Where are we now?

The COVID-19 pandemic forced businesses and consumers to accept and be comfortable with contactless payments. Although the world is opening back up and we see more in-person activities, the social effects of the pandemic remain. These effects have also upended the future of online payments.

For example, contactless payments are here to stay. They’re faster, easier, and more secure. Additionally, major work culture shifts like remote working have ripple effects that reach as far as the online payments industry. In this article, we’ll share what the future of online payments will look like and key predictions you need to be aware of to drive innovation and growth in your company.

Upcoming trends

Here are upcoming trends in the digital banking and payments industry that you need to know about.

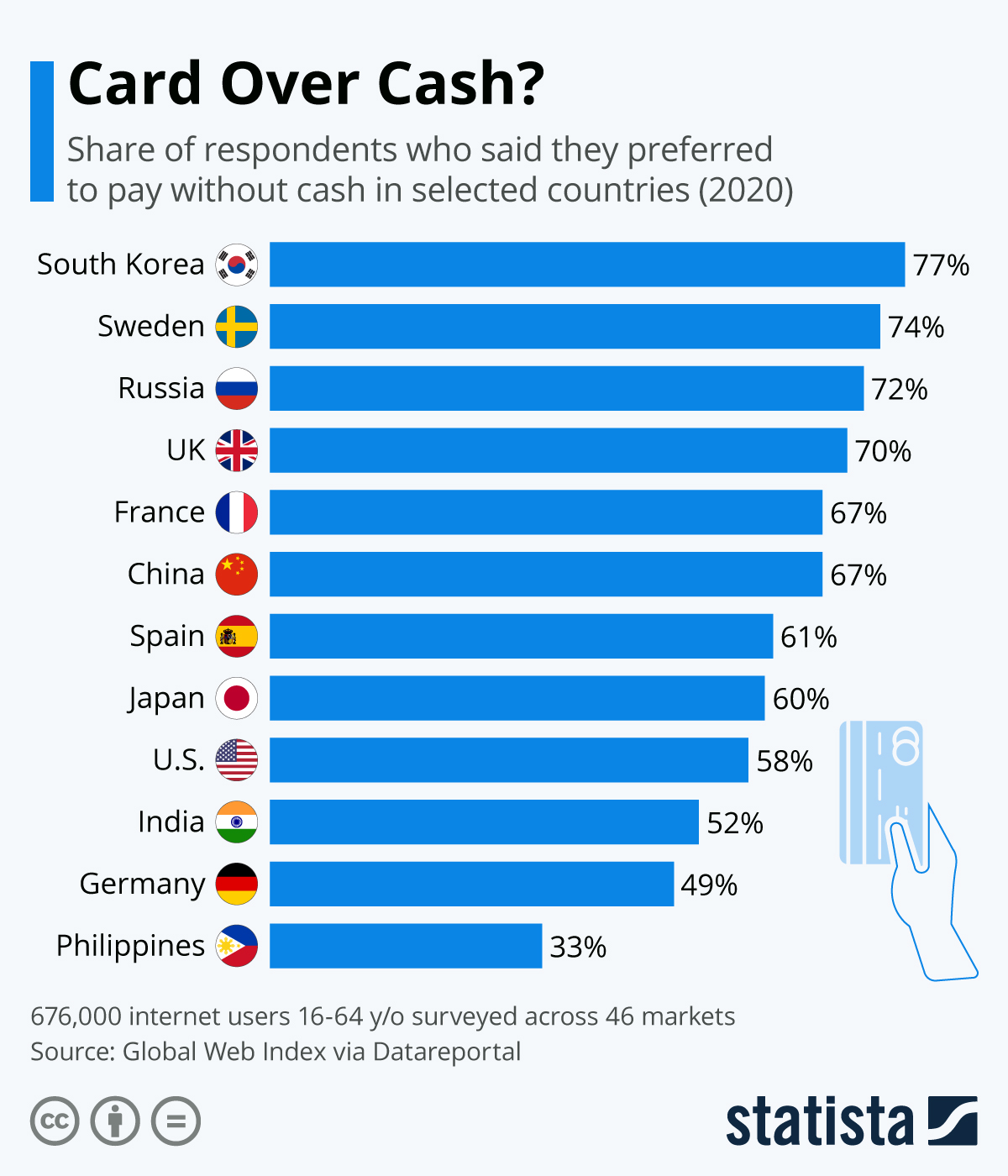

Cashless Payments

Cashless payments are on the rise. Now more than ever, there is great potential for a cashless global society. According to PWC, “Global cashless payment volumes are set to increase by more than 80% from 2020 to 2025.” The COVID-19 pandemic accelerated this trend because people preferred using cashless systems due to health and safety concerns. As a result, consumer habits changed, and people became more comfortable with online shopping, instant payments, and digital wallets.

Big data

As payments move away from cash and to digital solutions, banks have even more access to the incredibly valuable asset of data. PWC reports that payment data generates around 90% of banks’ useful customer data. This data is valuable because, within it, there are key insights into what people buy, how much they buy, and when they buy. The holders of this data then sell it to interested parties.

More remote workers

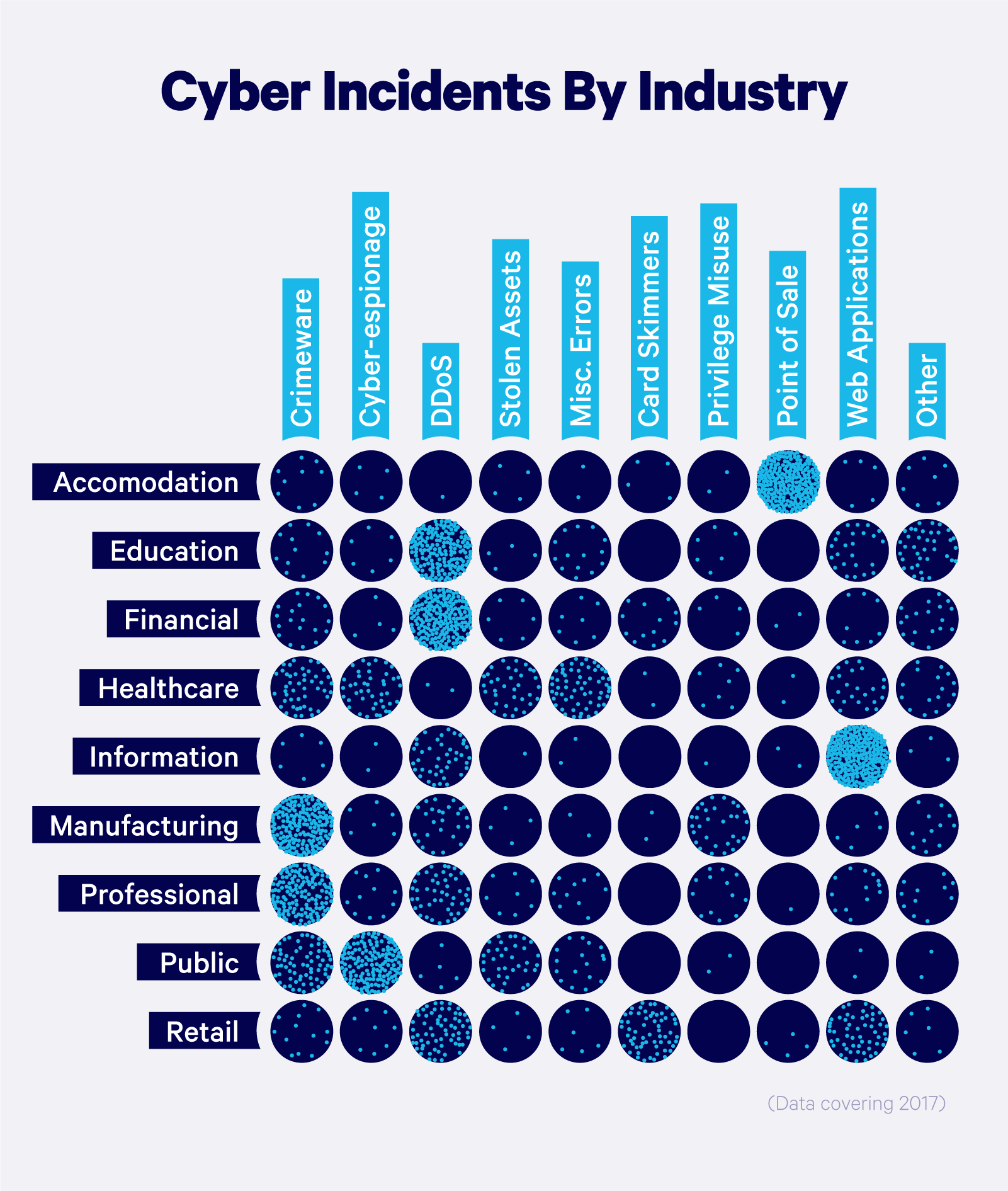

While many people are required to return to work in person, there has still been a major shift in remote workers that is here to stay. Unfortunately, with the increase in everyone’s online presence, there is an opportunity for criminals to take advantage of new vulnerabilities as people log into work computers remotely and may use less secure means to do so. This is important because privacy and cyber security are crucial to a business’s success.

Data privacy and cybersecurity

With great power comes great responsibility. Because of how valuable consumer data is, it is at risk of being hacked and breaking privacy laws. As mentioned before, because of remote work options, it is also often easier for criminals to exploit than ever before. As the future of online payments evolves, so too will the need to protect data and individuals and businesses from cyberattacks.

Data privacy is one of the top concerns of banks, fintech companies, and asset managers. Ultimately, there will most likely be a collaboration between the private and public sectors to help prevent fraud, money laundering, and terrorist financing (source).

While we mentioned big data before, it’s important to note that companies will also be able to leverage this data in partnership with AI and machine learning to help identify and red-flag fraudulent payment behavior.

Inclusion

Around the world, and in the U.S., many people do not have access to traditional banking options. However, with the rise in cashless systems, there is more opportunity for inclusion. For example, in Thailand, a “PromptPay” program allows users to make and receive payments by using digital wallets linked to their phone number, national ID, phone number, or email address. Additionally, as the use of mobile devices increases in society, even in developing countries, cashless transactions will become faster, easier, and more inclusive.

What this means for your business

Understanding these trends is important for banks, fintech companies, and SaaS developers as they look to innovate.

Because the adoption of contactless payments is still relatively new and growing, companies in the payments space need to create the most seamless and secure payment process possible. There will be tradeoffs, as convenience and security typically do not go hand in hand. For example, according to a ClearSale survey, 35% of customers mentioned abandoning an online cart because the checkout process was either too complicated or time-consuming.

The Bottom Line

By leveraging innovation and developments in new technology, as well as the important trends discussed above, the winning payments companies will ultimately be able to optimize the contactless checkout experience.