TABLE OF CONTENTS

ADDITIONAL RESOURCES

PaySimple Blog

A Guide to Accepting Credit Cards

Ultimate SMB Cash Flow Guide

SEE HOW PAYSIMPLE CAN HELP YOUR BUSINESS GROW

Get StartedOwning and operating a small business is not easy and not for the faint of heart. You’re tackling new obstacles each day and staying busy trying to make your business successful. Knowing this, many people tend to focus on the percentage of small businesses that close shop each year, but it’s actually more valuable as a business owner to look at the other half of that statistic: the small businesses that are successful each year. By doing this, you’ll find they all have one thing in common – healthy finances.

Cash is the lifeblood of your business, and without a good grasp on your finances, your business will not be able to live up to its full potential. We love small businesses and are on a mission to help them master their financial management. So we’ve put together much-needed weapon in your small business’ arsenal: The Ultimate Guide to Small Business Financial Management.

Gain Financial Awareness Through Cash Flow Analysis

Whether your business is just starting out, going through some changes, or has been around for many years, having a good understanding of your financial position (especially your cash flow) can make a huge difference in your daily management and how you approach the future of your business. Starting to fill out a blank spreadsheet with projections may seem intimidating, but it has less to do with pure math, and more to do with how much you know (or can find out) about your business, the market, and other factors that influence the numbers. We are going to walk through the eight steps to make an accurate financial projection, so grab a pencil and let’s get started!

1. Put on Your Honesty Hat

Before you start, in order to get the most helpful and accurate forecast, you first need to be completely honest and realistic with yourself. No one else needs to see these numbers, so you don’t need to inflate them to impress anyone. And there is no teacher to grade you at the end of the day, so if it ends up being wrong, you can take it as a learning experience and use the information to adjust future projections.

2. Set Your Structure and Think About Your Revenue/Cost Buckets

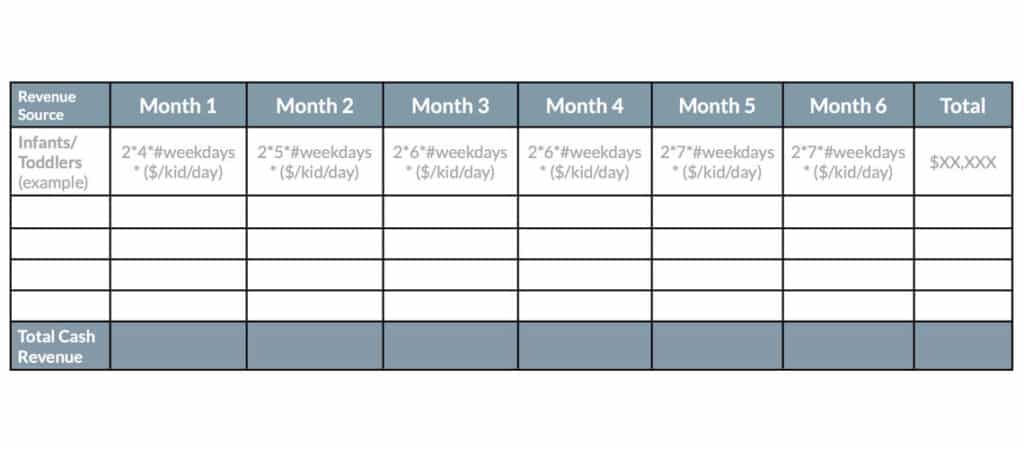

Open up Excel (use our example below as a reference), and determine the following:

Time Frame

Are you making an annual, quarterly, or monthly projection? If this is your first forecasting exercise, it might make sense to start with a 6-month plan, as it’s long enough to give you a good sense of what your business will do, but it’s short enough that you won’t feel “locked in” if something changes in Month 2. If you are creating a business plan, or looking for lending, you will probably need a monthly forecast for Year 1, and then 2 years of additional annual forecasts.

Potential Market Size

If you already have historical information about how many customers you can service or members in your base, that is the best place to start. If you don’t, you’ll need to think about your business model and your total opportunity. For example, if you have a day care center, do you know all you can about the neighborhood you are in? Are there businesses you can partner with to reach their employees (and ultimately, their kids)? Do most people work 8-5 or 9-6 or something else? This basic information can help to guide your sales projection and revenue potential. The local chamber of commerce is a good place to head if you need additional information or want to talk to a knowledgeable resource.

3. Build a Conservative Revenue Projection

Think realistically about the time you have available to sell to or service your customer base as well as the price and discounts you have for signing up. There are only so many hours in a day, only so many hours your business is open, and only so many employees you have to help run your business, so make sure you are using accurate factors. Let’s continue with our hypothetical day care center. Say you have four full-time staff members. Two are in charge of infants or toddlers (i.e. can handle 4 children each), and two watch the Pre-K kids (and therefore can handle 8 each). You know that you are already at capacity for the infants/toddlers, but you still need to ramp up on the Pre-K level, so you can build that up over the first 2 months. You multiply the number of staff you have, by the number of kids you have, by how much you charge per kid per day and then by how many days you are open.

By setting the projection up like this, you can add lines for additional services easily (say you want to launch an after school program in Month 4), and you can granularly track the results as well as help inform future decisions around staffing.

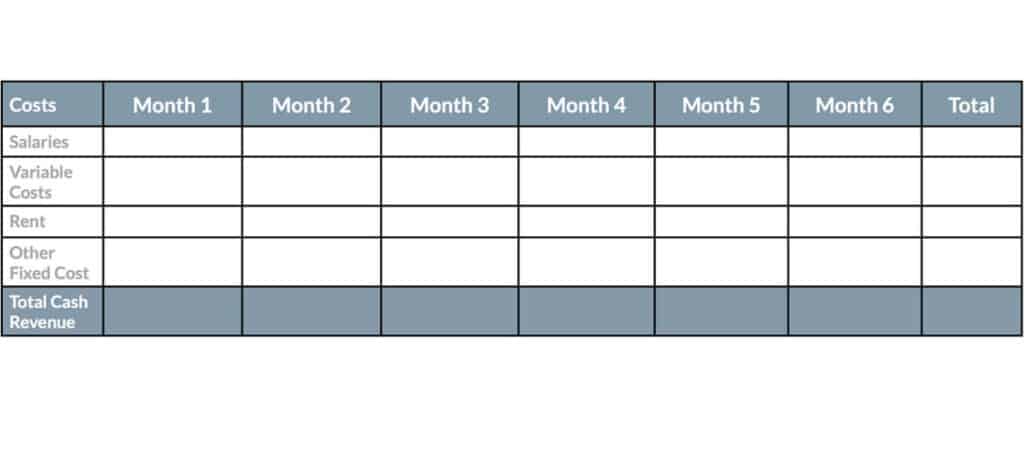

4. Don’t Underestimate Costs

After the previous step, you are probably feeling good about all of the money you are going to make, but you still need to do the cost side of the equation. Start with all of your fixed costs (rent payments, etc.), and then move to your variable costs. You can use your revenue projection to guide the rate for the variable costs (e.g. adding or subtracting a staff member). It can be easy to forget something, so be diligent in your notes!

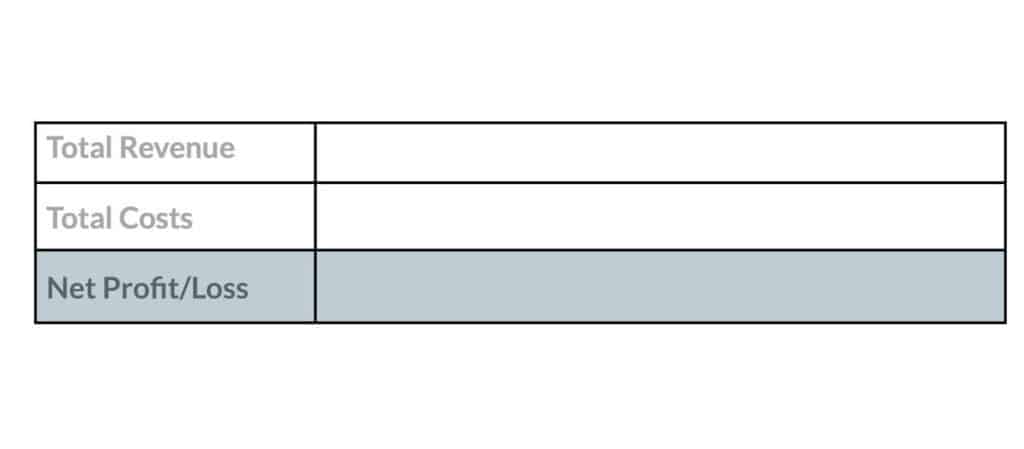

5. Understand Your Profit/Loss

Once you have both charts filled out, you add a few extra lines to summarize the data and see what it nets out to. If you are in the green, awesome! You can start to build a game plan to use or save it. If you are in the red, you might need to look over your plan again and see where you can cut some costs, build some additional revenue, or think about building a case for a loan.

6. Have Someone Check Your Work

We know we said you don’t need anyone else to see it, but sometimes it helps to talk through your assumptions and ideas with an advisor or consultant. The best is to find someone in your industry that you trust to review the plan. They can help you to talk through the risks, the assumptions, and the excitement you have around where your company might be going. If you don’t have a good resource, your local chamber of commerce, or the Small Business Administration can help you to find someone. Bonus steps! You have this beautiful, completely validated spreadsheet – exercise over, right? Wrong. There are two key things you should do with your forecast and projections.

7. Plan for the Future

With this information at your fingertips, you can set out your next steps. Is there a month where you might have some extra cash? Maybe you can pay off a little more principal on a loan, or spend a little more on marketing to see if you can grow your customer base. By building out the strategy around the numbers, you can continue to hit your projections and build a solid foundation for the future.

8. Don’t Set It and Forget It

Continue to evaluate and compare your actuals to your projections each month. Did you come close, or is there a “new normal” you need to adjust to? By keeping in tune with your projections you will be able to evaluate whether or not the past week or month was an anomaly or a new data point to inform a revised forecast. By starting with an honest and thorough assessment of your business, combining conservative revenue projections with accurate cost expectations, and understanding the final outcome, you can build a financial forecast that can help your business succeed.

Grow Revenue in Your Existing Customer Base

Now that you have established your expectations for the upcoming year through the exercise in Chapter 1, it’s time to dig deeper to identify ways to grow your revenue or shrink your costs. In the next few chapters we will look into ideas that increase the revenue side and shrink the cost side of the equation.

The first step in analyzing your client base is thinking about it as a portfolio – a mix of revenue opportunities made up of differing behaviors and benefits. Studies have been conducted at every business size showing that by evaluating an existing customer base, an organization can use the data to grow revenue without acquiring a single new customer, among other benefits. In this chapter, we’ll touch on the three main benefits of customer portfolio evaluation: revenue, marketing, and new customer acquisition. Every business owner knows that keeping a good customer is more valuable than acquiring a new one. But let’s take that notion a step further. Not only is keeping a good customer critical, but your existing client base is also a huge revenue opportunity.

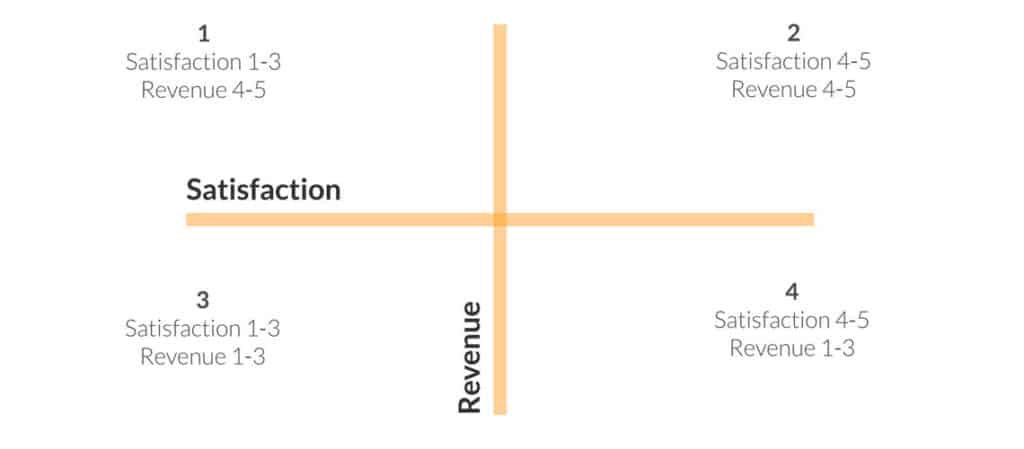

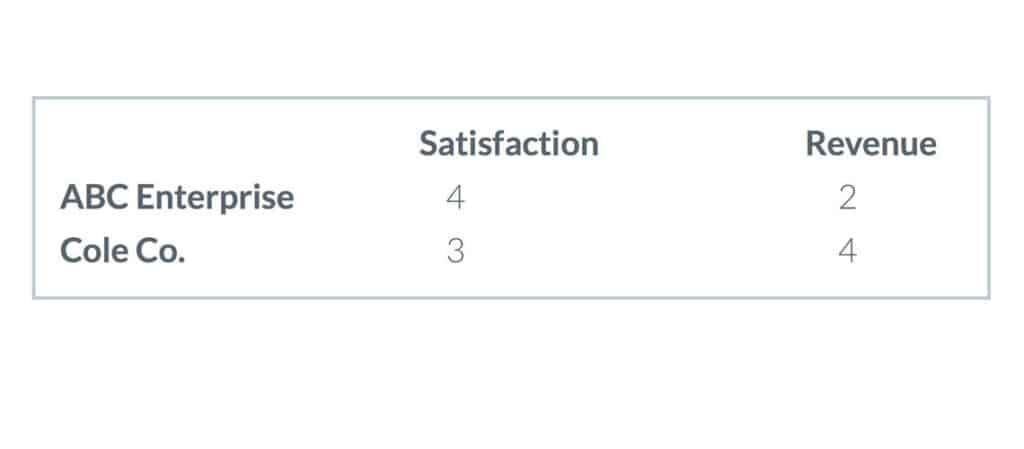

On a piece of paper, draw two intersecting lines through the middle to divide the page into 4 equal quadrants. The y-axis is going to be your “Satisfaction” line and the x-axis your “Revenue” line.

Now take a list of your client base, either in a spreadsheet or printout, and using two different columns, begin scoring each account 1-5 based on two factors: revenue and satisfaction. 1 is the lowest revenue or satisfaction and 5 is the highest.

Now, going back through the list you have scored, each client should fall into one of the four quadrants. Any score of 3 falls into the left or bottom half of the divider.

Quadrant 1: The Revenue Opportunities

Analyze this quartile of your customers to think about ways you could better serve each of them. Chances are, there is even more revenue opportunity than what the account is currently yielding. If you’re unsure of the exact reason for the low level of satisfaction, ask. Customers will always appreciate a candid conversation and an authentic attempt to fulfill specific needs. You can’t be everything to everyone, but sometimes a manageable tweak in service is worth the time and energy to keep a high-revenue account.

Quadrant 2: The Cream of the Crop

High satisfaction paired with high revenue – these customers are the best of the best. Break this list down into subcategories and leverage the data behind it to source similar clients. Sub-categories could include:

- • Demographics

- • Geography

- • Industry

- • Services/Goods Purchased

- • Source – How did they find you (or vice versa)?

Find the similarities in these clients and you’ve found a gold mine for new acquisition targeting.

Quadrant 3: The Red Flags

You may need to ask yourself if you’re already spending too much time servicing these accounts. This quadrant may be the example of clients not worth signing in the first place. Always consider if energy spent servicing a low-revenue, unhappy client could be better spent elsewhere, like keeping or attaining a high revenue opportunity. All customers are NOT created equal – with limited amount of time and energy in a day, it’s best to evaluate services alongside opportunity. It’s not worth running around and bending over backwards to service a small opportunity client. Keep your services consistent unless a high revenue opportunity deems it necessary to make modifications to win (or keep) the account.

Quadrant 4: The Marketing Opportunities

They’re happy, but they just don’t have the revenue opportunity of other accounts. That’s okay! Leverage these relationships to build out your marketing assets, including:

- • Feedback Surveys

- • Case Studies and Testimonials

- • Social Media Sharing

- • Lead Referrals

- • References

- • Online Reviews and Ratings

You’ll likely want to balance marketing assets with a sampling of larger accounts (to win other large accounts), but you can derive a lot of other assets from this easygoing client list. With a strong knowledge of your existing customer base, you’ll be able to take advantage of key opportunities while tuning into the most profitable targets to offer your services.

Increase Customer Satisfaction with Automated Billing

In Chapter 2, we identified a group of customers who have high revenue contribution, but aren’t completely satisfied. One way to potentially increase your customer satisfaction is to look at your billing processes to see if there are ways to tweak them to make it a more seamless experience. If you are struggling with collecting payments from your customers, then maybe you need to re-examine how and when your customers prefer to pay you. How do you begin to make it easier? Here are three “A’s” to ease the process.

Accept More Payment Types

While customers tend to stay with more traditional methods (credit and debit cards) they have shifted their preference for payment types beyond cash and check. Offering flexibility by accepting a variety of payment types will improve customer experience and can increase customer loyalty.

Accessibility for Paying

Technology has made customers expect more out of all of their vendors and business partners. Being able to provide payment acceptance online, over the phone, or even by swiping a card on a mobile device has become a standard practice for businesses and is expected by customers. Making all of the ways to pay available for your customers can help to reduce the opportunity for payments to be late.

Automation of Processes

By storing customer information and setting up an automated schedule for payments, you can make it not only convenient for your customers, but also easier to manage your incoming billing. By accepting all payment types and making it accessible and automated, you can reduce the hassle around the payment process and ultimately make your customers happier by giving them what they want.

Cut Your Costs in 5 Easy, Small Business Budgeting Ways

In order to survive, a small business must learn to be thrifty. But how can a business keep within budget, without at the same time risking the overall integrity of their business? To help you on your quest to save money, here are five of the easiest ways your small business can cut costs, without compromising the quality of your actual goods or services.

1. Go for Bundled Packages

Your Internet and phone packages can be one of the larger (and most necessary) monthly expenses for your small business. If you are not already using a bundled package, call your service provider to find out how to combine these costs to receive major savings. Many cable and telecom providers run occasional promotions, so call and ask them if you have been missing anything. Be persistent. Also, fees can change and different providers may run special offers at different times of the year. Always be shopping for better prices. By aggressively chasing better offers, you will be in a better position to pay the least amount for Internet and phone.

2. Look for Cheaper Software

One of the easiest ways to cut costs is with the software you are using for your company. Most likely, there is a cheaper version of what you are using. If you’re paying a lot in licensing fees for your accounting, inventory management, CRM or marketing software, there are great SaaS (Software-as-a-Service) applications on the market. You can find many online versions of what you need available for a low monthly cost or even for free. Take a look at your software and find out how much you are paying for each program. Pick the most expensive software packages you are currently using and look for alternatives.

3. Go Green

Another great way to shed costs is to go green. Not only will you save money, but also you will be conserving paper and electricity, which is an effort we should all be contributing to. So, where do you begin?

- • Have an energy savings plan for all electronicsTurn off lights when you leave your office or if you’re not using a particular part of the office space, keep the thermostat down, and put all computers and printers on energy-saving mode.

- • Print lessEncourage your employees to print only the pages they need (instead of the entire document) and learn to love the scanner. Trying to save a webpage? Print it as a PDF file; this creates a new electronic document that you can save on your desktop instead of printing.

- • Cut back on suppliesInstead of giving everyone their own set of supplies, set up an area for community supplies. Include things like staplers, scissors, envelopes, and binders.

- • Reuse your electronicsInstead of always buying the newest models of electronics, take a look at what your employees really need and try to solve the problem by, say, buying more memory or a new monitor, before going for a completely new machine.

- • Automate your paymentsInstead of waiting to get an invoice by mail and then sending a paper check, automate your bills to save on postage. They will send you emails instead of mail and you can pay with a credit card. Although this doesn’t cut immediate costs, this can keep you from paying late fees.

4. Consider Joining a PEO

Did you know there are opportunities out there to join forces with other small businesses to create one large human resources conglomerate? They are called Professional Employer Organizations (PEOs). PEOs enable you to cost-effectively outsource many of your HR responsibilities. They oversee your company’s health benefits, workers’ compensation claims, payroll and payroll tax compliance. They deliver these services by effectively pooling all the employees of their clients and getting better pricing and better deals from benefit providers. Here are some of the advantages:

- Timesaving on administrative human resources work (i.e. on-boarding papers, employment eligibility verifications, workers compensation, payroll paperwork, etc.)

- No more hassles about compliance, risk management and employment practices. They keep you entirely up-to-date.

- You get access to incredibly comprehensive benefit packages that give you access to such things as health insurance rates that keep you competitive in the labor market.

5. Join a Buying Group

As we discussed above with PEO’s, small businesses receive awesome discounts when they come together as one. This same idea can be applied to purchasing office supplies and equipment. How? Look into joining a buying group. The thought is, as you are buying in larger quantities, you get bulk pricing you would not otherwise have received. With the combined buying power of your group, you can meet the enormous purchase minimums you could never afford on your own. Sometimes, you even get better payment and freight terms and with certain-sized orders, wholesalers will waive the freight altogether. If you are already a member of a purchasing group, speak with your group’s administration to consider joining BizUnite, a great marketplace between top Fortune 500 suppliers and over 70 buying groups in the US.

Ace Your Cash Management Processes

When you’re a small business, cash flow is king and ensuring you have complete control over the cash entering and exiting your business is the key to success. Here are our favorite tips and tricks on managing both your accounts payable and accounts receivable.

Managing Accounts Payable

Accounts payable are, simply put, the money you owe someone else. Whenever you are working with a variety of vendors, it can be difficult to keep up with whom you owe what. If you allow this to turn into a passively managed administrative task, your relationships with these suppliers can suffer. It can also mean that you spend more time than necessary paying. Here are some tips to help you streamline the process.

Manage Accounts Payable on a Daily Basis

Even with software like QuickBooks, the data entry doesn’t do itself. If you’re the type to set bills and receipts aside until you have time to do them, consider moving it to a process that is more actively managed. Entering a few lines of expenses or a new invoice at the end of the day when you’re closing up shop can save you hours of trying to remember what you bought and when.

Create Consistency

You should establish a basic accounting workflow whether it is for yourself or someone else. This ensures that everyone who invoices you is entered into your accounting system the same way and can expect a certain level of service. Once you start a new vendor relationship, ensure that you have a W-9 on file for them and that checks are always issued from original invoices. If for some reason you have a copy, or amended invoice, those invoice numbers and dollar amounts should follow each other such that you pay what is owed, but can also track what a vendor says is owed. In addition to what is entered into the accounting software, maintain paper copies or scans of invoices so that you have a record on hand to go back to.

Break down Expenses on a Regular Basis

Another part of actively managing vendor relationships is understanding cash flow at a deeper level. Are you taking advantage of any discounts offered by vendors? Are you consistently late on certain relationships? Are vendors constantly late providing you with invoices? Adding a qualitative layer to your cash management can ensure that you aren’t wasting money.

Look for ways to get a better deal on services, either by asking for a discount outright or looking for competitors that may be cheaper. Breaking out your expenses on a quarterly basis can help you plan ahead and make sure that you don’t fall into the trap of passively paying for something you no longer need.

Get Two Signatures

This may be a little harder if you’re a one-man show, but it is worthwhile to have multiple eyes on a balance sheet before doing a check run. Keeping the number of check runs to two per month can make things easier to track for both you and anyone helping. If you’re taking in invoices, tracking expenses and then writing checks, it’s much more likely that you’ll make an error. Software can help guard against that by creating audit trails and helping with the math.

Consider also employing a CPA at least on a quarterly basis to give the books a once over, almost like a shadow audit. Many larger enterprises maintain shadow audits, and it is worth the cost to do so for small businesses as well.

Managing Accounts Receivable

Accounts receivable are, simply put, the money someone owes you. It’s about accessing the cash you’ve earned. It’s not always the easiest of processes, but it’s one of the most important. Here are our favorite tips on managing open invoices.

1. Get Organized

If you are going to excel at accounts receivable management, you have to start from the very beginning. Be diligent in every step of the process but, most importantly, in whom you decide to extend credit. Net terms aren’t for everyone. Start by setting up a professional credit application that gives you a chance to get as much info as you can on these customers. Use this info to vet them so you are making informed credit decisions. Once you’ve decided to move forward on credit with a customer, be sure you have a contract that clearly states the terms you are operating on and that the customer knows when they must pay you. Also, be sure you are using top-notch invoicing software so you have an excellent way to keep an eye on your accounts and get your invoices to customers as seamlessly as possible.

2. Watch Your Language

When it comes to invoices, the wording you choose to include can affect the time frame in which you receive the check. For example, by including a “please” or “thank you”, you can increase your chances of getting paid. If you avoid jargon such as “net terms” and be more specific with a phrase like “14 days to pay”, you’ll also get paid faster.

3. Start Early

Don’t just wait for the customer to pay. Create a system that allows you to remind customers when they have a payment around the corner. If it is a week before payment is due, and you still haven’t received the check, send the customer a friendly reminder email simply reiterating the due date and how you accept payment.

4. Remind, Remind, Remind

This seems silly, but your customers might not know their payment is late if you don’t tell them. Believe it or not, some of them haven’t paid because they just simply forgot. It’s your job to make sure this isn’t the case. As soon as the payment is past due, get a reminder letter in the mail. However, don’t just use a generic letter. Be crafty and sculpt the letter’s language to be appropriate for the situation. If somebody is a chronic late payer, you might want to step up the severity; whereas if it’s someone’s first time, keep it friendly.

5. Collection Call

After you have sent the letter and have received nothing, it’s time to get on the phone with the customer. You must not let your emotions get the best of you and you cannot let the customer run the conversation. You need to prepare for the call and be ready to accomplish your goal. To do this, follow these tactics:

- • Be specific

- • Be positive

- • Be professional

- • Be in control

- • …But be flexible

- • Be committed to finding a solution

6. Prepare for Excuses

The hardest part of the collection call is listening to the customer’s different excuses for not paying. No matter what, you have to be prepared to battle these. Although (in some cases) it is easy to sympathize, accounts receivable management is about action and you must require some from the customer. Get acquainted with the most common late payment excuses and learn how to respond to each one. Practice makes perfect and helps you get paid.

7. Installment Plans

When you do come across a customer who seems to be experiencing a financial hardship and you really would like to help them out, installment plans are key. Having a customer pay you back in smaller amounts over time is MUCH better than a customer not paying you back at all. It gets cash in your pocket immediately and says a lot to the customer. Work with the customer to create a payment plan that works for both of you. Ideally, it would be great to always receive all of your money up front, but in those moments you can’t, be creative in how you can help the customer pay you.

8. Finance Charges and Rewards

Incentives go a long way, no matter what you are doing. Consider this when it comes to accounts receivable management. Are you adding finance charges for late payments? Are you giving customers a discount if they pay early? Whether it is to have consequences for paying late or rewards for paying early, give customers a little push to get that cash to you on time (or early). It’s worth it, especially to see what kind of effect it has on your payments. If you are considering adding a finance charge, check your state’s usury laws to make sure you are not overcharging.

9. Outside Resources

You still need to know when to turn for help. There are many things you can do to help with late payments or delinquent accounts. Consider reporting late payments to the credit bureaus, which will affect those customers’ credit scores. Knowing you are reporting will certainly motivate them to pay next time. If you have particularly large or repeatedly delinquent accounts, consider calling a debt collection lawyer to help take legal action. And if you need cash fast, look into receivables factoring, which will help you get your hands on cash while a factor pursues your late payment.

Investing in the Smartest Opportunities

A smart investment is one that pays itself back over time. And it could be a new way to market your business, a new tool that streamlines your business, or better process management.

The “paying back” part is what’s tough to consider, and it shouldn’t just be measured in dollars. All too often business owners don’t consider their own time as an actual cost, but just like a budget, time is a finite resource. As the driver and lifeblood of the business, you don’t want your time invested in tasks that don’t drive value.

So, how do you decide? The best place to start is to think about your goals for the business. Where are you trying to go in the next year? Are those areas covered by internal resources you already have or is there an opportunity to expand that function of your business? Here are some key areas to start thinking about.

Market Your Services

One commonly overlooked component of growing a business is developing a consistent and thoughtful marketing plan and program. Many small businesses rely on word-of-mouth and some networking to get the word out, but that’s not enough for a business owner that wants stability and with a desire to grow.

Whether you budget to hire an external marketing resource, or tap some marketing skills within your existing team. Investing in time and money into your marketing efforts can sometimes be the catalyst a needed to take your business to the next level.

Automate Your Business Operations

Business owners who spend half of their days organizing files, updating spreadsheets, hand-mailing invoices, and reconciling client records likely do not have time to focus on customer acquisition or strategy. These are administrative tasks that could be drastically simplified, improved, and even automated to help run the business smoother, and in many cases improve customer experience.

- Billing/Receivables. With all of the great technology advancements over the past several years, there is a plethora of receivables management, invoicing, and payment software available that are priced and specialized for smaller and mid-size businesses. Make a list of your needs and do some research. You will likely find that the sum of the monthly expenditures is well worth the automation and timesaving in your or your staff’s day.

- Marketing Tactics. If you have a marketing strategy in place, you can often execute the strategy with a few pieces of software or investing in online advertising. Check out email marketing software like Constant Contact or MailChimp, search engine marketing platforms like Google Adwords, or even all-in-one solutions like Hubspot.

- eCommerce Opportunities. If you’re not already selling online, consider setting up an online store for your services. When you can sell 24/7 from anywhere, you increase the opportunity to engage new customers and grow your business in way that it’s easy to manage and easy to scale and grow.

Focus on Retaining Customers

While it’s important to invest in resources that will grow and expand your business’ reach, it is just as important to maintain and grow your existing customer base. Not only are some of these customers the best advocates and sounding boards for your business, but serving them better can be increasing your revenue from them without the cost of acquiring a new customer.

- Customer Management. Use your database or your customer management tool of choice to research your customers and get to know your business better.

- Surprise and Delight. Reach out to loyal customers with a thoughtful note or a small gift to show your appreciation for their business.

- Get Feedback. Use a survey service to request feedback from your customers to help you improve and evolve your business.

Conclusion

Congrats on finishing the Ultimate Guide to Small Business Financial Management! Just remember, reading this guide doesn’t make you a financial guru, but putting what you’ve learned into action can. Having a strong financial structure for your business can enable you to focus on the reason you started your business: to do what you love. Therefore, we encourage you to begin your financial makeover today. Best of luck on your road to financial success!