The idea that “cash is king!” is casually accepted as gospel by most small business owners. And it’s true, the ability to bring in money consistently is essential to the success of your business. That’s a no-brainer. However, many businesses aren’t aware of the vital differences between cash and revenue. The gross profit margin formula is a straightforward way for you to actually determine how much revenue you’ve made after accounting for the costs of goods or supplies.

Ready to learn more? This post discusses what the gross profit margin formula is, how to use it in your business, and how to improve your gross profit over time.

The Gross Profit Margin Formula

The gross profit margin, sometimes called gross margin, helps you analyze your company’s overall financial health. Before looking at the formula itself, let’s define some key accounting terms:

- Revenue: Money that flows into your company. You can find this number at the top of your income statement, which is what causes revenue to also be called “topline.”

- Cash: This term doesn’t necessarily refer to literal dollar bills, but instead refers to your business’s bank account balance. Your business’s liquidity is most often dictated by your cash on hand. This amount appears on your company’s balance sheet.

- Cost of Goods Sold (COGS): This is the expense your company incurs that directly relates to the production of your product or service. Not all expenses are included in the group, since not all business expenses directly relate to a transaction. For example, if you own a lemonade stand, your COGS would include sugar, lemons, water, and labor. You would not include general operating costs, like the cost of the stand itself or your neighborhood marketing flyers.

The gross profit margin ratio takes these numbers into account and calculates what percent of your sales are profit, before accounting for your operating costs. That sounds a bit overwhelming, so let’s break it down into bite-sized pieces.

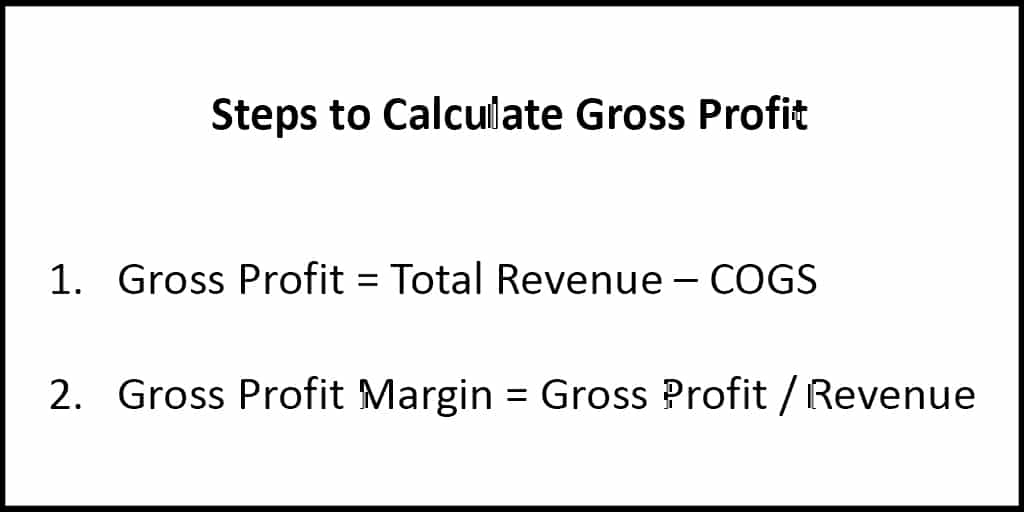

The gross profit margin formula is generally done in two steps:

Gross Profit = Total Revenue – COGS

Gross Profit Margin = Gross Profit / Revenue

How to Calculate Gross Profit Margin

Let’s look at an example to show how to calculate gross profit margin.

If your income statement doesn’t already show your gross profit, you will need to solve for it first (but a professional bookkeeping service will generally break it out for you already). If not, on your income statement, start with your overall Revenue. From that, subtract all of your COGS, or cost of goods. The difference between these two numbers is called your Gross Profit.

Calculating your gross profit margin from this number is pretty straightforward. Simply divide your Gross Profit by your Total Revenue.

For example, let’s suppose you had Total Revenue of $40,000 last month and your COGS for the same period is $15,000. To calculate your gross profit margin, first solve for your Gross Profit, which is $25,000 in this example.

Now, you can use this to calculate your Gross Profit Margin, by dividing $25,000 by $40,000. This gives you a Gross Profit Margin of 62.5%.

What Is A Good Gross Profit Margin?

Now for the big question: what does this mean? This number tells you what percent of sales are left after subtracting the costs that produce your product or service. This can be of huge value to you when determining your competitiveness in your industry, but as with many things, the number itself will depend on your industry and other factors.

Put simply, a “good” gross profit margin is always relative.

For example, if it’s your strategy to have a low cost compared to your competition, your gross profit margin should also be lower. On the other hand, if your strategy is to provide an exceptional product or service at a premium price point, your gross profit margin will likely be higher than your competition.

A more valuable exercise would be to compare your gross profit margin over time. For example, if your GPM for 2018 was 62.5%, but in 2019 it was 66%, this tells you that it is becoming more expensive for your company to provide your product or service, relative to your sales.

How To Improve Your Gross Profit Margin

If you want to improve your gross profit margin over time, there are a few things you can focus on.

- Increase your prices: Although some of your customers may go elsewhere, you’ll earn more in gross profit from those who stay loyal to you. You’ll have to balance the fear of losing customers with the dangers of a low gross profit margin when determining the perfect price.

- Reduce your COGS: Perhaps you can continue to provide a similar product or service while reducing the costs that directly relate to that sale. Many suppliers will reduce their price for you if you order in bulk, for example.

- Analyze your sales mix: Many businesses have multiple revenue streams (more than one product or service that they offer). Check your gross profit margin for each of your revenue streams, and take action to sell more of the items with higher gross profit margins as this will raise the margin of your overall company.

- Introduce new revenue streams: Perhaps there are new products or services that you can offer your customers. If these new revenue streams have gross profit margins that are better than your current margin, adding them to the mix will increase your overall gross profit margin.

Make Payments Easier

PaySimple makes it easier to accept payments anywhere, but it can also help you analyze your payments over time so you can find areas to improve your profit margins. And, with our flexible payment options, you’ll be able to seamlessly automate many of your billing and payment options.

If you’re interested in learning more about the benefits of using PaySimple to collect payments online, give us a try.

Start a 14 day Free Trial and streamline your business with PaySimple:

Start My Free Trial