or Downgrade Their Subscriptions Easily

While it may seem counterintuitive to make it simple for customers to cancel or downgrade their subscriptions, it’s vital to maintain good standing with payment processors. Often friendly fraud occurs when businesses make it overly complex or challenging for their customers to cancel a subscription. Rather than wasting their time on hold or trying to figure out a complex system, customers know they can easily call their credit card processor and challenge a charge to get it taken off easily, so they do that.

If you are hesitant to make it easy to unsubscribe, consider adding easy downgrade options based on customer feedback. Downgrade options allow you to continue capturing some revenue from customers even if their needs or budgets change. Additionally, in the long run, having a customer-centric business will not only make you rate higher with payment processors, but your customers will appreciate a more user-friendly experience that can lead to positive word of mouth and referrals.

Image courtesy https://seon.io/resources/friendly-fraud/

Provide Prompt Customer Service

Effective and responsive customer service can help address concerns before they escalate to chargebacks. Remembering that effective customer service means more than just answering questions or solving issues as they arise is important. It involves proactively identifying potential problems and addressing them before they escalate.

For example, suppose your customer support team notices a pattern of customers questioning the frequency of their subscription charges. In that case, this might indicate a broader problem of customers not fully understanding the billing cycle. Proactively addressing this through clearer communication, user-friendly FAQs, or even one-on-one assistance can nip the problem and prevent a slew of chargebacks.

Speed is also a key component of effective customer service in preventing chargebacks. Customers are more likely to file a chargeback if they feel unheard or if their issue is not resolved promptly. Ensuring your customer service team responds swiftly and effectively can prevent such situations. This might involve training your team in efficient issue-resolution techniques, implementing automated responses for common queries, or offering multiple channels for support, such as email, phone, live chat, or even social media.

Strong Authentication Measures

Implementing robust authentication measures is crucial to ensuring the security of transactions and protecting against unauthorized activities, which can ultimately lead to chargebacks. Strong authentication measures add an additional layer of security, reducing the risk of fraudulent transactions, which are a significant source of chargebacks. For example, two-factor authentication (2FA) requires the customer to provide two types of identification to validate a transaction. This two-pronged approach adds an extra hurdle for potential fraudsters, making unauthorized transactions less likely.

Create an Efficient Refund Policy

An efficient refund policy is a proactive measure that can curb chargebacks in the subscription-based business model. It serves as a safety net for customers, offering them a hassle-free way to resolve their issues without resorting to a chargeback, which can be a lengthy and complex process.

When designing a refund policy, transparency and accessibility should be key priorities. The policy should be easy to find and clearly articulate the conditions and procedures for a refund. Using simple, jargon-free language and providing examples can make the policy easier to understand and lessen potential confusion.

Your policy should outline specific scenarios where customers would be eligible for a refund, such as if they are dissatisfied with the service or were billed erroneously. It should also include clear instructions on requesting a refund, what information they need to provide, and what they can expect regarding response time.

As mentioned before, making the refund process easy can also make a significant difference. This might involve providing a simple online form for refund requests or ensuring your customer service team is trained to handle refund requests efficiently. Offering multiple refund methods, such as crediting back to the original payment method or offering store credit, can also enhance the customer experience.

Dealing with Chargebacks When They Do Occur

Even with precautions in place, chargebacks may still occur. When they do, it’s important to respond promptly and professionally. Maintain thorough records of customer interactions and transactions to help resolve disputes. In some cases, it may be beneficial to issue a refund rather than fight the chargeback, especially when the cost of time and resources to dispute the chargeback exceeds the refund amount.

The Bottom Line

Chargebacks are a considerable challenge for subscription-based businesses, but they can be significantly mitigated with proactive management and modern tools. By prioritizing clear communication, robust authentication, and efficient customer service, you can create a more secure and customer-friendly environment that reduces the risk of subscription chargebacks.