Introducing, the PaySimple + QuickBooks Online Integration

For most small business owners, QuickBooks Online is the easy choice when it comes to finding an accounting solution. It’s the gold standard of accounting software with over 2+ million customers around the world.

Slightly more difficult, is finding a way to accept payments that is not only flexible enough to meet your business’s—and more importantly, your customers’—needs, but also versatile enough to integrate with your accounting solution.

That’s where PaySimple comes in.

Why Your Payment and Accounting Tools Need to “Get Along”

Perhaps you’re still thinking, “I have a payment acceptance solution and I have an accounting solution. That’s good enough, right?”

Not unless those tools are capable of “talking to” one another. When your payment solution is not connected to your accounting solution you create a situation where double-entry is required.

Need help learning how to file your business taxes?

We created The Simplified Guide to Filing Business Taxes so you have everything you need to know about filing business taxes in one place.

Download Now →

Without integrating the two systems together, you will be forced to batch upload all payment information into your accounting software. Unfortunately many business owners are familiar with double-entry and the negative outcomes that this manual process can cause.

This manual process can lead to:

- Human error

- “Dirty” data

- Wasted time

- Costly mistakes

All of these issues can be disastrous come tax time, or any situation requiring you to share your books with another entity. Errors that arise from double-entry not only present issues for your business, but also for the accountant you may have hired to do your taxes leading to increased costs. Increased costs are also found internally due to this manual process. If your business is manually uploading payments to your accounting software, you are paying staff to complete work that is not revenue generating. You could also be paying staff extra to work more hours to sort out errors that occur from the manual process. These scenarios increase your internal costs and fatigue staff as they are unable to work on handle their main priorities.

For these reasons, businesses who don’t find a payment solution that integrates with their QuickBooks Online account are at a distinct disadvantage to those who do.

PaySimple + QuickBooks Online – Put Cash Flow and Accounting on Autopilot

As a payment gateway software, we are dedicated to making it easy for business owners to offer flexible payment options to customers. We want you to spend less time worrying about things like bounced checks, bank runs, chargebacks, and late payments so you can spend more time focusing on what really matters to your business.

Our Integration with QuickBooks Online helps us take that mission a step further.

By allowing our customers to sync their PaySimple payment data into their QuickBooks Online account automatically, we’re striving to make financial management easier than ever and accounting headaches a thing of the past.

How the PaySimple + QuickBooks Online Payment Integration Delivers Clean, Realtime Data

The PaySimple + QuickBooks Online integration is designed to be incredibly simple and should require almost no work on your behalf when set up—sound too good to be true?

It’s not, we promise!

Once you link your accounts, all of your PaySimple payment data will automatically sync to your QuickBooks Online account in real time, so there’s never any lag time between your business activities and your QuickBooks Online data.

We’ve also designed safeguards around the syncing of bad data or duplicate transactions. You are in complete control of the process of merging customer and transaction information, so you can rest assured that all of your data is clean data.

How to Get Started

When you’re ready to start saving time, reducing costly errors, and ensuring accurate accounting and tax reporting, all you have to do is take a few steps to get up and running.

There is no additional fee to take advantage of this integration, as long as you are signed up for a PaySimple Pro account.

Not signed up for PaySimple Pro? Click here to get started.

To begin,

Step 1: Log into your PaySimple account

Step 2: Access the “App Center” tab on the left hand side of your screen in the main navigation.

Step 3: Choose the “QuickBooks Online” integration that appears inside of the App Center to view the integration profile. Select the “Enable Integration” button in the top right of the screen. (Note: you’ll need valid QuickBooks Online administrator credentials to authenticate between systems and finish set up of the integration)

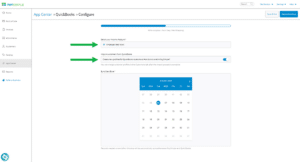

Step 4: Once you choose your integration setup, you select the income account in QuickBooks Online you’d like to payments to match to and select the date you’d like your data to start syncing.

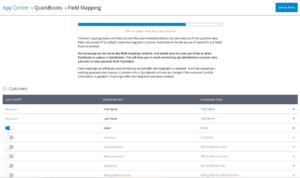

Step 5: If you have multiple customers with similar information, PaySimple will ask you to confirm that the correct customers are linked between both systems.

Step 6: Select the fields in QuickBooks Online that you want your PaySimple data to map to. This is called our “Field Mapping” section of the configuration. This gives you the confidence all of your data is going to the right place.

You should see your payment info populate in your QuickBooks Online account within 2 hours. From then on, your payment data will sync automatically in real time.

To learn more about our QuickBooks Online integration, click here.

Start a 14 day Free Trial and streamline your business with PaySimple:

Start My Free Trial